Activision Blizzard Q3 Preview: What's In Store?

The Zacks Consumer Discretionary sector has struggled to find its footing in 2022, down nearly 40% and coming nowhere near the general market’s performance.

A company residing in the realm, Activision Blizzard (ATVI), is slated to unveil quarterly earnings on November 7th, after the market close.

Activision Blizzard is a leader in video game development and an interactive entertainment content publisher, well-known for its hit Call of Duty franchise.

Currently, the gaming giant carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of an F.

How does everything else stack up heading into the quarterly report? Let’s find out.

Share Performance & Valuation

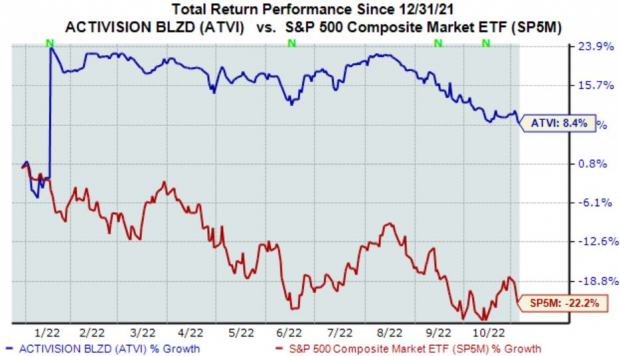

Year-to-date, Activision Blizzard shares are up more than 8%, massively benefitting from the news that legendary tech titan Microsoft (MSFT) plans to acquire the company at a price tag of $68.7 billion.

(Click on image to enlarge)

Image Source: Zacks Investment Research

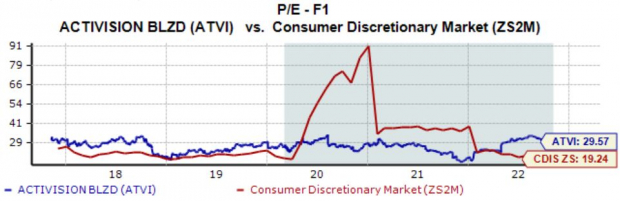

ATVI’s forward earnings multiple of 29.6X resides on the higher end of the spectrum, above its 27.1X five-year median and its Zacks Consumer Discretionary sector average of 19.2X.

The company carries a Value Style Score of a D.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Quarterly Estimates

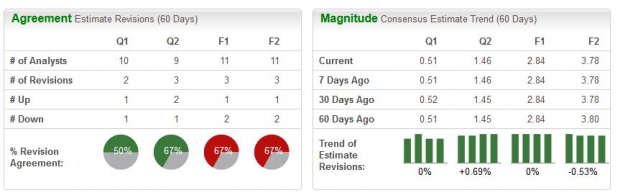

Analysts have had mixed reactions for the quarter to be reported over the last several months, with one positive and one negative earnings estimate revision. The Zacks Consensus EPS Estimate of $0.51 suggests a Y/Y earnings decline of roughly 29%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

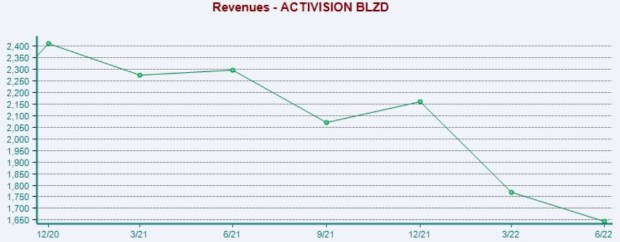

The company’s top-line appears to be undergoing some turbulence as well; the Zacks Consensus Sales Estimate of $1.7 billion indicates a decline of 9% from year-ago revenue of $1.9 billion.

Quarterly Performance

ATVI has had mixed earnings results as of late, penciling in two bottom-line beats and two misses across its last four releases. In its latest print, however, the company registered a 6.5% EPS surprise.

Sales results paint precisely the same picture; ATVI has exceeded sales estimates in two of its last four quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Putting Everything Together

ATVI shares got a big boost earlier in the year, stemming from the news that Microsoft will acquire the company.

The company’s valuation multiples are on the higher end of the spectrum, with its forward earnings multiple well above its five-year median and Zacks sector average.

Analysts have had mixed reactions for the quarter to be reported, with estimates indicating a Y/Y decline in earnings and revenue.

The company has had mixed earnings results as of late, falling short of earnings and revenue estimates in two of its last four prints.

Heading into the release, Activision Blizzard carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of -6.9%.

More By This Author:

Walt Disney To Report Q4 Earnings: What's In The Cards?Is A Surprise Coming For Lyft This Earnings Season?

Bull of the Day: Covenant Logistics Group (CVLG)

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more