Acreage Holdings' ACRDF Vs. ACRHF Shares

Canopy Growth's original deal was to buy 100% of Acreage Holdings when the U.S. federally legalized cannabis. That deal was recently amended and has resulted in the creation of two new share classes which began trading on the OTCQX on October 7, 2020, namely, Class D “floating” shares (ACRDF) and Class E “fixed” shares (ACRHF) In the new deal, Canopy will buy only 70% of Acreage at the fixed share price. The remaining 30% will float with the market enabling Canopy shareholders to participate in any upside in the stock. Canopy has the option to buy these shares if they so decide.

It seems that retail investors prefer the "fixed" share class because they know that Canopy will buy these shares while the "floating" shares are only an option to buy and if Canopy decided not to buy the "floating" shares they would become much less valuable. That being said, however, analysts have been using the "floating" shares for their basis of valuation - not the "fixed" shares. Given this confusion the "fixed" and "floating" shares prices are added together in the munKNEE Pure-Play Pot Stock Index, of which Acreage is a constituent, to better highlight and record the price trend of Acreage within the pure-play market sector.

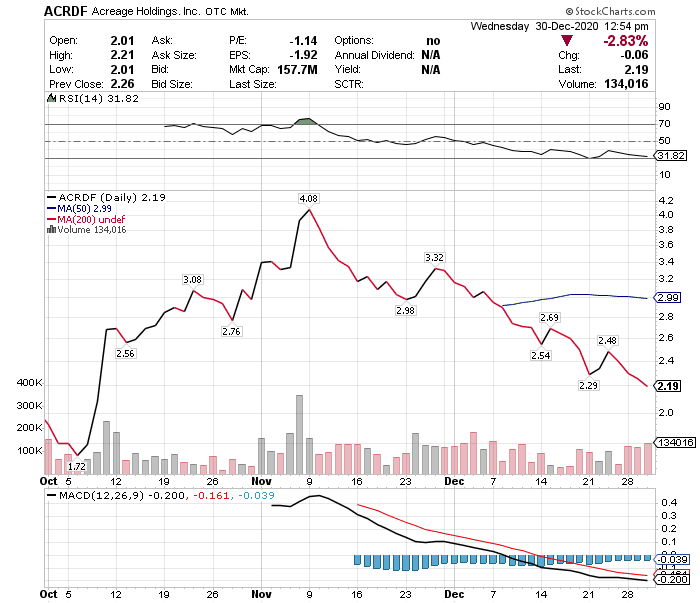

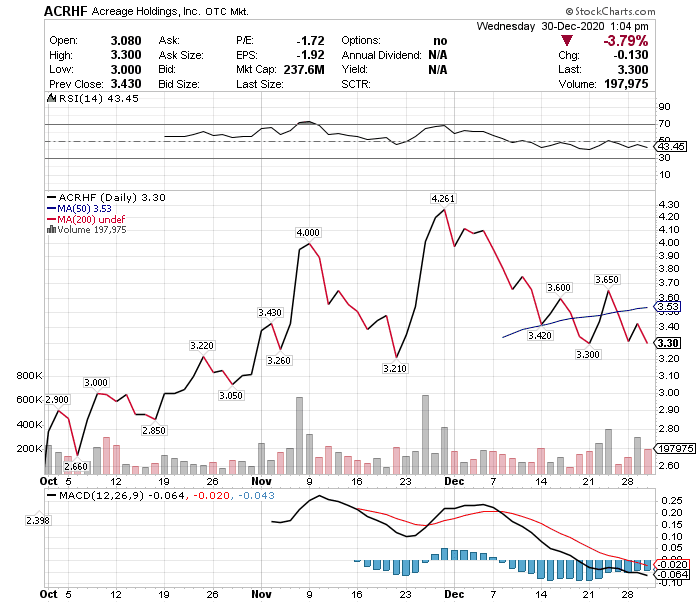

Below are the charts for both share classes:

Floating Shares (ACRDF)

Fixed Shares (ACRHF)

Since the issuance of the new share classes on October 7th the daily movement of each has not been in lockstep but their performances have been very similar with the "floating" shares (ACRDF) going up 27.3% vs. the "fixed" shares (ACRHF) which have gone up 24.1%.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more