Acquisition Watch: Time To Buy Exxon Mobil Or Pioneer Natural Resources Stock

Image Source: Nick Youngson CC BY-SA 3.0 Alpha Stock Images

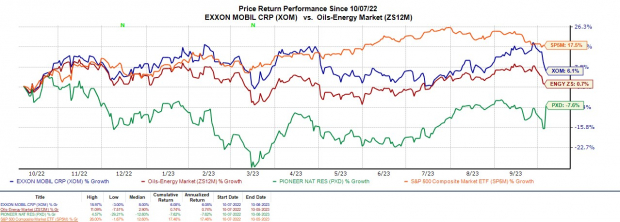

The announcement that Exxon Mobil (XOM) plans to potentially acquire Pioneer Natural Resources (PXD) was a highlight of this week’s trading session.

As one of the world’s largest oil producers, this would give Exxon even more access to potential oil reserves with Pioneer being a leading upstream energy firm with operations in the lucrative Permian Basin. For Pioneer, the acquisition would see the company valued at $60 billion and roughly $10 billion above its current market value.

Following the news break on Thursday, Pioneer’s stock popped +10% today with Exxon shares down over -1%. Needless to say, investors may be pondering if now is a good time to buy stock in either of these oil and energy leaders.

Image Source: Zacks Investment Research

Growth Potential

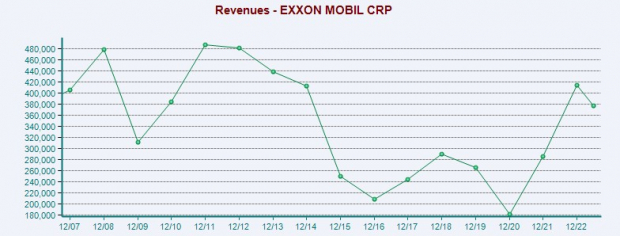

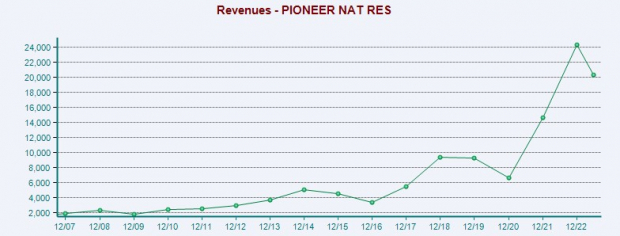

Taking a look at total sales will help comprehend how lucrative an Exxon and Pioneer deal would be. Following tougher-to-compete-against years, Exxon’s sales are now forecasted to drop -17% in fiscal 2023 to $344.13 billion with Pioneer’s sales expected to decline -18% this year at $19.92 billion.

Still, the nearly $20 billion revenue boost would theoretically see Exxon sales be 37% above pre-pandemic sales of $264.93 billion in 2019.

Image Source: Zacks Investment Research

This would still trail rival Chevron’s (CVX) 42% anticipated sales growth over the last five years. However, it’s likely that Exxon’s growth will be substantially compounded considering Pioneer has seen a stellar 114% increase in sales since 2019.

Image Source: Zacks Investment Research

EPS Outlook & P/E Valuations

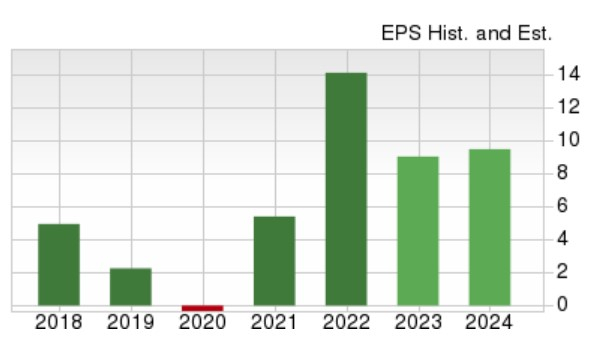

Regarding their bottom lines, Exxon’s earnings are projected to drop -33% in FY23 at $9.41 per share compared to EPS of $14.06 last year. Fiscal 2024 earnings are expected to stabilize and rise 4% to $9.76 per share.

Exxon’s stock trades at 11.5X forward earnings which is slightly above its Zacks Oil and Gas-Integrated-Internatinoal Industry average of 8.7X. With that being said, Exxon is a leader in its pace and trades well below the S&P 500’s 19.7X forward earnings multiple.

Image Source: Zacks Investment Research

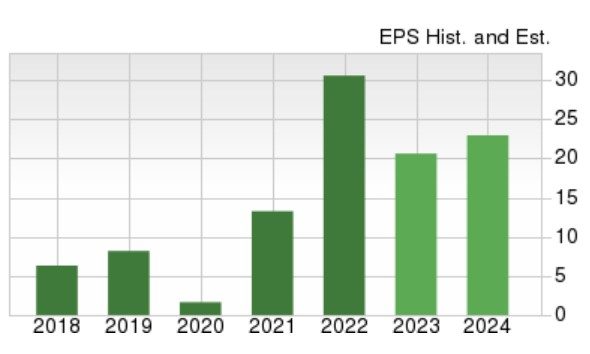

Pivoting to Pioneer, annual earnings are expected to fall -31% this year at $21.17 per share versus $30.57 a share in 2022. Fiscal 2024 EPS is projected to rebound and jump 18% to $24.96 per share.

Plus, Pioneer’s stock trades at a 10.1X forward earnings multiple which is roughly on par with the Zacks Oil and Gas-Exploration and Production-United States Industry average and an even steeper discount to the benchmark.

Image Source: Zacks Investment Research

Bottom Line

The prospects for a potential Exxon and Pioneer deal are promising for both parties. Pioneer's stock especially stands out sporting a Zacks Rank #1 (Strong Buy) at the moment while Exxon lands a Zacks Rank #3 (Hold). Exxon could certainly reap the long-term benefits but Pioneer could see its stock rise nicely above current levels considering the rumored $60 billion acquisition price.

More By This Author:

Bear Of The Day: Sun Country AirlinesBull of the Day: National Fuel Gas Company

3 Low-Beta Stocks To Buy For Technology Exposure

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more