Airbnb Stock: Excellent Business Model And Long-Term Upside

Airbnb (ABNB) stock has been mostly flat in the past year, which is arguably due to a combination of a high initial valuation after the IPO and all the uncertainty related to travel demand in the current environment. Growth stocks, in general, have been under pressure lately.

However, management is executing well in a challenging period for the industry, and demand trends will probably keep getting better in the coming quarters. From a long-term perspective, Airbnb offers enormous room for further growth in the years ahead.

Fundamental Strength

Airbnb has many of the characteristics that I like in a business model. It is asset-light and it was approaching profitability before the pandemic. The company also benefits from two key sources of sustainable competitive advantage, or moat: brand recognition and the network effect.

Airbnb is so recognized that it is turning into a noun and a verb used all over the world. Nearly 90% of traffic comes through the direct or unpaid channels, meaning that customers go straight to Airbnb when they want to make a reservation.

Airbnb also benefits from the network effect, which means that users on both sides of a transaction attract each other to a leading platform such as Airbnb. The platform has more than 4 million hosts all over the world, and those hosts have welcomed hundreds of millions of guests through Airbnb. Supply creates demand and demand creates more supply on a global scale.

As the platform widens its reach over the years, it is going to keep attracting more hosts and experience providers, which is going to make the value proposition for customers even more attractive. This creates a virtuous cycle for Airbnb and its shareholders.

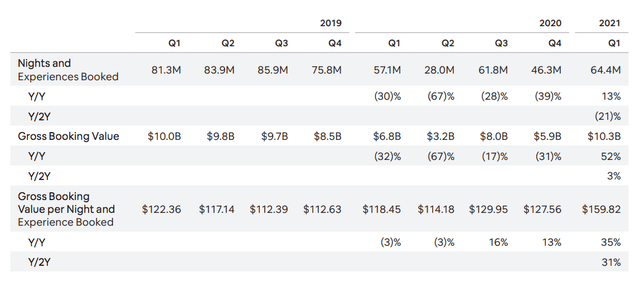

The company was delivering bookings growth in the range of 30-35% in 2019 before the pandemic. Then there was a major decline in the first quarter of 2020, and the numbers bottomed in the second quarter of last year.

Source: Airbnb

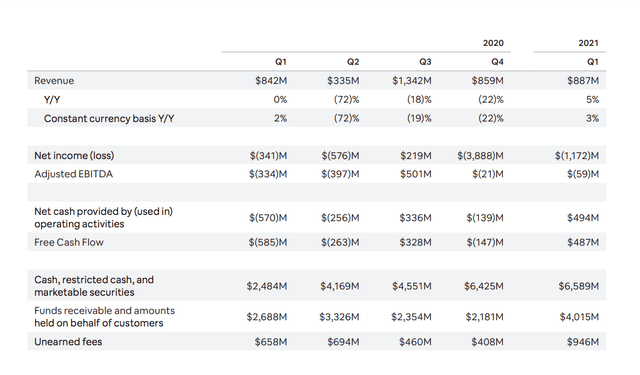

In spite of the sharp decline in revenue from Q2 to Q4 in 2020, management did a solid job of controlling cash burn in a challenging period via cost cuttings. Now the company is in a good shape to capitalize on a major rebound in travel demand over the quarters and years to come.

Source: Airbnb

ABNB Stock's Long-Term Growth Opportunities

Over the past year, there have been some permanent shifts in industry dynamics that could be beneficial to Airbnb going forward. Many companies in the world now have the tech infrastructure for employees to work remotely most of the time. People are now able to travel more if they can work from anywhere and they don't need to be physically present at the place of work.

Airbnb is increasingly focusing on providing more flexible search features, where instead of searching on fixed dates the customer can search for a weekend getaway, or a week-long vacation, or a month-long stay. These longer stays could be particularly lucrative for the company.

From the latest earnings conference call:

People can now travel any time. People are also traveling everywhere. They're not just going to the same 20 or 30 cities. They're visiting smaller cities, towns and rural communities. And when people do travel, they're staying longer. 24% of our nights booked in Q1 were for stays for 28 nights or longer. People are not just traveling on Airbnb; they're now living on Airbnb. And these trends are not going away. The world is never going back to the way it was, and that means that travel is never going back to the way it was either.

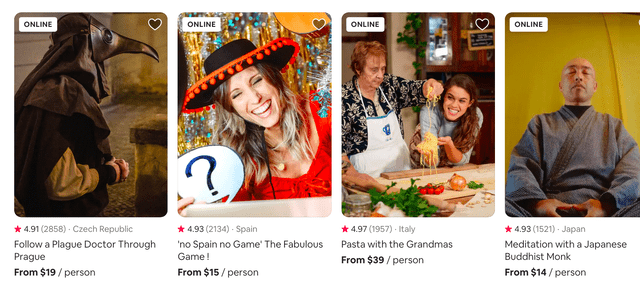

Airbnb is also expanding into experiences in areas such as culture and history, food and drink, and nature and outdoor activities. There is really no limit to what new experiences hosts and entrepreneurs can build over the years, and this could be a major source of growth and optionality for Airbnb.

Some of these experiences can also be delivered online, so customers don't even need to physically travel in order to enjoy them.

Source: Airbnb

Management estimates that the total addressable market ("TAM") could be worth $3.4 trillion, including $1.8 trillion for short-term stays, $210 billion for long-term stays, and $1.4 trillion for experiences.

These numbers should obviously be taken with a big grain of salt since it is very hard to make these kinds of estimates with any degree of precision. However, Airbnb stands to benefit from the rebound in travel demand, as well as the benefits of the network effect by adding more properties and experiences to the platform. The company has what it takes in order to deliver vigorous growth in the years ahead.

Risk Considerations

The most obvious risk factor in the short term is the pandemic, a resurgence of COVID-19 cases due to the delta variant or similar developments in different markets would be a major headwind for Airbnb and other companies in the travel industry. Airbnb has managed to go through the pandemic with remarkable strength, but this is still a major risk factor affecting the business.

Travel demand is also cyclical and tied to the economic cycle, and factors such as weather conditions, natural disasters, and terrorist attacks can be serious problems for the industry.

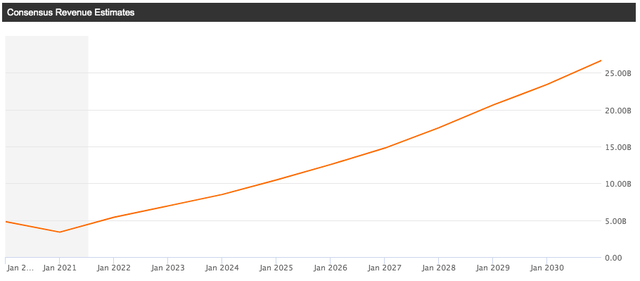

Valuation is another factor to keep in mind. The market is expecting strong growth rates from Airbnb in the years ahead, and this is reflected in the stock price. Based on the average revenue estimate for 2022, the stock carries a price to sales ratio of around 13.

The company has both the fundamental strength and the growth opportunities to meet and exceed those growth expectations, but it is important to keep in mind that valuation does not leave any room for disappointments in financial performance.

Source: Seeking Alpha

There is a wide dispersion in sales estimates for Airbnb in the years ahead, the lowest estimate for 2022 is for $5.28B in revenue and the highest estimate is at $8.47B in revenue. This can be a good thing because it shows that there is not much herding or even conviction among the analysts following the stock.

If you believe that Airbnb has the ability to outperform expectations, improved visibility should drive rising conviction and increased price targets among the analyst community. This happens frequently in these cases, as Wall Street analysts tend to run from behind when a company consistently outperforms.

| Fiscal Period Ending | Revenue Estimate | YoY Growth | FWD Price/Sales | Low | High |

| Dec 2021 | 5.39B | 59.64% | 16.88 | 3.38B | 6.28B |

| Dec 2022 | 6.94B | 28.70% | 13.12 | 5.28B | 8.47B |

| Dec 2023 | 8.49B | 22.33% | 10.72 | 7.60B | 9.81B |

| Dec 2024 | 10.46B | 23.16% | 8.71 | 9.10B | 12.22B |

| Dec 2025 | 12.55B | 20.01% | 7.25 | 10.53B | 14.79B |

| Dec 2026 | 14.78B | 17.77% | 6.16 | 12.58B | 17.84B |

| Dec 2027 | 17.55B | 18.74% | 5.19 | 15.09B | 21.45B |

| Dec 2028 | 20.63B | 17.54% | 4.41 | 17.33B | 25.70B |

| Dec 2029 | 23.42B | 13.52% | 3.89 | 19.69B | 30.67B |

| Dec 2030 | 26.67B | 13.88% | 3.41 | 22.18B | 36.46B |

Source: Seeking Alpha

Another risk factor to watch is competition, with traditional online travel agencies such as Expedia (EXPE) and Booking (BKNG) expanding into rentals over recent years. There is always the risk that big tech companies would want to broaden their presence in this area beyond search capabilities in the future, but it seems like they are too concerned about regulatory risk in order to make those kinds of moves for the time being.

Airbnb has remarkable competitive strengths due to brand value and the power of the network effect, and this is reflected in the fact that more than 90% of traffic comes from unpaid sources. Nevertheless, competition is always a key variable to monitor in such a dynamic industry.

Regulatory pressure is an additional risk factor to consider. Some big cities have imposed restrictions and regulations on Airbnb, such as special registrations and licenses for landlords. In cities such as New York and San Francisco, for example, property owners need to prove that they are actually full-time residents in order to rent their properties on Airbnb.

It seems unlikely that this will escalate into something more serious, though, as Airbnb collected over $3.4 billion in tourist rent and tourism-related taxes over the years and big cities are in need of tax revenue.

The Bottom Line

It is always important to be careful when investing in a relatively recent IPO such as Airbnb, as the company still has a lot to prove in terms of its ability to consistently execute in the years ahead. That said, Airbnb has an excellent business model, management is doing a great job during a challenging time, and the company has abundant potential for long-term growth. The upside potential in Airbnb should more than compensate for the risks in a multi-year time horizon.

Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives.

Disclaimer: I wrote this article myself, and it ...

more