Airline Stock Roundup: United Airlines, Alaska Air & Southwest's Q3 Fuel Cost Warning, Hawaiian Holdings' Dull View

Image: Bigstock

In the past week, management of airline heavyweights such as United Airlines (UAL - Free Report), Alaska Air Group (ALK - Free Report), and Southwest Airlines (LUV - Free Report) increased their respective projections for third-quarter 2023 fuel price per gallon. Hawaiian Holdings (HA - Free Report), meanwhile, revised its projections downward for key metrics for third-quarter as well as full-year 2023.

The devastation caused by wildfire to the Lahaina town in West Maui resulted in dull projections. Also, issues with RTX's Pratt & Whitney engines that power Airbus' popular A320neo jets added to the woes. We note that HA’s fleet includes A320neo jets with engines, which need to be inspected following problems identified by Pratt & Whitney.

European carrier, Ryanair Holdings (RYAAY - Free Report), grabbed headlines by virtue of its stellar traffic numbers for the month of August. You can read the Last Airline Roundup here.

Recap of the Past Week’s Most Important Stories

United Airlines’ management stated that “since mid-July 2023, jet fuel prices have climbed over 20%.” United Airlines now expects the fuel cost per gallon to be in the $2.95-$3.05 band (the earlier guidance was in the $2.5-$2.8 range).

Southwest Airlines now expects the fuel cost per gallon to be in the $2.7-$2.8 band (the earlier guidance was in the $2.55-$2.65 range). Operating revenue per available seat mile for the third quarter of 2023 is now expected to decline in the 5%-7% band from third-quarter 2022 actuals (the earlier projection was for a 3%-7% decline).

Alaska Air now expects the fuel cost per gallon to be in the $3.15-$3.25 band (the earlier guidance was in the $2.7-$2.8 range). Due to high costs, the third-quarter adjusted pre-tax margin is now expected to be in the 10%-12% range (earlier guidance was 14%-16%). Total revenues are now expected to increase in the 1%-2% range from third-quarter 2022 actuals (the earlier projection was for a 0%-3% increase).

Non-fuel unit costs are now expected to be down 1%-2% (earlier guidance: down 0%-2%). Available seat miles (a measure of capacity) are now expected to be up approximately 13% in third-quarter 2023 from the third-quarter 2022 actuals (earlier guidance: up 10%-13%).

Ryanair, currently sporting a Zack Rank #1 (Strong Buy), reported highly impressive traffic numbers for the month of August, driven by upbeat air travel demand. You can see the complete list of today’s Zacks #1 Rank stocks here.

The number of passengers ferried on RYAAY flights in August was 18.9 million, implying that 12% more passengers flew than a year ago. This was an all-time monthly high traffic number. Owing to upbeat traffic, the load factor (the percentage of seats filled by passengers) was as high as 96% in August.

For the third quarter of 2023, available seat miles are now projected by HA to increase 4%-5.5% from third-quarter 2022 levels (earlier guidance: 4.5%-7.5% rise). Total revenues per available seat miles are now anticipated to decrease 4%-7% from third-quarter 2022 levels (prior projection: 2%-5% decline).

Fuel price per gallon is now expected at $2.91 in third-quarter 2023 (the earlier view was $2.67). The effective tax rate is still anticipated to be 21% in the third quarter. Available seat miles are now projected to climb in the 8%-10% band for full-year 2023 (earlier guidance: 8.5%-10.5% jump).

Price Performance

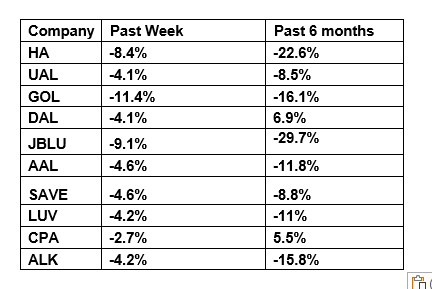

The following table shows the price movement of the major airline players over the past week and during the past six months.

Image Source: Zacks Investment Research

The table above shows that all airline stocks traded in the red in the past week. As a result, the NYSE ARCA Airline Index declined 5% over the period to $58.66. Over the course of the past six months, the sector tracker has decreased 7.7%.

What's Next in the Airline Space?

Stay tuned for the usual news updates in the space.

More By This Author:

High Energy Momentum: 3 Oil Stocks Breaking Out NowBull Of The Day: Camtek

Bear of the Day: Dollar General

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more