Add Some Spice To Your Portfolio With McCormick

Image Source: Unsplash

We are going to put a little spice in our fast-money holdings by adding a great company that literally makes the spices in your life — that company is McCormick & Co., Inc. (MKC).

If you go check your pantry right now, you are almost certain to have a few products made by McCormick. Salt, pepper, cinnamon, oregano, parsley, and spices of nearly every variety are the lifeblood of this company, and their products are ubiquitous around the globe.

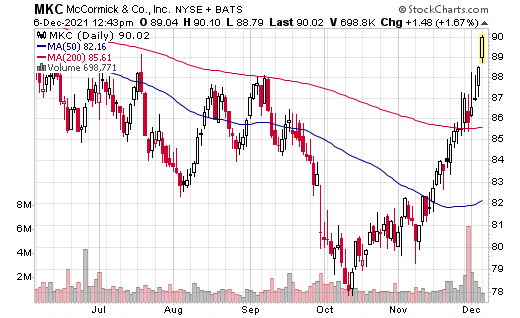

Last year, during the height of the pandemic, MKC shares surged as the company benefited from the “cook-at-home” trade. Well, since its recent low on Oct. 12, shares are up some 15%. Could this be in response to another expected cook-at-home wave? Perhaps, but MKC is much more than a pandemic play.

The fact is that MKC is a stalwart in the food industry, and it’s expected to have a strong earnings showing when it reports results again on Jan. 28, 2022.

We suspect that, given the changing character of this market due to both Omicron and the Fed, the fast money will continue to rotate into more cyclical plays, such as consumer staples. MKC just happens to be a very fast-moving staple that is well-positioned to break out.

In fact, one look at the chart above from the beginning of December shows that it has been recently breaking above its 52-week high, and that was the catalyst we were waiting for to add this stock to our holdings. So, we are looking to buy McCormick & Co. at market, with a protective stop at $71.90.

Disclaimer: © 2021 MoneyShow.com, LLC. All Rights Reserved.