Alcoa Hit Our Minimum Target; Possible Ending Diagonal In Progress

Since March 2020 crash, Alcoa (AA) has risen in share value around 800% and with the high prices of the Aluminum it must continue rising its value. Besides, AA has built an incomplete impulse and it needs to keep the rally to develop the whole structure. We are considering a target above $47.00 US in first instance and in the future, we are going to recalculate that because the price should be higher.

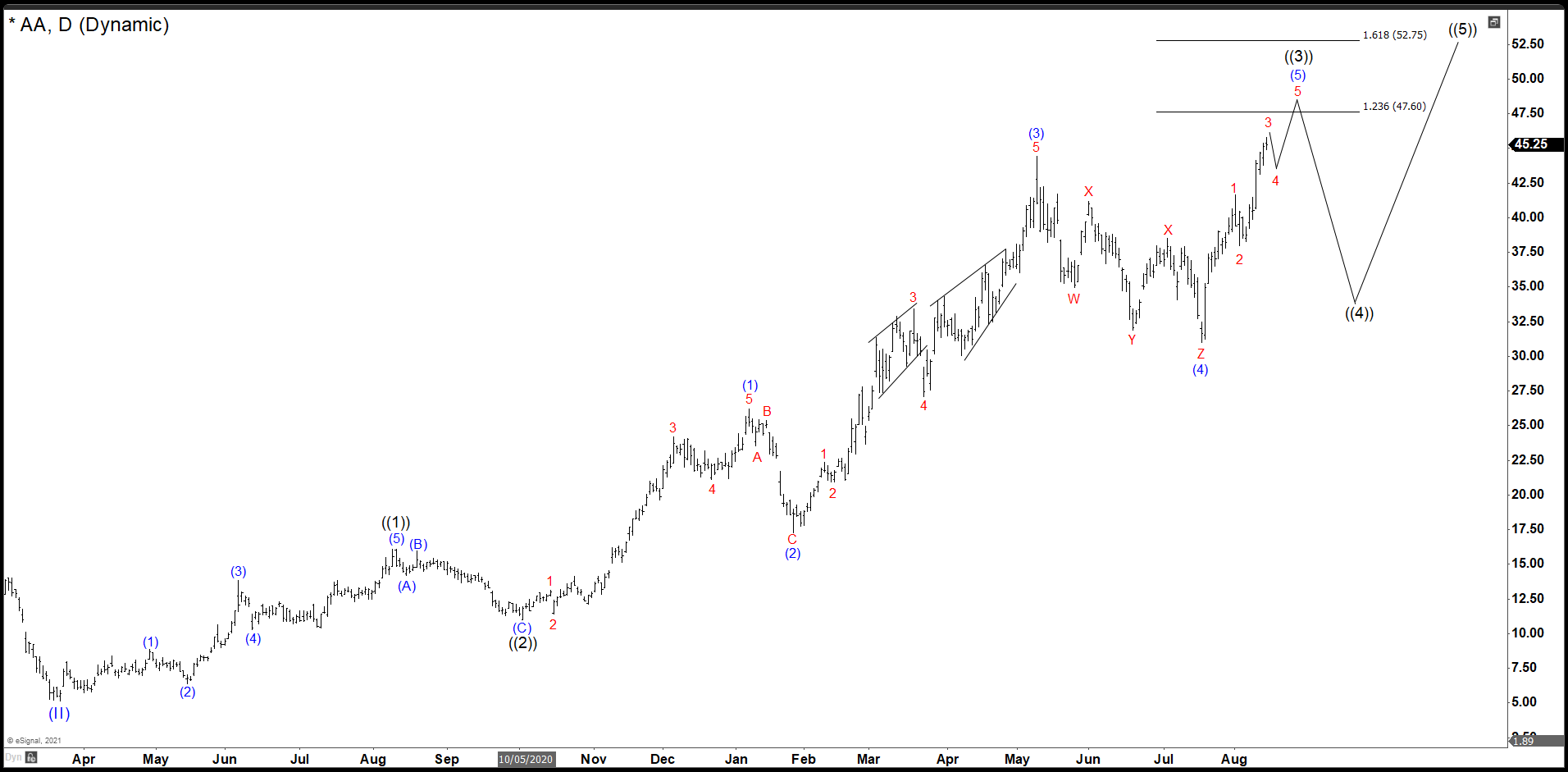

Alcoa (AA) Old Daily Chart

As we see in the daily chart, the wave ((1)) ended in 5 swings and the pullback as wave ((2)) bounced from $10.95. With the break of the price of wave ((1)) we confirmed that wave ((2)) has done. Currently, we are developing the wave ((3)) that needs one high to complete 5 swings up.

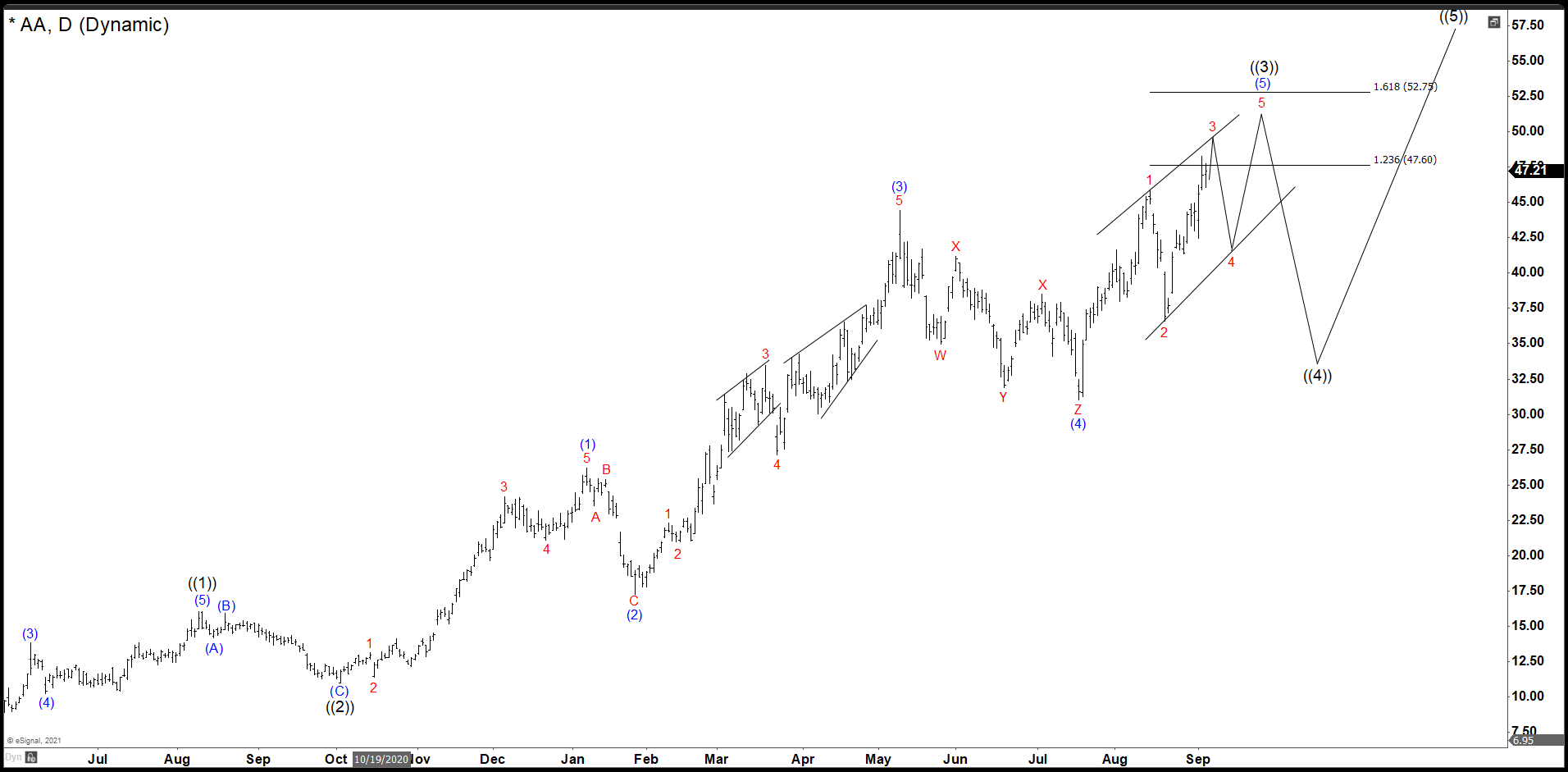

Alcoa (AA) Last Daily Chart

The wave (3) of ((3)) reached $44.49 and wave (4) of ((3)) ends as a triple correction. With that data, it gives us an area of $47.60 – $52.75 as target to end the wave ((3)). If you want to learn more about Impulse and Elliott Wave Theory, please follow this link: Elliott Wave Theory).

Alcoa (AA) Daily Chart

Short Term the bounce reached minimum target at $47.60 from wave (4) of ((3)) and it looks like at ending diagonal to complete wave (5) of ((3)). Therefore, we should do a pullback soon as wave 4 and continue higher to complete (5) and wave ((3)). An alternative possibility, it is wave 3 of (5) breaks more higher and looks to do an impulse instead a ending diagonal.

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more