AI Stocks: Does Burry's Hyperscaler Depreciation Thesis Hold Water?

Photo by Steve Johnson on Unsplash

Michael Burry, the man behind the “Big Short” during the Great Financial Crisis, is shorting the AI trade because he notes that hyperscalers have been depreciating their GPU chip investments over more than three years. We side with the hyperscalers rather than Burry,

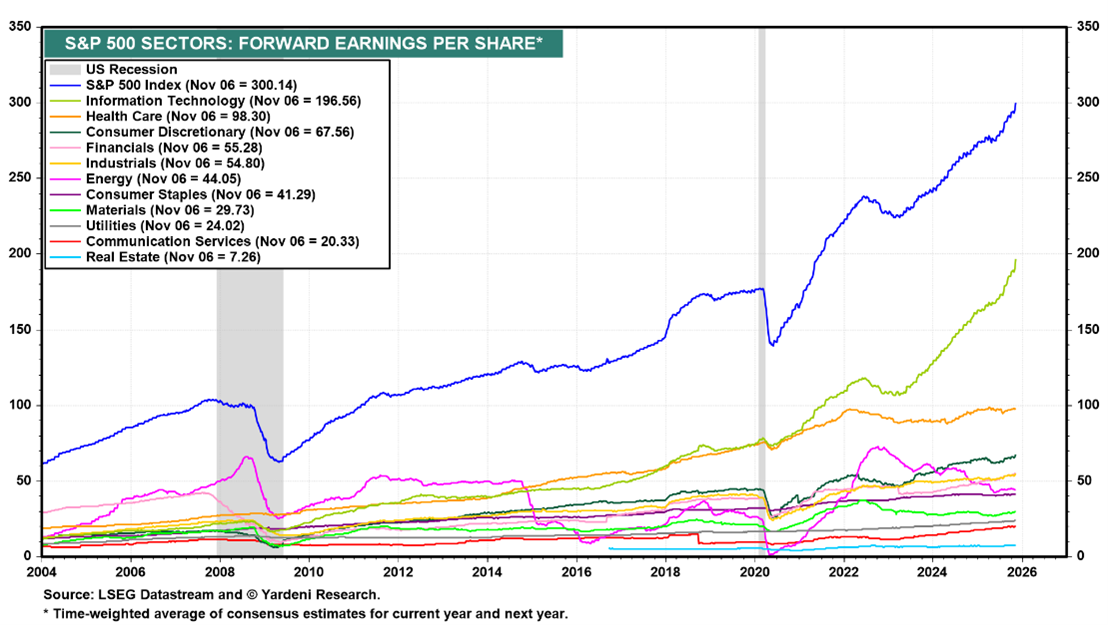

He thinks that they should be doing it for under three years. That is a reasonable concern given that the forward earnings of the S&P 500 Index (SPX) have been led higher since the start of the Roaring 2020s by the Information Technology sector.

But the depreciation of GPU chips by hyperscalers like Alphabet Inc. (GOOGL), Microsoft Corp. (MSFT), Meta Platforms Inc. (META), and Amazon.com Inc. (AMZN) is a complex and current topic in financial accounting, with significant debate over the appropriate lifespan. Hyperscalers are stretching GPU depreciation schedules, a move that lowers expenses and boosts reported earnings. Critics argue that this is aggressive accounting since GPUs often become obsolete faster.

But hyperscalers justify the longer depreciation schedule by arguing for a value cascade model. They contend that older generation GPUs, once replaced in top-tier training jobs, are simply cascaded down. In other words, they power less-computationally intense, but high-volume, inference (running the model) or other tasks.

That lets them still generate significant economic value for years. They also cite continuous software and data center operational improvements that extend the hardware’s life and efficiency.

If depreciation schedules don’t align with real-world replacement cycles, companies may be overstating their profitability and underestimating the capital-intensive nature of AI infrastructure. That would increase the chances that the AI boom is turning into an AI bubble that may be about to burst.

But data centers existed before AI caught on in late-2022 when ChatGPT was first introduced. During 2021, there were as many as 4,000 of them in the US as a result of the rapidly increasing demand for cloud computing. Many are still operating with their original chips.

More By This Author:

XLE: This Is No Replay Of 2015 In The Oil PatchBuffett: Yes, Luck Plays A Big Role In Investing, Too

ET: A High-Yielding Energy Play To Target