AI Earnings Roundup: NVIDIA & Palantir

Photo by Steve Johnson on Unsplash

The 2025 Q3 earnings cycle continues to chug along, with the vast majority of S&P 500 companies already delivering results. The period has so far been one of resilience, with overall growth remaining strong and an above-average number of companies exceeding quarterly expectations.

So far, several companies closely involved in the AI frenzy – Palantir (PLTR - Free Report) and NVIDIA (NVDA - Free Report) – have posted massive growth, with demand remaining red-hot. Let’s take a closer look at the releases.

Another Historic Period for NVDA

NVIDIA posted a double-beat relative to our consensus expectations, with sales of $57 million growing 62% alongside a 67% jump in EPS. Unsurprisingly, it reflected a record-setting release yet again, with both overall and Data Center sales breaking previous records.

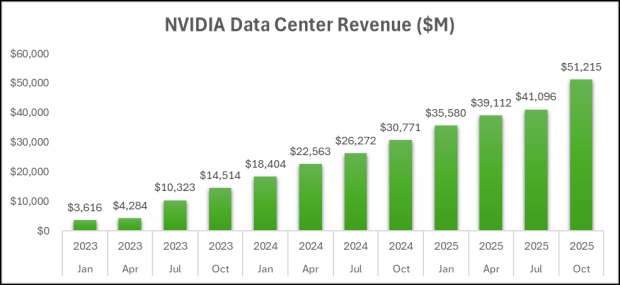

And concerning the Data Center, revenue of $51.2 billion grew 66% from the year-ago period, also crushing our consensus estimate of $49.1 billion.

Below is a chart illustrating NVDA’s Data Center revenue on a quarterly basis.

Image Source: Zacks Investment Research

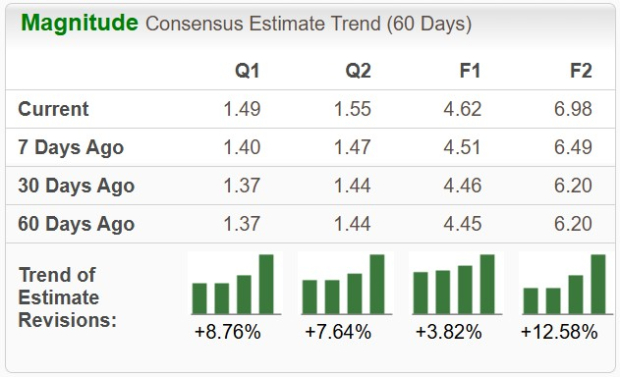

A favorable outlook remains for the AI poster-child following the release, with analysts continuing to revise their EPS expectations higher across the board. The stock sports the highly coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Notably, shares aren’t expensive on a historical basis, with the current 29.1X forward 12-month earnings multiple well below the five-year median and steep five-year highs of 106.3X. It’s worth noting that NVDA shares traded well above current valuation levels in 2020 and 2021, a period when the AI theme had yet to fully emerge and when shares were primarily driven by its gaming results.

PLTR Breaks Records

Regarding Palantir’s results, quarterly sales of $1.2 billion set another record, up a sizable 63% from the year-ago period. Growth was broad-based, with US commercial revenue surging 121% YoY and US government revenue shooting 52% higher.

PLTR inked many lucrative deals throughout the period, closing more than 200 deals worth at least $1 million, 91 worth at least $5 million, and 53 deals worth at least $10 million. It closed a record-setting $2.8 billion of Total Contract Value (TCV) overall, up a staggering 340% from the same period last year.

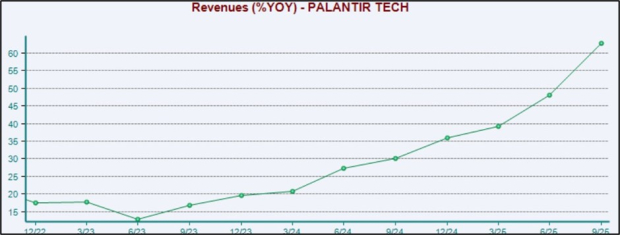

And for the cherry on top, Customer count grew by a massive 45% YoY. It goes without saying that the company has continued to witness extremely hot momentum, underpinned by a rapidly growing customer base. This is further reflected in the chart below, which tracks the company's YoY % change in sales.

Please note that these are not actual sales numbers, rather the YoY % growth rates.

Image Source: Zacks Investment Research

To top off the robust results, Palantir provided its highest sequential quarterly revenue growth guide in its history for its Q4 (61% growth expected), while also increasing its current year sales, adjusted operating income, and adjusted free cash flow guidance.

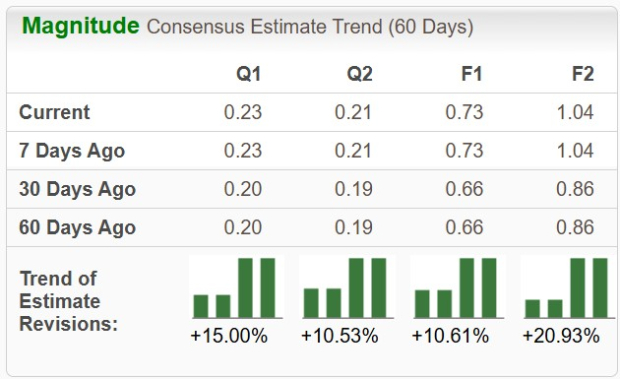

The stock sports a favorable Zacks Rank #2 (Buy), with EPS expectations rising across the board.

Image Source: Zacks Investment Research

Bottom Line

The 2025 Q3 earnings season has been one of strength, with growth remaining strong and a nice number of companies exceeding expectations.

And concerning AI earnings, both NVIDIA and Palantir crushed it, both reporting big growth and seeing positive EPS revisions post-earnings.

More By This Author:

Q3 Earnings Season: 2 Big WinnersNVIDIA Earnings: Good Or Bad?

These 'Boring' Stocks Have Outperformed Nicely