Agilent Gets An A

Summary

- 100% technical buy signals.

- 16 new highs and up 11.98% in the last month.

- 76.25% gain in the last year.

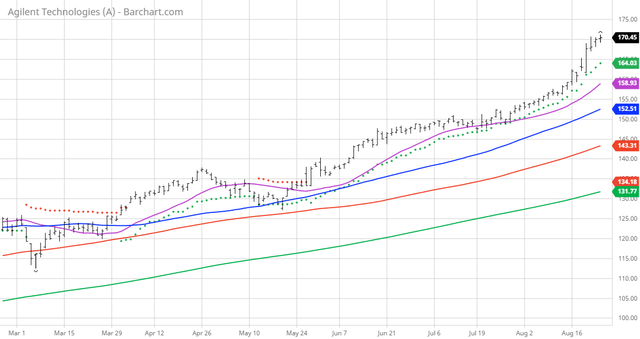

The Barchart Chart of the Day goes to the healthcare research and diagnostic company Agilent Technologies (NYSE: A). I found the company by sorting Barchart's All-Time High list first by the highest number of new highs in the last month, then used the Flipchart function to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 5/27 the stock gained 23.91%.

Agilent Technologies, Inc. provides application-focused solutions to the life sciences, diagnostics, and applied chemical markets worldwide. The Life Sciences and Applied Markets segment offers liquid and gas chromatography systems and components; liquid and gas chromatography-mass spectrometry systems; inductively coupled plasma mass and optical emission spectrometry instruments; atomic absorption instruments; microwave plasma-atomic emission spectrometry instruments; raman spectroscopy; cell analysis plate-based assays; flow cytometer; real-time cell analyzer; cell imaging systems; microplate readers; laboratory software, information management, and analytics; laboratory automation and robotic systems; dissolution testing; vacuum pumps; and measurement technologies. The Diagnostics and Genomics segment provides arrays for DNA mutation detection, genotyping, gene copy number determination, identification of gene rearrangements, DNA methylation profiling, and gene expression profiling, as well as sequencing target enrichment, genetic data management, and interpretation support software; and equipment to produce synthesized oligonucleotide. It also offers immunohistochemistry, in situ hybridization, and hematoxylin and eosin staining and special staining; instruments, consumables, and software for quality control analysis of nucleic acid samples; and reagents for use in turbidimetry and flow cytometry, as well as develops pharmacodiagnostics. The Agilent CrossLab segment provides GC and LC columns, sample preparation products, custom chemistries, and laboratory instrument supplies; and startup, operational, training, compliance support, software as a service, asset management, and consultation services. The company markets its products through direct sales, distributors, resellers, manufacturer's representatives, and electronic commerce. It has collaboration agreement with SGS AXYS. The company was incorporated in 1999 and is headquartered in Santa Clara, California.

(Click on image to enlarge)

Barchart technical indicators:

- 100% technical buy signals

- Weighted Alpha 76.25+

- 74.75% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50, and 100 day moving averages

- 16 new highs and up 11.98% in the last month

- Relative Strength Index 87.84%

- Technical support level at 168.56

- Recently traded at 170.85 with a 50 day moving average of 152.51

Fundamental factors:

- Market Cap $51.59 billion

- P/E 40.91

- Dividend yield .46%

- Revenue expected to grow 16.50% this year and another 6.60% next year

- Earnings estimated to increase 26.20% this year, an additional 11.80% next year and continue to compound at an annual rate of 10.80% for the next 5 years

- Wall Street analysts issued 10 strong buy, 3 buy, 3 hold and 1 sell recommendation on the stock

- The individual investors following the stock on Motley Fool voted 533 to 68 that the stock will beat the market, with the experienced investors voting 96 to 4 for the same result

- 53,830 investors are monitoring the stock on Seeking Alpha

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the ...

more