AIG Agrees To Sell Part Of Its Insurance Business To Blackstone For $2,200 Million

During yesterday's session, Blackstone (BX) and AIG (AIG) announced that they had reached an agreement for the US fund to acquire 9.9% of the insurance and pension business.

This is part of AIG's strategy to convert its pension division into an independent company so that the parent company can focus on other types of insurance. Blackstone have agreed to pay 2,200 million US dollars for the acquisition.

AIG plans to present its second-quarter results on 4 August. We should pay particular attention to these since, in their results for 2020 and Q1 of this year, there were mixed signals with better than expected earnings per share by the consensus of analysts but with revenue lower than expected.

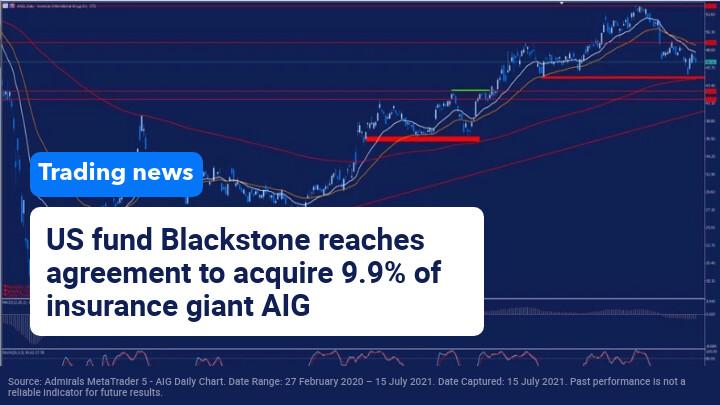

Technically speaking, although during the first half of the year the AIG share price has risen 25.73%, since the beginning of June, the share price is in full correction. This has led it to lose 12.17%, reaching the lows of last March in the meeting point of its red band of support and its 200-session average.

The loss of these support levels could lead to a further correction in search of its next support levels around $42.60 and $41.50 per share. The loss of these levels could jeopardize the uptrend by pitting the price against its long-term trend line.

On the contrary, it seems that this announcement is being well received by the market since during the pre-opening of today's session, shares are trading with a rise of close to 5.6% to 49 dollars per share. It is important to see if the price is able to exceed and maintain in a sustained way the level of 48.90 dollars because, if it manages to do so, we could find a new upward momentum until the annual highs.

(Click on image to enlarge)

Source: Admirals MetaTrader 5 - AIG Daily Chart. Date Range: 27 February 2020 – 15 July 2021. Date Captured: 15 July 2021. Past performance is not a reliable indicator for future results.

Evolution in the last 5 years:

- 2020: -26.24%

- 2019: 30.25%

- 2018: -33.85%

- 2017: -8.77%

- 2016: 5.39%

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter ...

more