Friday, November 18, 2016 2:12 PM EST

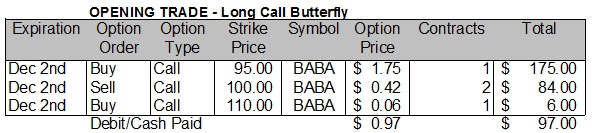

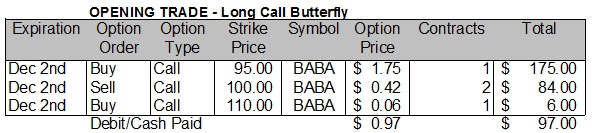

TheOptionPlayer.com sets up an Alibaba Group Holding, Ltd. (NYSE: BABA) short-term (15-day) option strategy (Based on Thursday’s closing quoted bid/ask mean).

The difference between funds paid out and received is a $.97 per share debit maximum risk for this trade. The maximum profit is approximately $4.00 per share if Alibaba Group Holding, Ltd. shares move higher prior to the option contract expiration date. See Guidelines page for explanation on how trade is set up.

Why we recommend it:

As evidenced in the daily chart below, Alibaba Group Holding, Ltd. started crashing a few weeks ago after the Chinese e-Commerce giant announced decelerated sales growth compared to the prior year. Even though investors were disappointed, Alibaba still notched a 30% year-over-year growth rate. Even with the recent slide, shares are up 10% for the year compared to approximately 6% for the S&P 500. Several analysts confirm Alibaba stock is oversold and the sell-off presents a buying opportunity, especially considering the company exceeded expectations with its fiscal second-quarter earnings results.

Investopedia reports that SunTrust analyst Bob Peck still believes in the Chinese e-commerce juggernaut. "We think Alibaba is a rare and valuable global Internet platform," said Peck, "with a powerful ecosystem that creates three distinct value propositions for investors, including the value of: what Alibaba generates today; what Alibaba is becoming; and the optionality of what Alibaba can be long term." We are betting Alibaba Group Holdings, Ltd. stock price will reach our $100 target price over the next few weeks.

52-Week High: $109.87

52-Week Low: $59.25

Disclaimer: Futures, Options, Mutual Fund, ETF and Equity trading have large potential rewards, but also large potential risk. You must be aware of the risks and be ...

more

Disclaimer: Futures, Options, Mutual Fund, ETF and Equity trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these markets. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to buy/sell Futures, Options, Mutual Funds or Equities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this Web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

Performance results are hypothetical. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as a lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

Investment Research Group and all individuals affiliated with Investment Research Group assume no responsibilities for your trading and investment results.

Investment Research Group (IRG), as a publisher of a financial newsletter of general and regular circulation, cannot tender individual investment advice. Only a registered broker or investment adviser may advise you individually on the suitability and performance of your portfolio or specific investments.

In making any investment decision, you will rely solely on your own review and examination of the fact and records relating to such investments. Past performance of our recommendations is not an indication of future performance. The publisher shall have no liability of whatever nature in respect of any claims, damages, loss, or expense arising out of or in connection with the reliance by you on the contents of our Web site, any promotion, published material, alert, or update.

For a complete understanding of the risks associated with trading, see our Risk Disclosure.

less

How did you like this article? Let us know so we can better customize your reading experience.

thanking for sharing

thank for sharing