Airline Stock Roundup: Delta, Hawaiian Holdings' Upbeat Q2 Revenue View, Ryanair Holdings In Focus

Image: Bigstock

With air-travel demand increasing by the day, as reflected in the northbound trend in bookings, Delta Air Lines (DAL - Free Report) and Hawaiian Holdings (HA - Free Report) provided an improved view for their respective second-quarter 2022 revenues.

Meanwhile, European carrier Ryanair Holdings (RYAAY - Free Report) turned down Dublin Airport Authority’s (DAA) application for an 88% increase in airport charges at Dublin, terming it “unjustified and unwarranted” in the current scenario.

Frontier Group Holdings (ULCC - Free Report), the parent company of Frontier Airlines, decided to sweeten its pot regarding its buyout offer to Spirit Airlines (SAVE - Free Report). The move to introduce a clause pertaining to a reverse termination fee comes ahead of the SAVE shareholders’ vote on the Frontier deal, scheduled to be held on June 10.

Recap of The Latest Top Stories

On the back of upbeat air-travel demand and favorable pricing, Delta expects June quarter's adjusted total revenues to be fully restored to the 2019 level. Previously, the airline had expected the same to have recovered 93-97% from the 2019 level. DAL anticipates total unit revenues to increase seven to eight points from its initial expectations.

However, the carrier now expects second-quarter 2022 capacity to be 82-83% of the second-quarter 2019 actuals. The earlier expectation was 84%. The operating margin is predicted to be 13-14% compared with the previous guidance of 12-14%.

The guided range is less than the 2019 level by three to four points due to lower capacity and higher fuel prices. Fuel price per gallon is now estimated to be $3.60-$3.70 in the second quarter of 2022, higher than the previous guidance of $3.20-$3.35. You can see the complete list of today’s Zacks #1 Rank stocks here.

Hawaiian Holdings now expects total revenues to decline 4.5-7.5% from the second-quarter 2019 level compared with the previous estimation of a decrease of around 8-12%. The improved guidance is due to an uptick in domestic yields.

The company now anticipates second-quarter 2022 capacity to decline 11.5-13.5% from the comparable period’s level in 2019. The previous view was a decrease of about 11.5-14.5%. With rising oil prices, HA now estimates fuel price per gallon to be $3.76 compared with the previous view of $3.59.

Per Ryanair’s Eddie Wilson, "At a time when Irish air travel and tourism are struggling to recover from the COVID-19 pandemic, this application by the DAA for an 88% price increase is unjustified and unwarranted.”

Per RYAAY’s management, Dublin Airport traffic is recovering only due to the government-funded Traffic Recovery Scheme, which lowers charges at Dublin Airport until March 2023-end. Hence, the 88% price increase from 2023 onward would be an exploitation of this Government Traffic Recovery Scheme.

Meanwhile, on the back of improved air-travel demand, RYAAY carried 15.4 million passengers in May 2022, up 756% year-over-year. The actual figure is in line with the expectation mentioned in the previous week’s write-up, which had indicated that May traffic will exceed 15 million. Its load factor (percentage of seats filled with passengers) climbed to 92% in the month from 79% a year ago.

In a move that provides regulatory protection to the shareholders of SAVE, ULCC agreed to pay a $250-million reverse breakup fee to Spirit. Such a payment will be made only if the regulators turn down ULCC’s proposed takeover of SAVE on the grounds of antitrust concerns.

We believe that the introduction of the new clause to their previously announced merger agreement, dated Feb. 5, 2022, is a prudent move and may find favor with Spirit Airlines’ shareholders as they vote on the deal next week.

Performance

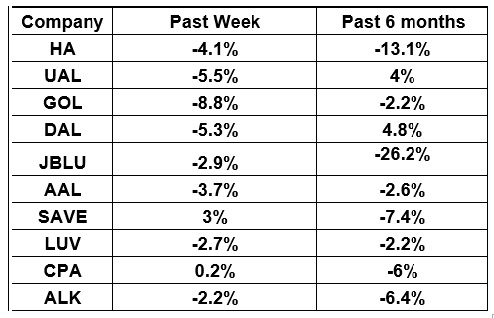

The following table shows the price movement of the major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that almost all airline stocks traded in the red over the past week. The NYSE ARCA Airline Index declined 3.7% to $70.44. Over the course of the past six months, the NYSE ARCA Airline Index plummeted 14.6%.

What's Next in the Airline Space?

Watch this space for more updates on the impending takeover of Spirit Airlines.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more