Advanced Micro Devices Can Sustain Its Rally

Advanced Micro Devices (AMD) spent a large portion of 2015 being punished by NVIDIA (NVDA) for its mistakes and underperformance. As a result, shares of the company plunged considerably in 2015 and the stock carried its downward momentum to 2016 as well.

However, AMD recently delivered better-than-expected earnings report which saw its shares jump over 40% in just one trading session. AMD has sustained its rally and is now up almost 100% from its year-to-date lows. I recommended buying the stock just before its rally and although the stock has moved considerably higher since then, it can continue moving higher due to several reasons mentioned below.

A lot of upside potential

A look at AMD’s financial statements indicates that the company is in severe problem. The company’s revenue plunged 28 percent previous year mainly due to the sluggish PC sales. The company lost market share to Intel and NVIDIA in the CPU and GPU market, respectively. Moreover, the company reported a net loss of $660 million associated to $3.99 billion of overall revenue, a consecutive fourth yearly loss. All in all, the picture for the stock is ugly. However, since the stock beaten down, it is also a turnaround candidate. And as many of you would know, turnaround stocks tend to rally hard even on the smallest bit of good news.

AMD anticipates 2106 to blot the turning point of its struggles to get the business on the right track. The company’s guidance suggests coming back to top-line growth, mainly due to the new semi-custom design wins and the imminent release of its graphics cards based on Polaris architecture. Non-GAAP operating profitability is likely to return throughout the other half of 2016, a huge enhancement as compared to previous year.

AMD delivered enthusiastic guidance previous year, but the company was not able to come even close to that guidance and was forced to evacuate those goals just a few months later. This is the reason why many investors do not believe the company’s guidance anymore.

But now the case is different, as the company is about to launch its new architecture, and if Polaris is a winner, and if Zen architecture, which will be released anytime around the end of this year and for servers in 2017, is also a winner, the company’s stock could be valued far better as compared to past. AMD is a high-risk high-reward investment and the stock could still deliver significant upside if its upcoming products are winners.

Virtual Reality

Despite the fact that AMD lost considerable market share to NVIDIA and Intel in the GPU segment, the company’s shares surged more than 50 percent recently and the better-than-expected earnings revided the hopes of a turnaround.

According to the company, virtual reality appears to be the reason behind this success. Its APUs unites CPUs with GPUs on a single chip, turning them into a supreme all-in-one solution for devices that necessitate huge graphical processing horsepower in slenderer packages.

Both Microsoft’s Xbox and Sony’s PS4 uses AMD’s semi-custom, efficient APUs, which are retailed via its enterprise, embedded and semi-custom business.

It is highly likely that these APUs will be used in discrete virtual reality headsets in the future, and at this point AMD clearly has an advantage over NVIDIA mainly for the reason because it governs the market for custom APUs.

(Source: kzero.co.uk)

As you can see from the image above, the virtual reality market represents a huge opportunity (especially in the gaming segment), investors can be a little less skeptical of the company’s guidance.

Zen architecture will assist the turnaround

Keeping in mind AMD’s performance throughout the last few years, it can be definitely said that the company has lost almost every battle against Intel in the CPU market and has been losing market share to Intel belligerently. Approximately ten years back, the company was a robust player in the market because it offered products that were viable with those introduced by Intel. But, the case is not the same today.

The company made some chief mistakes with its prevailing Bulldozer architecture released in 2011. Single-threaded performance was terrible equated to comparable Intel products, and several modifications did not help. However, AMD’s imminent CPU microarchitecture titled as Zen has a lot of potential that aims to solve this problem.

AMD claims a 40 percent improvement in instructions-per-clock, and it is also shifting to a 14 nanometer manufacturing process. Both of these modifications together should aid the company to shrink the gap with Intel in terms of performance. It might be possible that the company snatches back considerable amount of market share from Intel.

Conclusion

At present, all I can say that everything depends on Advanced micro Devices’ upcoming architecture. However, by the look of things, it seems like AMD may finally deliver on the expectations. That being said, AMD is still a risky investment and only investors who have a high appetite for risk should consider adding the stock after the recent rally.

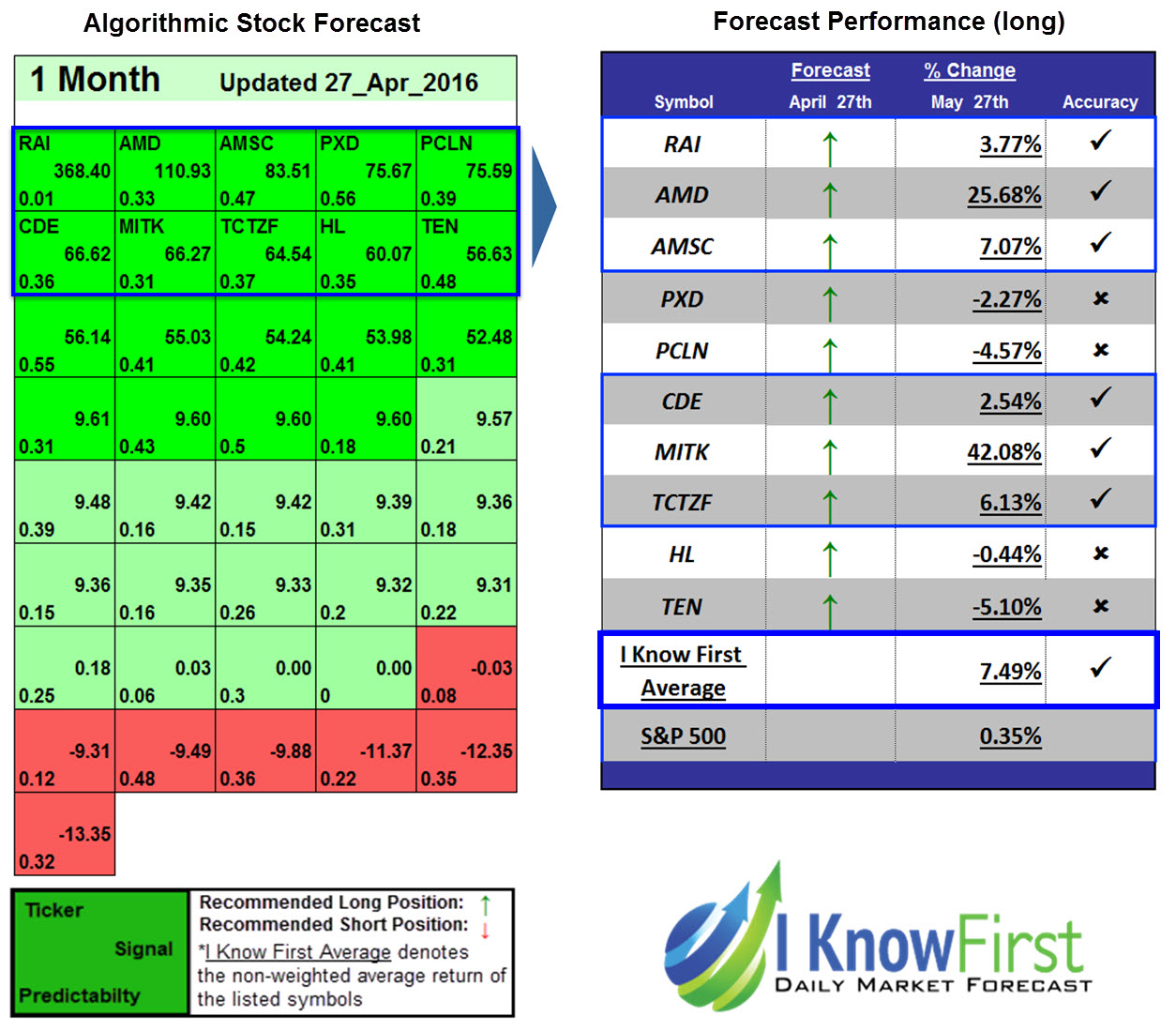

My bullish stance on AMD is resonated by I Know First’s algorithmic forecasts. I Know First uses an advanced state of the art algorithm based on artificial intelligence and machine learning to foresee market performance for more than 3,000 markets including stock forecasts, world indices, commodities, interest rates, ETFs, and currencies. The algorithm generates a forecast with a signal and a predictability indicator. The signal is the number at the center of the box. The predictability is the figure at the bottom of the box. At the top, a particular asset is identified. This format is standardized across all forecasts. The middle number indicates strength and direction, not a price target or percentage gain/loss. The bottom figure, the predictability, signifies a confidence level.

As you can see from the image above, the green 43.43, 75.34 and 376.07 indicates that the algorithm is bullish on AMD in the short as well as the long-term.

In addition, I Know First Algorithm predicted in the past the stock movement of AMD in this forecast from the 27th of April to 27th of May 2016. With a signal of 110.93 and predictability of 0.33 bringing returns of 25.68% in just 1 month.

Disclosure: This article originally appeared on more

$AMD exploded by more than 10% on Friday and is up more than 43% from this bullish forecast on $AMD issued on May 15

Congrats!