Affiliated Managers Group: An Asset Management Play With Strong Wall Street Support

Image Source: Pixabay

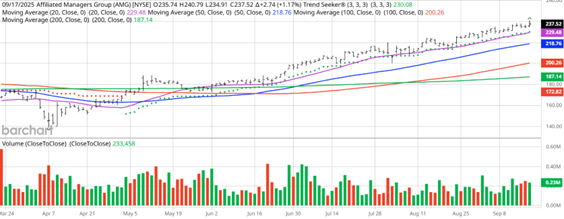

Valued at $6.9 billion, Affiliated Managers Group Inc. (AMG) is a global asset management company with equity investments in leading boutique investment management firms. Since the Trend Seeker tool signaled a “Buy” on Affiliated Managers Group on May 7, the stock has gained 36%, highlights Jim Van Meerten, analyst at Barchart.

Affiliated Managers Group's affiliates offer many investment products across a broad array of active, alpha-oriented strategies to both institutional and retail clients around the world. So, Affiliated Managers Group shares offer investors a unique opportunity to participate in the growth of a diverse group of high-quality boutique investment management firms.

Affiliated Managers Group Price vs. Daily Moving Averages Chart

The stock hit a new all-time high of $240.79 on Sept. 17. It has recently boasted a Weighted Alpha of +44.1, a 100% “Buy” opinion from Barchart, and it has been trading above its 20-, 50-, and 100-day moving averages. Affiliated Managers Group also made 13 new highs in the last month, and it has sported a Relative Strength Index (RSI) of 72.2%.

Meanwhile, it looks like Wall Street analysts are high on Affiliated Managers. Those tracked by Barchart have recently issued seven “Strong Buy” ratings and only one “Strong Sell” opinion. Their price targets are between $210-$331. Value Line gives the stock its “Above Average” rating with a price target of $260, while CFRA’s MarketScope Advisor rates it a “Buy.”

Affiliated Managers Group seems to have it all – growth in both revenue and earnings and a wide following by individual and institutional investors. But the stock is volatile and even speculative in the current environment, which means investors should use strict risk management and stop-loss strategies.

About the Author

Jim Van Meerten earned a BS in Accounting and Business Administration from Berry College; a Juris Doctorate from the Woodrow Wilson School of Law; and attended post-baccalaureate and graduate courses in Business Administration, Quantitative Math, and Education at Florida Atlantic University, Georgia State University and University of North Carolina at Charlotte.

Previously he has been an accountant, attorney, adjunct professor in Business Law, Accounting and Internal Auditing, financial advisor, supervisory principal, and compliance officer. He also passed the Georgia CPA Exam, the Certified Internal Auditor Exam, and the FINRA Series 7, 24 and 9/10 exams.

He is presently an analyst at Barchart and writes "Chart of the Day," an article sent out daily that utilizes the tools available on Barchart.com, including screeners, Barchart technical indicators, and trading signals, to find stocks with compelling setups.

More By This Author:

Mining Stocks: Three Places To Find The Biggest Potential GainsWhat’s Really Powering The Rally In Stocks And Metals

DLS And DFJ: Two International ETFs For This Post-Powell Market

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more