AI Earnings: 2 Key Reports To Watch

Photo by Mohamed Nohassi on Unsplash

The 2025 Q2 earnings season keeps chugging along this week, with a notable number of companies on the reporting docket. Among the bunch are several Mag 7 members, with several other heavyweights also reporting.

But concerning notable companies reporting in the coming weeks, Palantir (PLTR - Free Report) and NVIDIA (NVDA - Free Report) reflect highly consequential reports concerning the AI frenzy.

Both stocks have enjoyed stellar growth over recent periods thanks to the red-hot demand, with many expecting the upcoming releases to further confirm the bullish trend.

For those interested in the AI frenzy, let’s take a closer look at what analysts are expecting for each.

Palantir Reports August 4th

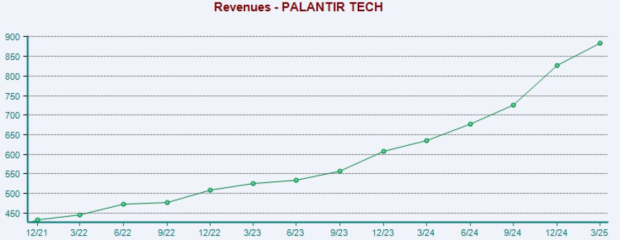

Palantir’s latest set of quarterly results continued to impress, with sales climbing 40% year-over-year alongside an upgrade to its current-year sales outlook. Massive growth has been driven by red-hot demand that’s seemingly only continuing to grow.

As shown below, the company’s sales growth has been outstanding over recent periods, a reflection of the red-hot demand PLTR has been enjoying.

Image Source: Zacks Investment Research

Importantly, customer count grew nearly 40% year-over-year and 8% sequentially. Palantir also booked a record U.S. commercial total contract value throughout the period ($810 million), which grew a staggering 180% year-over-year.

Customer growth will be the key metric to watch for the release, one that PLTR has consistently positively shocked on over recent periods. Analysts have been silent concerning their EPS and sales revisions, with expectations unchanged over recent months.

The AI-favorite is expected to see 55% EPS growth on 38% higher sales.

NVIDIA Reports August 27th

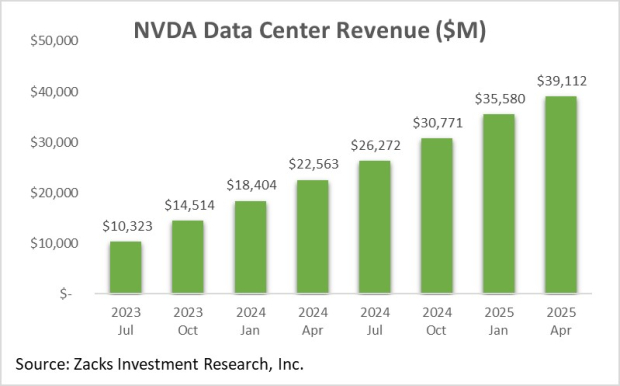

Unrelenting demand for its Data Center products has provided NVIDIA with unprecedented growth over recent years. The AI favorite again came out with rock-solid results in its latest quarterly print, with Data Center sales of $39.1 billion climbing 73% from the $22.5 billion print in the same period last year.

Below is a chart illustrating NVIDIA’s Data Center sales on a quarterly basis. While the results themselves will (unsurprisingly) be the focal point of the release, commentary surrounding upcoming periods and new product launches will be a key post-earnings factor concerning share movement.

Image Source: Zacks Investment Research

EPS revisions for NVDA’s print have remained stagnant over recent months, with the current $1.00 Zacks Consensus EPS estimate suggesting 47% year-over-year growth. The $48.5 billion expected in sales is up a marginal 0.9% over the same timeframe, reflecting sizable YoY growth of 52%.

Bottom Line

The 2025 Q2 earnings cycle continues to roll along, with this week’s reporting docket notably stacked. And concerning the broader AI frenzy, reports from NVIDIA and Palantir will be key in getting a better gauge on the current AI landscape.

More By This Author:

Will Cloud Results Boost Microsoft Earnings?PayPal And Visa Earnings: A Closer Look

A Closer Look At The Top IPOs Of 2025: Circle Internet Group, CoreWeave

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more