ADP - String Of All-Time Highs

Summary

- 100% technical buy signals.

- 17 new highs and up 10.85% in the last month.

- 33.34% gain in the last year.

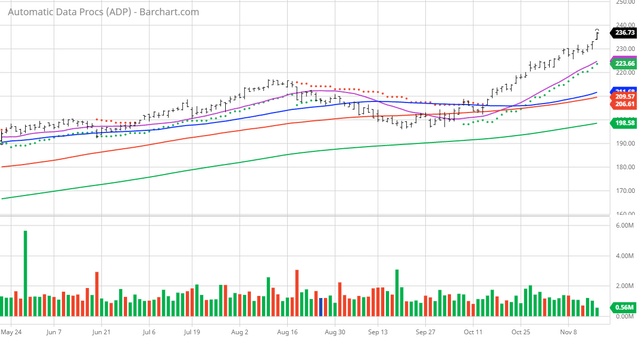

The Barchart Chart of the Day belongs to the outsourcing company Automatic Data Processing (Nasdaq: ADP). I found the company by sorting Barchart's All-Time High list first by the highest number of new highs in the last month, then used the Flipchart function to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 10/14 the stock gained 13.49%.

Automatic Data Processing, Inc. provides cloud-based human capital management solutions worldwide. It operates in two segments, Employer Services and Professional Employer Organization (PEO). The Employer Services segment offers strategic, cloud-based platforms, and human resources (HR) outsourcing solutions. Its offerings include payroll, benefits administration, talent management, HR management, workforce management, insurance, retirement, and compliance services. The PEO Services segment provides HR outsourcing solutions to small and mid-sized businesses through a co-employment model. This segment offers benefits package, protection and compliance, talent engagement, comprehensive outsourcing, and recruitment process outsourcing services. The company was founded in 1949 and is headquartered in Roseland, New Jersey.

Barchart technical indicators:

- 100% technical buy signals

- 42.17+ Weighted Alpha

- 33.34% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 17 new highs and up 10.85% in the last month

- Relative Strength Index 79.01%

- Technical support level at 230.81

- Recently traded at 236.15 with a 50 day moving average of 211.67

Fundamental factors:

- Market Cap $98.21 billion

- P/E 36.89

- Dividend yield 1.61%

- Revenue expected to grow 7.70% this year and another 6.40% next year

- Earnings estimated to increase 12.50%this year, an additional 9.70% next year and continue to compound at an annual rate of 14.03% for the next 5 years

- Wall Street analysts issued 2 strong buy, 1 buy, 12 hold, and 5 underperform recommendations on the stock

- The individual investors following the stock on Motley Fool voted 1,087 to 68 that the stock will beat the market with the more experienced investors voting 240 to 8 for the same result

- 42,490 investors are monitoring the stock on Seeking Alpha

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the ...

more