Airbnb Earnings Preview: Buy For The Long-Term

Photo by Viacheslav Bublyk on Unsplash

Airbnb (ABNB - Free Report) is one of the most significant new technology companies to emerge in the last decade. It has completely revolutionized the way people travel and enabled real estate owners to enter the tourism industry without having to buy a whole hotel. 4 million Airbnb hosts have now served an estimated 1 billion guests.

After a shaky start in public markets, Airbnb has dramatically improved its business fundamentals and set itself up for the long run. While some of the weakness the stock experienced over the last year had to do with macroeconomic factors, the circumstances pushed ABNB to profitability quicker than it may have planned.

While the most recent earnings reports showed some softening in sales growth, tourism is a very sensitive industry to economic trends. So, even if there is some near-term weakness in the stock, ABNB has the potential to be a great long-term investment. Airbnb reports earnings on Tuesday, May 9 after the market closes.

(Click on image to enlarge)

Image Source: Zacks Investment Research

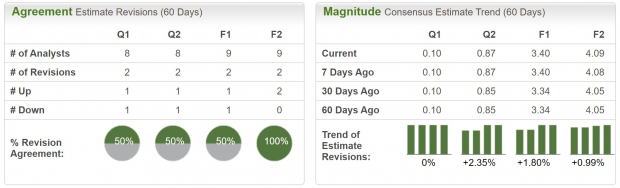

Earnings Estimates

Airbnb currently has a Zacks Rank #3 (Hold), indicating a mixed earnings revision trend. Analysts are split in their expectations for the coming quarters, although they are in full agreement about upgrading FY24 earnings.

(Click on image to enlarge)

Image Source: Zacks Investment Research

The current quarter earnings are expected to be $0.10 per share, which would be a huge increase from the year-ago results of -$0.03. Additionally, the next quarter estimates project earnings of $0.87 per share, which shows just how rapidly ABNB is increasing its profitability.

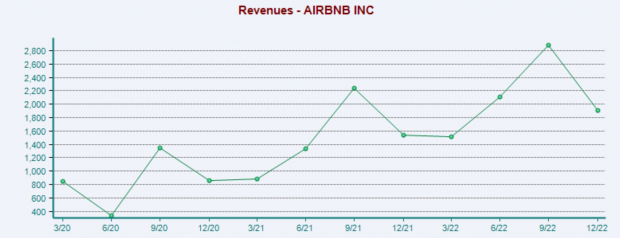

However, revenues have begun to slow down from the highs in late 2022. If sales come in around estimates of $1.8 billion for the quarter, it would mark the second consecutive quarter of slowing growth. It should be noted that sales have grown massively over just the past few years though, and that the slowdown is more a result of economic trends.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Technical Setup

Airbnb stock has clearly been having trouble breaking out above the $125 level. This level is clearly acting as resistance. However, the price has been carving out a convincing cup and handle pattern below that level.

If the price can breakout above the $125 level and hold, it should kick off a big bull run for ABNB stock. Alternatively, if the stock trades meaningfully below $110, it may be taking another trip down to the lows. Nonetheless, I consider this 12-month basing process, where investors have clearly been accumulating stock, to be a bullish development.

(Click on image to enlarge)

Image Source: TradingView

Valuation

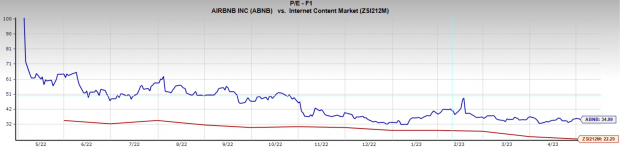

Airbnb is trading at one-year forward earnings multiple of 35x, which is above the industry average of 22x, and below its one-year median of 46x. For a company growing as fast as Airbnb, and with such advantageous business economics, I consider this to be an appealing valuation.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Airbnb is one of the leading new platform technology companies. It has a strong brand, a proven business model, high sales growth, and rapidly improving business economics. Even if there is some near-term volatility in the stock, I think it presents a good opportunity over the long term.

More By This Author:

AMC Entertainment To Post Q1 Earnings: What's In Store?

Block Beats Q1 Earnings And Revenue Estimates

Kellogg Surpasses Q1 Earnings And Revenue Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more