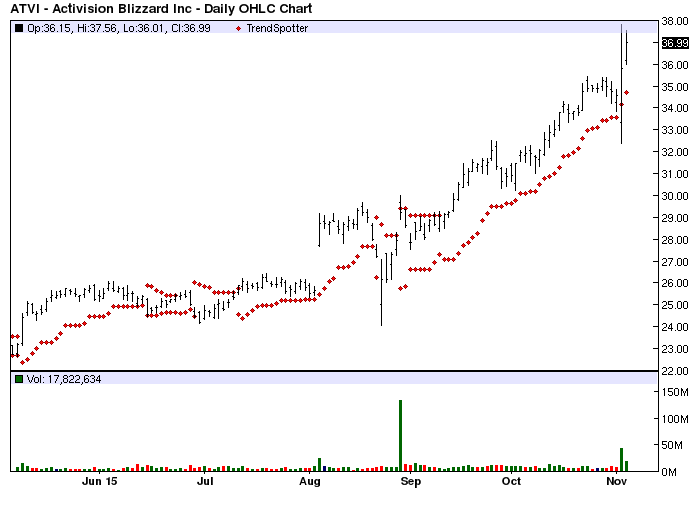

Activision Blizzard - Chart Of The Day

Activision Blizzard (NASDAQ:ATVI) is the Chart of the Day. The console and on line game company has a Trend Spotter buy signal, a Weighted Alpha of 93.30+ and gained 85.41% in the last year.

The Chart of the Day belongs to Activision Blizzard . I found the online game stock by using Barchart to sort the Russell 3000 Index stocks first for a Weighted Alpha of 50.00+ or more, then again for technical buy signals of 80% or better. Next I sorted again for a 50-100 Day MACD Oscillator buy signal before using the Flipchart feature to review the charts. Since the Trend Spotter signaled a buy on 8/28 the stock gained 26.59%.

ACTIVISION BLIZZARD, INC. is a worldwide pure-play online and console game publisher with leading market positions across all categories of the rapidly growing interactive entertainment software industry. Activision Blizzard's portfolio includes best-selling video games such as Guitar Hero, Call of Duty, and Tony Hawk, as well as Spider-Man, X-Men, Shrek, James Bond and TRANSFORMERS, leading franchises such as Crash Bandicoot and Spyro and Blizzard Entertainment's StarCraft, Diablo, and Warcraft franchises including the global number one subscription-based massively multi-player online role-playing game, World of Warcraft. Activision Blizzard maintains operations in the U.S., Canada, the United Kingdom, France, Germany, Ireland, Italy, Sweden, Spain, Norway, Denmark, the Netherlands, Romania, Australia, Chile, India, Japan, China, the region of Taiwan and South Korea.

The status of Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 100% Barchart technical buy signals

- 93.30+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 11 new highs and up 17.58% in the last month

- Relative Strength Index 79.67%

- Barchart computes a technical support level at 29.93

- Recently traded at 36.99 with a 50 day moving average of 31.72

Fundamental factors:

- Market Cap $26.80 billion

- P/E 25.23

- Dividend yield .67%

- Revenue expected to be down 3.10% this year but up again by 7.50% next year

- Earnings estimated to be down 5.60% this year buy increase again by 17.90% next year and compound annually at a rate of 10.54% of the next 5 years

- Wall Street analysts issued 6 strong buy, 14 buy and 1 hold recommendation on the stock

The 20-100 Day MACD Oscillator has been a reliable technical trading strategy for this stock.

Disclosure:None.

The darling of video-game stocks! Can nothing stop her? Stellar performance this year up over 60% is very enticing. This month, out of 21 analysts; 14 are a buy, 6 are a strong buy, and 1 is a hold. With an expected boost to sales leading up to holiday season, we can surely look forward to beating quarterly earnings at the next earnings announcement. Major competitors include; Electronic Arts, Sony, and TakeTwo Interactive Software.