Advanced Micro Devices Inc. Bearish Sequence Calls For More Downside

Image Source: Unsplash

In today’s article, we’ll examine the recent performance of Advanced Micro Devices, Inc (AMD) through the lens of Elliott Wave Theory. We’ll review how the decline from the December 05, 2024, peak unfolded as a 5-wave impulse and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock.

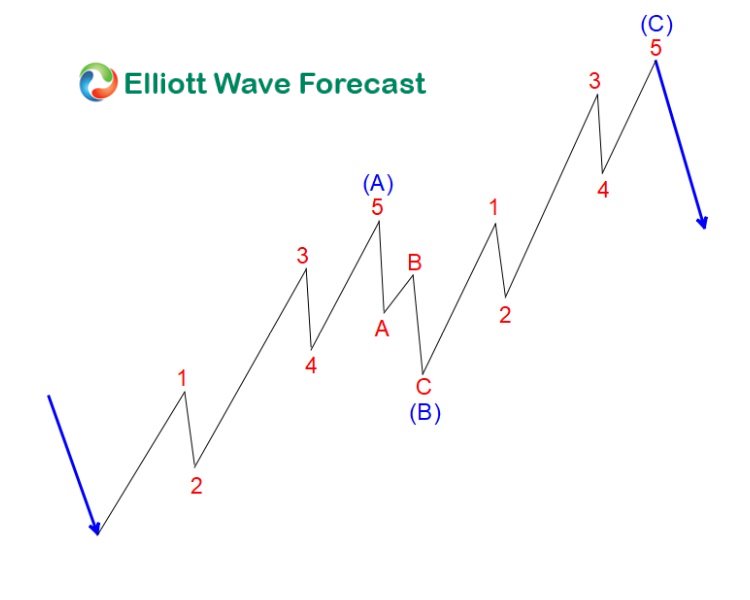

Zig-Zag ABC correction

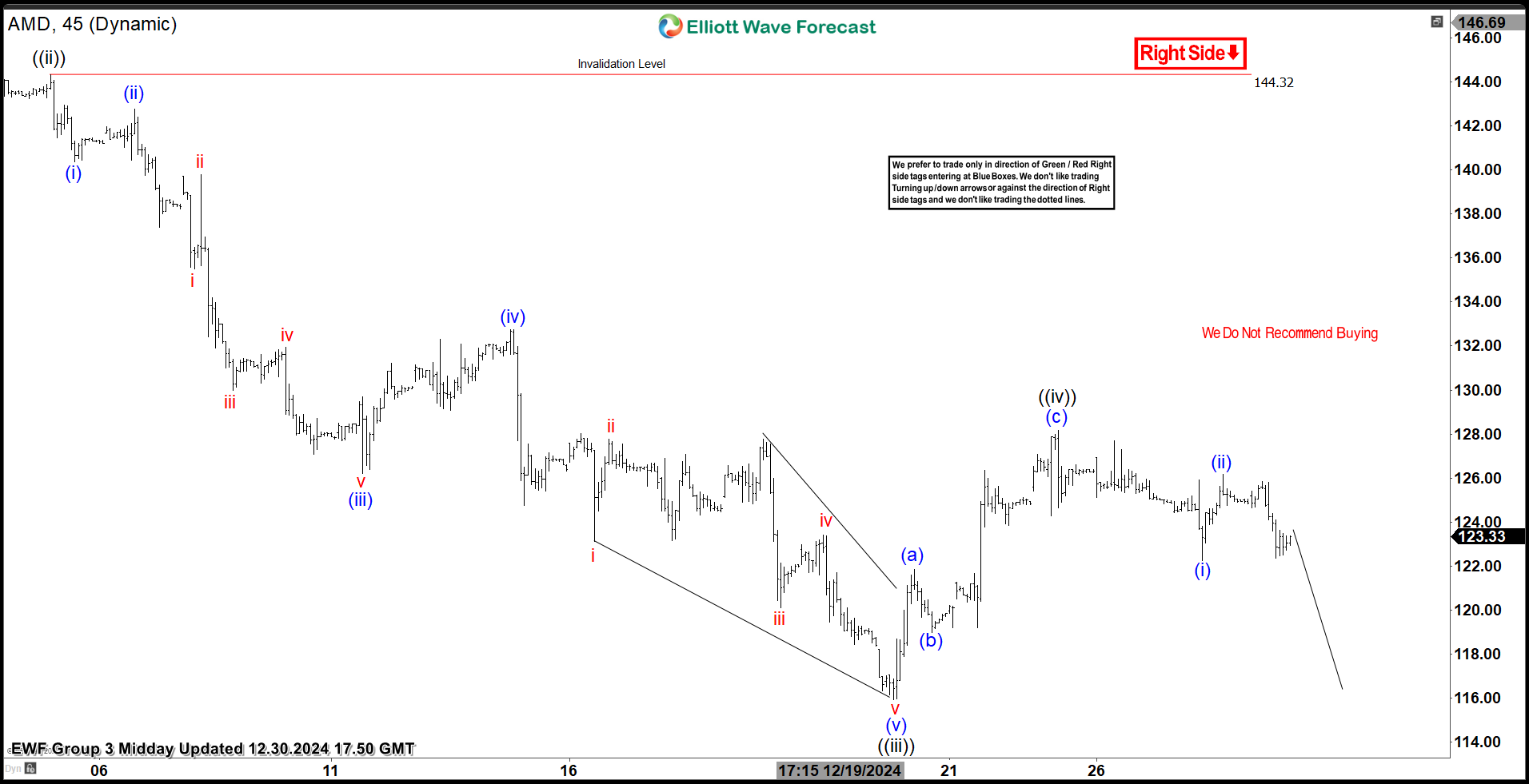

AMD 1H Elliott Wave Chart 12.23.2024:

In the 1-hour Elliott Wave count from December 23, 2024, we see that AMD completed a 5-wave impulsive cycle beginning on December 05, 2024, and ending on December 20, 2024, at the black ((iii)). As expected, this initial wave prompted a bounce. We anticipated this bounce to find sellers after unfolding in 3 swings.

This setup aligns with a typical Elliott Wave correction pattern (ABC), where the market pauses briefly before resuming the main trend.

AMD 1H Elliott Wave Chart 12.30.2024:

The most recent update, from December 30, 2024, shows that AMD reacted as predicted. After the bounce from the recent low, the stock found sellers after 3 swings up, leading to a decline.

What’s Next for AMD?

With the current decline, $AMD sellers are in control. Based on the Elliott Wave structure, we expect the stock to continue its downward trajectory, targeting the $113 – $108 range before another potential bounce. Therefore, it is essential to keep monitoring this zone as we approach it.

Conclusion

In conclusion, our Elliott Wave analysis of Advanced Micro Devices, Inc suggests that it should remain weak in the short term. Therefore, sellers should monitor the $113 – $108 zone as the next target, keeping an eye out for any corrective bounces. By using Elliott Wave Theory, we can identify potential selling areas and enhance risk management in volatile markets.

More By This Author:

Nike Reacting Perfectly From Elliott Wave Hedging AreaETHUSD Buying The Dips After Elliott Wave Double Three

Netflix Buying The Dips At The Blue Box Area

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more