"All Hell Could Break Loose": The Fate Of The Market Is In The Median 2023 Dot

With less than 24 hours to go until one of the most closely watch Fed announcements in a long time, the VIX finds itself hanging just below 20, the gamma gravity in the S&P is at 4,000 while dealers remains short Nasdaq/QQQ gamma (which however is shrinking by the day). In short, depending on what Powell says (we previewed how the market would respond to a hawkish... and dovish Fed), markets could tumble or surge.

A quick rundown of the key technical factors ahead of tomorrow's 2 pm announcement:

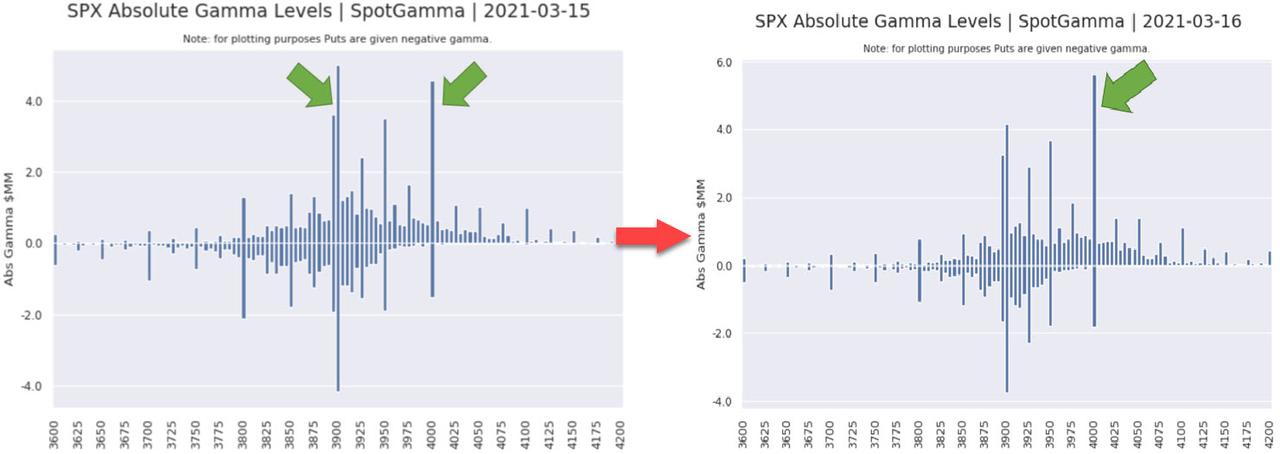

As our friends at SpotGamma note, the 400/4000 Call Wall in SPY/SPX has grown in size to over $5BN from yesterday - 10k 4000 strike calls were added yesterday, along with 100k SPY calls (to 400) - which increases its “pull” and yet total gamma is little changed in the S&P500 (that said, due to the FOMC tomorrow SG does not expect much movement today a forecast which has so far proven accurate).

(Click on image to enlarge)

On the other hand, Nasdaq/QQQ gamma remains negative, but that continues to shrink and SG notes that the upcoming March op-ex should flush out the remainder of that negative gamma position.

Meanwhile, the VIX continues to slide which is rather curious ahead of a major event-risk day such as the FOMC.

Putting it all together, Nomura's Charlie McElligott notes predicts "massive days ahead for markets", between heavy central bank information and options flows around quarterly expiration, particularly noting

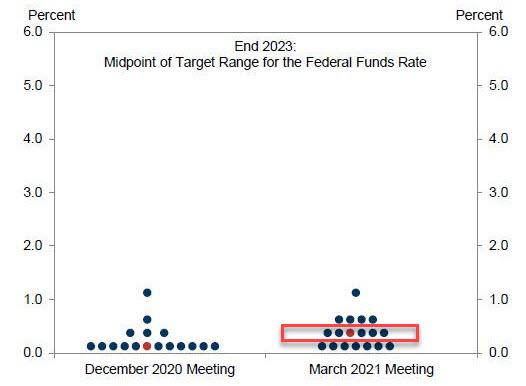

- the release of the Fed dots, featuring what Charlie calls the "credibility conundrum" of the market anticipating and pricing a ’23 rate liftoff along with Nomura/GS/JPM all calling for +25bps in 2023, yet with Bloomberg “consensus” of Street economists expecting that the Fed will not likely reflect this in their median forecast in order to strengthen their own forward guidance and avoid further tantrums (something we expanded on earlier), and...

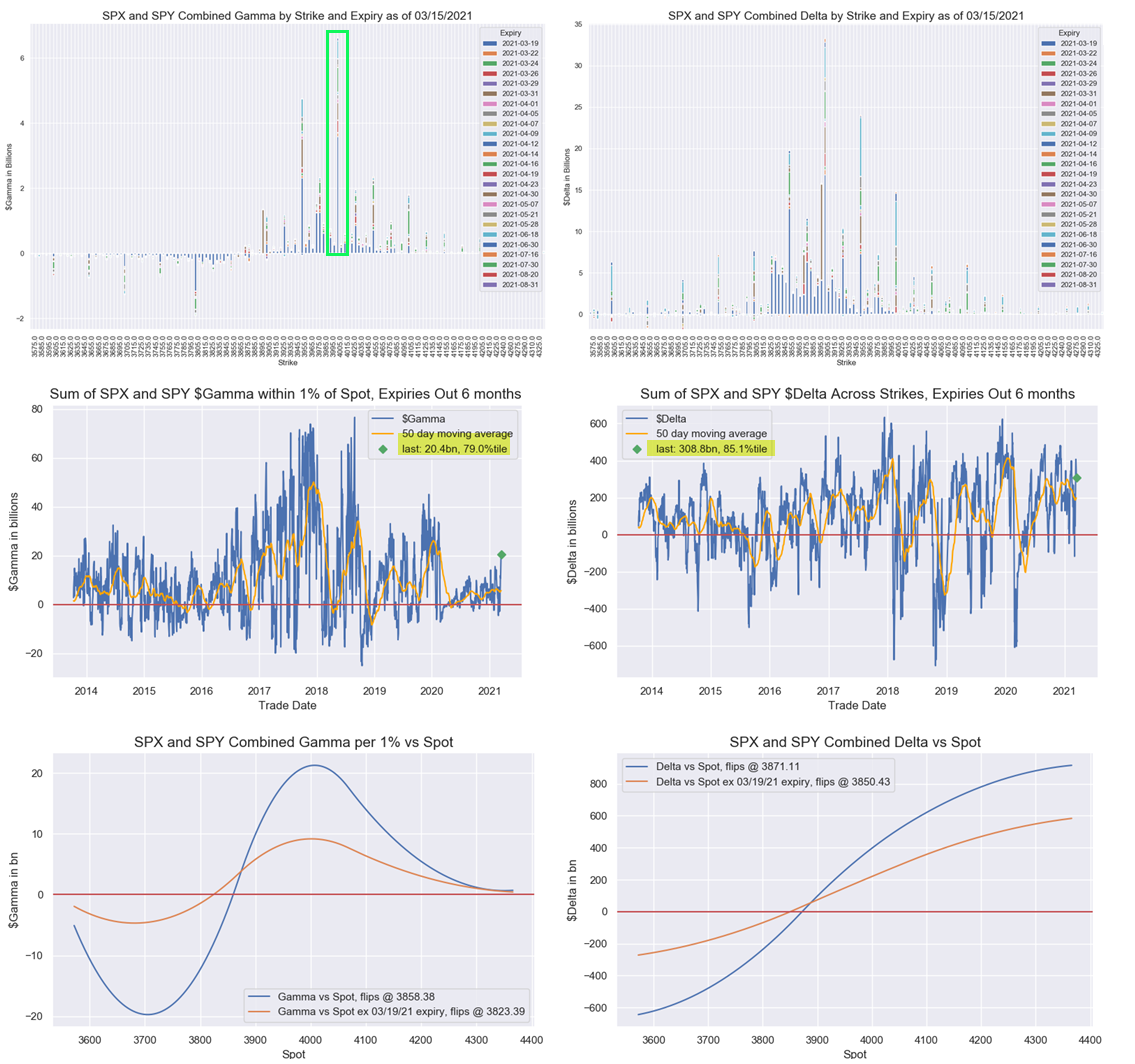

- US serial Op-Ex in VIX Wed (ahead of the Fed) and Quad Witch Equities on Friday, which has the potential to unlock new ranges and see a heavy reduction of risk and Delta.

Echoing SpotGamma's forecast, McElligott notes that the quarterly equities expiration is likely to see "very substantial dealer gamma unclenching thereafter", which following Op-Ex "exposes markets to larger price ranges with the inherent reduction of dealer hedging flows as that risk goes away, while the market is long a ton of Delta in SPX and IWM, and also set to be sharply de-risked, (SPX net Delta +$308.8B (85th %ile), with front-month +$209.4B and front-week +$139.2B of that).

Next, the Nomura quant quantifies the impact of the expiration, writing that he sees a post-Op-Ex reduction of the aggregate Gamma of -44.7% SPX / SPY, while the QQQ change is even greater at -60.0% (IWM is -50.5%; EEM is -62.7%), so as thresholds expire, CME warns that "we are open to big moves in both directions next week"

Going back to the Fed, McElligott says that he believes that if we do get a “soft-surprise” of +25bps on median ’23 dot, that the Rates market will just keep feeding that status quo, grinding bear-steepener, but the immediate flow-through is that stocks would knee-jerk trade lower (at least short-term), "as it would be higher yields for “tightening” and not “higher growth- / inflation- expectations”; ultimately though, the Nomura strategist views this is a much “healthier” outcome for both Rates and Equities markets. As a reminder, earlier we showed Goldman's projections for the Fed's latest set of dots, with the bank expecting 11 participants to show at least one hike in 2023 versus 7 showing no hikes (Of those showing at least one hike, most will show just one, but a handful will show two or more, in line with market expectations of 3 rate hikes)

(Click on image to enlarge)

Alternatively, McElligott writes that if that ’23 median dot doesn’t move, the Equities party may likely gap-higher with the largest Gamma strike at Spooz 4000 being easily in-play and beyond (Charlie's summary of the Greeks is charted below), while the previously discussed standoff in rates market-pricing vs the Fed "will only grow wider and force an eventually dangerous reckoning at a future point - market pricing QE Taper in ’22, first hike in late ’22, 3 or more hikes in ’23…..vs Fed “kicking the can” until a later date - but not now, with stocks staging a furious relief rally in response.

(Click on image to enlarge)

Finally, as a reminder, the x-factor for rates or spreads - not to mention stocks - is the Fed’s “deafening silence” on SLR relief—with nothing still yet to be addressed there (more on that in a post latter today) leading to the "reflation" bear-steepener getting further pressed by traders until the narrative is altered either by data, some risk-off catalyst or the Fed/politicians finally concede on extending the SLR as the alternative could spark a full-blown bond (and stock) market crash.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

moreComments

No Thumbs up yet!

No Thumbs up yet!