Advance Auto Parts Should Perform Well In Stagflation

For a while I’ve been looking for a spot to pick up the auto parts retailers AutoZone (AZO), O’Reilly (ORLY), and Advance Auto Parts (AAP) because I think they will perform well in stagflation. Auto parts are necessities as people need to drive to get to work and ferry their kids to and from schools. So while consumers may cut back on eating out or new clothes, they won’t cut back on maintaining their cars.

In addition, in tough economic times like a recession, consumers are more likely to repair their existing cars than buy new ones. My issue has been that the stocks have been strong and they have not given me an opening. However, action in the sector over the last couple of days has provided an entry.

Advance Auto Parts – the smaller of the three chains with a market cap of ~$10 billion – reported Q1'22 earnings after the close on Monday. While comps rose only 0.6%, they were facing extraordinarily tough comparisons, as comps were +24.7% in Q1'21.

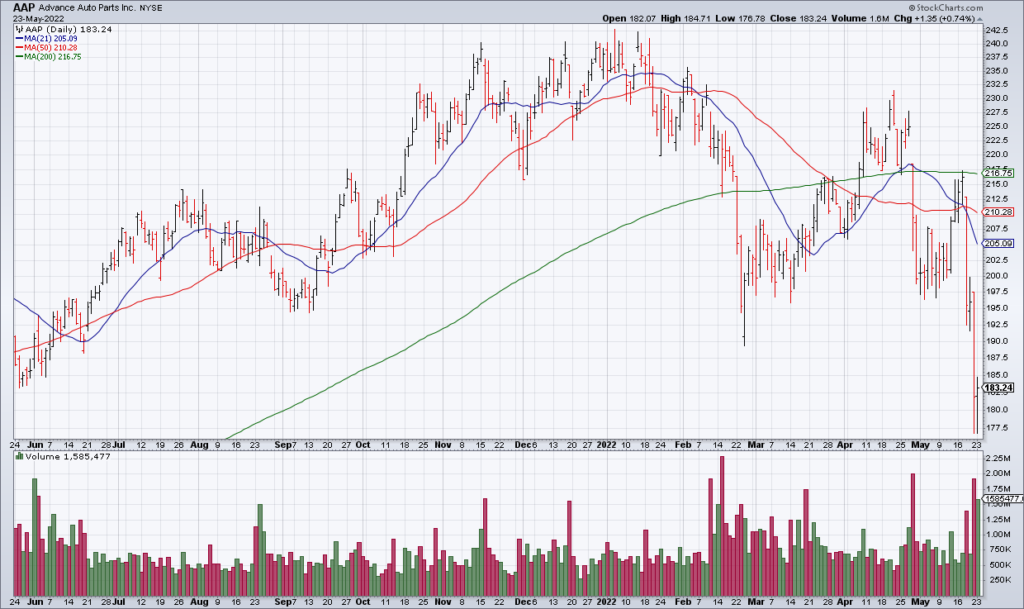

Therefore, as Advance Auto Parts pointed out in its press release, its two-year stack is +25.3%. The company guided full year comps to +1% to +3% and EPS to $13.30-$13.85. At a closing price of $183.24 on Monday, that works out to just 14x current year guidance. Throw in a 3.27% dividend, and Advance Auto Parts looks like a great buy to me.

Weekly #earnings

— Earnings Whispers (@eWhispers) May 21, 2022

Technical issues are delaying our Saturday email and access to our site. We apologize for the inconvenience! $NVDA $BABA $BBY $XPEV $ZM $COST $M $AZO $DKS $NIU $ANF $MRVL $SNOW $RL $DLTR $WOOF $DG $SBLK $BKE $AAP $CAAS $STRR $CGC $CSIQ $EXPR $ZS $BIDU $MDT pic.twitter.com/UjoWDXuczw

AutoZone reported earnings earlier today, so keep an eye on the numbers.