Airline Stock Roundup: AAL, ALK & UAL Give Upbeat Q2 Revenue View, GOL In Focus

In the past week, key players in the industry like American Airlines AAL, United Airlines UAL and Alaska Air Group ALK reported their respective first-quarter 2022 earnings results. Even though the carriers incurred a loss in the March quarter with Omicron-led woes hurting performances in the early part of the quarter, the bullish revenue views for the June quarter ,owing to upbeat air-travel demand, were highly encouraging,

On the non-earnings front, Gol Linhas’ GOL logistics unit GOLLOG inked a Cargo and Logistics Services agreement with Mercado Livre, which operates marketplaces for e-commerce and online auctions. Also, Allegiant Travel Company’s ALGT March traffic was impressive on upbeat travel demand.

Recap of the Latest Top Stories

1 American Airlines’ first-quarter 2022 loss (excluding 20 cents from non-recurring items) of $2.32 per share compared favorably with the Zacks Consensus Estimate of a loss of $2.43. Operating revenues of $8,899 million skyrocketed 122.03% year over year and also surpassed the Zacks Consensus Estimate of $8,810.8 million. This massive year-over-year jump reflects improving air-travel demand. With the Omicron-related threat subsiding in the latter part of the quarter, American Airlines posted record sales in March. The month marked the first period wherein AAL’s total revenues could exceed the 2019 levels since the advent of the pandemic.

Driven by soaring demand as evidenced by the healthy scenario with respect to bookings, management expects AAL to reap profit in the June quarter. The top-line guidance was naturally very bullish. Total revenues in the second quarter of 2022 are anticipated to be roughly 6-8% higher than the level recorded in second-quarter 2019. Management expects total revenue per available seat mile (TRASM: a key measure of unit revenue) to be 14-16% higher than the second-quarter 2019 actuals.

American Airlines, currently carrying a Zacks Rank #3 (Hold), reported average fuel price per gallon (including related taxes) of $2.80, touching the lower end of the first-quarter guidance in the $2.80-$2.85 band. The story about the Q1 guidance was covered in the previous week’s write-up.

2. United Airlines incurred a loss of $4.24 per share in the first quarter of 2022, wider than the Zacks Consensus Estimate of a loss of $4.19. This is the ninth consecutive quarterly loss reported by UAL as coronavirus fears continue to squeeze air-travel demand. Results were hurt by Omicron-induced softness in travel demand during the first half of the reported quarter. Operating revenues of $7,566 million also fell short of the Zacks Consensus Estimate of $7,657.2 million.

UAL expects to revisit profitability in the second quarter with an operating margin (both on a reported and adjusted basis) of 10%. TRASM is estimated to climb about 17% in the ongoing quarter from the comparable period’s level in 2019. UAL is seeing steady recovery in business travel demand and expects improvement in international demand.

3. Alaska Air incurred a loss (excluding 19 cents from non-recurring items) of $1.33 per share in the first quarter of 2022, narrower than the Zacks Consensus Estimate of a loss of $1.58. In the year-ago period, ALK had incurred a loss of $3.51. Operating revenues of $1,681 million outperformed the Zacks Consensus Estimate of $1,669.3 million.

Alaska Air expects capacity to decline 6-9% in the second quarter from the comparable period's level in 2019. Revenue passengers are estimated to fall 10-12% in the ongoing quarter from the 2019 level. Passenger load factor is expected to be in the range of 85-88%. Total revenues are forecast to increase 5-8% in the second quarter from the comparable period in 2019. CASM, excluding fuel and special items, is predicted to climb 16-19% in the current quarter from the 2019 level. Economic fuel cost per gallon is estimated to be in the band of $3.25-$3.30 in the second quarter.

4. At Allegiant, scheduled traffic (measured in revenue passenger miles) surged 56% in March 2022 from the year-ago levels. Capacity (measured in available seat miles) for scheduled service inched up 0.6% from the March 2021 reading. With the traffic surge outweighing capacity expansion, the load factor (% of seats filled by passengers) in March expanded 30.7 points to 86.5% from the year-ago period’s levels. For the total system (including scheduled service and fixed fee contract), Allegiant carried 52.3% more passengers in March 2022 from the year-ago period’s level. Per Drew Wells, Allegiant’s senior vice president, revenue. "Demand began picking up in earnest mid-February resulting in load factors for the month of March above levels observed in 2019. TRASM during the month of March exceeded March of 2019 on capacity growth of over 14 percent. Demand strength has continued into the second quarter with booking growth exceeding planned forward capacity growth for the quarter. We expect second quarter load factors to exceed 2019 levels, with a more than ten percent increase in TRASM on double-digit anticipated capacity growth."

5. The 10-year deal inked by Gol Linhas with Mercado Livre aims to cater to increasing e-commerce demand in Brazil. In fact, GOLLOG, which offers cargo services to 52 airports and over 3,900 destinations in Brazil, aims to widen its range of services and tonnage capacity by 80% during 2023. It intends to generate additional incremental revenues of more than R$1 billion in five years. GOLLOG intends to invest in up to 12 Boeing converted freighters under the e-commerce deal

Performance

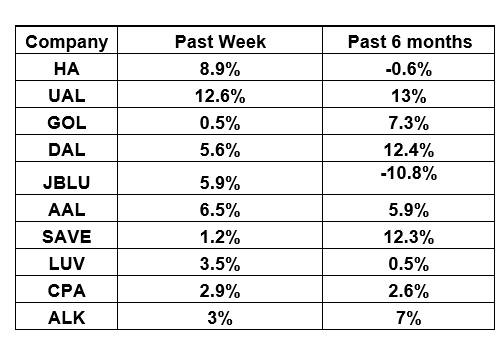

The following table shows the price movement of the major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that all airline stocks have traded in the green over the past week. Strong air-travel demand, which led to impressive revenue projections for the second quarter of 2022 from American Airlines and others, was behind the uptick. The NYSE ARCA Airline Index has increased 4.9% to $84.42. Over the past six months, the NYSE ARCA Airline Index has declined 4.6%..

What's Next in the Airline Space?

With some more airlines slated to report their first-quarter 2022 financials shortly, investors interested in the industry will keep a close eye on how they perform.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more