AI Bubble? Non-Tech Stocks Worth A Look

Image Source: Pexels

Fears of an impending AI ‘bubble’ have mightily skewed sentiment among the beloved AI stocks over recent weeks, causing them to face adverse price action.

The bullish moves from these stocks is undoubtedly fair to question given lofty expectations and outlooks that sometimes seem unreal. Not even NVIDIA’s (NVDA - Free Report) robust, record-breaking Q3 release was enough to silence the doubters, with the stock facing notable pressure following the release.

For those seeking to broaden their exposure to non-tech stocks outside of the AI frenzy, American Express (AXP - Free Report) and Caterpillar (CAT - Free Report) all reflect attractive options, with each recently coming off strong quarterly releases. Let’s take a closer look at each.

AXP Raises Guidance

American Express posted a double-beat concerning our headline expectations, with adjusted EPS climbing 19% alongside a 10% sales increase. AXP raised its current year sales and EPS outlook thanks to the strong results, with shares seeing a nice pop post-earnings.

Sales of $18.4 billion reflected a quarterly record, with successful launches of updated Platinum Cards providing nice benefits. Increased Card Member spending also provided big tailwinds, with Net Interest Income of $4.5 billion also exceeding our consensus estimate by nearly 4%.

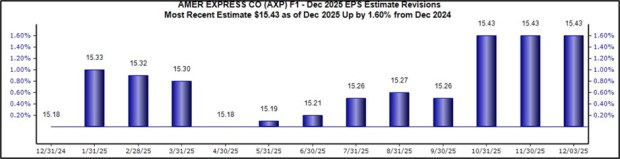

The revisions trend for its current-year EPS expectations is notably bullish, with the current $15.43 Zacks Consensus estimate only going up since April.

Image Source: Zacks Investment Research

CAT Keeps Generating Cash

Caterpillar posted a double-beat relative to our consensus expectations, with sales growing 10% alongside a small decline in adjusted EPS. Strength was broad-based, with the company seeing nice growth across all three of its primary segments.

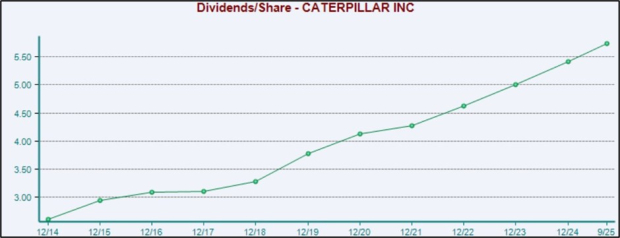

Notably, the company’s cash generation remained strong, with operating cash flow totaling $3.7 billion. Strong cash-generating abilities are a major perk, allowing it to pay out dividends, stack cash, and more.

And the company has long been known for its shareholder-friendly nature, currently a Dividend Aristocrat. Below is a chart illustrating the company’s dividends paid on an annual basis. Please note that the final value tracked is on a trailing twelve-month basis, as CAT's current fiscal year is still ongoing.

Image Source: Zacks Investment Research

Bottom Line

The AI frenzy continues to dominate market headlines, with some calling it a ‘bubble’ while others continue buying into the story. The entire development certainly warrants caution among investors after their huge runs, but the results that these companies have been reporting (specifically NVIDIA) do reflect reality.

And for those seeking to lessen their exposure to the trade, both stocks above – American Express and Caterpillar– reflect strong options, with both companies recently coming off robust quarterly results that have revealed strong demand trends.

More By This Author:

Q3 Earnings Season: 3 Companies That Crushed ExpectationsAI Earnings Roundup: NVIDIA & Palantir

Q3 Earnings Season: 2 Big Winners