Activist Investors Are Increasingly Active. Can You Profit By Riding Their Coattails?

Image Source: Pexels

Some of the world’s largest firms have been in the crosshairs of activist investors. The Walt Disney Co. (DIS) and Salesforce (CRM) are two recent examples. And there’s speculation that many others, including Target (TGT) and Paramount Global (PARA), could be on the short list for attention later this year. Here’s why that matters, writes Kelly Green, editor of Dividend Digest.

The number of activists in the market has increased significantly over the past 10 years. According to S&P Global, 1,026 activist investor campaigns were launched in 2022—the highest annual total on record. And there were 17 instances of “swarming,” which happens when a company draws more than one activist campaign.

So, what exactly is an activist investor? This is a hedge fund or high-net-worth individual who targets underperforming companies with the goal of increasing shareholder value. They buy up shares of a company with the intention of influencing the company’s management to make changes.

Although some activist investors can address their concerns with quiet boardroom conversation, the media picks up on the instances when activists start a PR campaign to convince other shareholders of their positions. And then there are the juicy instances when an activist tries to secure multiple board seats.

Here’s how it works:

- Activist investors look for targets. Some focus on strong brands that have been dragged down by bad strategic decisions. This also includes companies that have lost focus on their core profitable businesses. Generally, it’s an undervalued company that has a solvable problem.

- They start accumulating common shares. Once the activist acquires more than 5% of the company’s voting shares, it’s required to file a Schedule 13D. This filing is a clue that the company might shortly see a campaign from an activist investor. Although it can be a lot of shares, activist investors can typically launch a campaign with a 5%–10% ownership of shares.

- They publicly propose a set of changes. This can be done through a public letter to the management. I’ve also seen this include letters to the employees and other shareholders.

- They negotiate or get other shareholders on board to vote for changes. If management isn’t open to changes, then the activist investor heads off to convince other shareholders that its solutions are viable. At this point, it’s common to see the activist investor put nominations forward for board seats.

- They sell shares for a profit once their objectives are achieved. Many activist investors see this process as a short-term investment. If the company pays a dividend, you may see them continue to hold shares if long-term value was created.

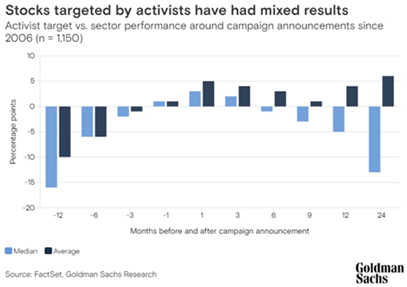

Can activist investors make real change? A recent study from Goldman Sachs analyzed more than 2,100 shareholder campaigns since 2006. These were all instances where activists attempted to add value to companies listed on the Russell 3000 Index.

The results were mixed. And for many companies, the results were short-lived (less than six months).

In the end, it’s important to remember that an activist investor is always looking out for their self first. So, if you’re following the lead of an activist investor like this, make sure your entry and exit points are timed just right to make money.

About the Author

Kelly Green, senior editor at Mauldin Economics, has been a researcher for as long as she can remember. She was always fascinated with taking things apart and asking hundreds of questions, whether it was a car or a complex math equation.

Ms. Green graduated at just 20 years old with a bachelor's degree in mathematical economics. A short time later, she passed her Series 7 and 66 exams, sponsored by one of the largest financial services companies in the world. Within months of starting her promising career, however, Kelly realized she wasn't suited to preparing information packets. She longed for analysis work.

Kelly turned to a career researching the lucrative field of high-yielding equities. The numbers and the research didn't lie. She fell in love with exploring the ins and outs of income-investing opportunities and sell-side options trades.

Over the next few years, Kelly would work as co-editor of several income-focused newsletters, chief researcher, and portfolio analyst. She even wrote an educational series for investors covering topics ranging from making first trades to how to trade options.

More By This Author:

Enterprise Products: "Buy And Hold Forever"History Is On Your Side After A Strong H1 2023 For Stocks

Omega Healthcare: A Turnaround With Value And Yield

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.