Acquisition Watch: Time To Buy Microsoft Or Activision Blizzard Stock?

Image: Bigstock

In a turn of events, the United Kingdom’s Competition and Markets Authority (CMA) now views Microsoft’s (MSFT - Free Report) restructured deal to acquire game developer Activision Blizzard (ATVI - Free Report) as a positive for the nation's merger and acquisition sector (M&A).

This came after the E.U. and U.S. have already approved the deal, with the U.K.’s provisional decision likely to be the final nod. The news of such saw Activision Blizzard’s stock rise by roughly +2% and approach Microsoft’s acquisition offer of $95 a share with the deal valued at $68.7 billion.

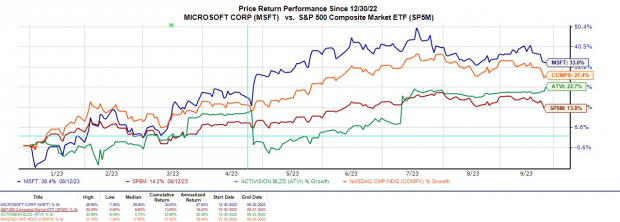

As for Microsoft, shares were virtually flat upon the announcement, although MSFT’s +33% year-to-date performance still topped ATVI’s +23% and the broader indexes.

Image Source: Zacks Investment Research

Restructured Deal

The CMA’s provisional agreement to accept Microsoft’s acquisition of Activision Blizzard is reliant upon the transfer of cloud gaming rights to UbiSoft Entertainment (UBSFY - Free Report), which saw its stock pop over +4% on Friday.

Ubisoft is a French video game publisher, and all of Activision Blizzard’s cloud gaming rights will be shared with the company over the next 15 years so that Microsoft can’t exclusively release the games on its Xbox Cloud. This includes rights to the iconic Call of Duty brand. In return, Ubisoft will compensate Microsoft for the rights with a one-time payment based on usage.

Growth Potential

With Microsoft addressing the CMA’s monopoly concerns, investors can start to gravitate toward the growth conversation of a potential Activision Blizzard takeover.

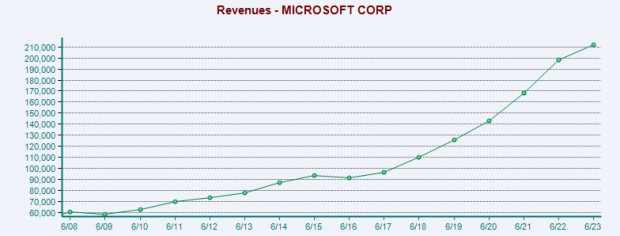

Taking a look at total sales, we can ponder the prospects. Microsoft’s sales are forecasted to rise 10% in its current fiscal 2024 to $233.80 billion, with Activision Blizzard sales expected to jump 13% this year at $9.66 billion.

Theoretically, the nearly $10 billion revenue boost would give Microsoft a 70% growth increase over the last five years, with sales at $143.01 billion in its fiscal 2020.

Image Source: Zacks Investment Research

This would easily eclipse Apple’s (AAPL - Free Report) 47% sales growth over the last five years, with AAPL having the largest market cap on U.S. stock exchanges just ahead of Microsoft.

Furthermore, it’s likely that Microsoft’s growth will be substantially compounded considering Activision Blizzard has seen a 49% increase in sales since 2019, which also beats Apple’s top-line expansion rate.

Image Source: Zacks Investment Research

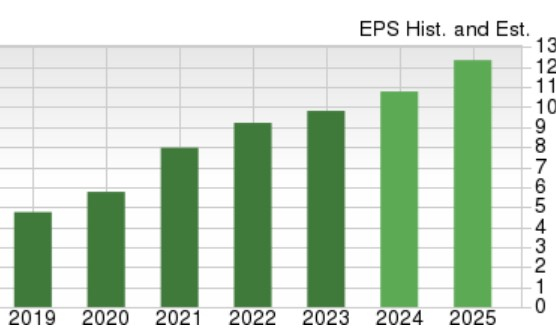

EPS Outlook & P/E Valuations

Regarding their bottom lines, Microsoft’s earnings are projected to rise 11% in FY24 and leap another 14% in FY25 to $12.42 per share. Microsoft’s stock trades at 29.3X forward earnings, which is above the S&P 500’s 20.2X but mostly on par with the Zacks Computer-Software Industry average, and the company is a historical leader in the space.

Image Source: Zacks Investment Research

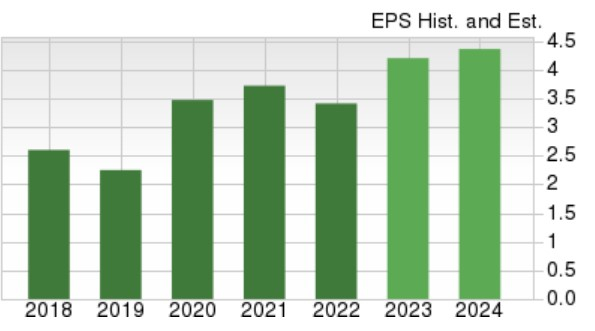

Pivoting to Activision Blizzard, annual earnings are expected to climb 23% this year and rise another 4% in FY24 at $4.37 per share. Plus, Activision Blizzard’s stock trades at a 21.9X forward earnings multiple, which is closer to the benchmark and not a stretched premium to its Zacks Toys-Games-Hobbies Industry average of 17.6X, and the company is a leader in its market as well.

Image Source: Zacks Investment Research

Takeaway

The prospects for a potential Microsoft and Activision Blizzard deal look promising for both parties at the moment. Microsoft will reap the long-term benefits, with its stock landing a Zacks Rank #3 (Hold). Additionally, Activision Blizzard’s stock maintains a Zacks Rank #3 (Hold), as it edged closer to its acquisition price.

More By This Author:

3 Quarterly Releases To Watch Next WeekThree Mutual Fund Picks For Your Retirement

3 Top-Ranked Tech Stocks To Buy For High Growth

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more