AAPL And TSLA Stock Splits Attract Low Information Investors

Recent stock split announcements by Apple (AAPL) and Tesla (TSLA) have lit a fire under the companies’ share prices. I suspect that many investors scooping up the shares are not aware of exactly how the splits will work. I am curious about how new-to-the-stock market investors will react when they discover that post-split their holdings are not four or five times more valuable.

For the last decade, I have wondered about the lack of stock split announcements from America’s biggest companies. Once upon a time, companies would announce stock splits to keep shares affordable to individual investors.

In the 1980s and 90s, Walmart (WMT) declared a split every time the share price hit $60. The company announced eight two-for-one splits during that period. In contrast, a company like Amazon seems content with the fact that one share costs $3,400, a value that keeps many individual investors from being able to own AMZN shares.

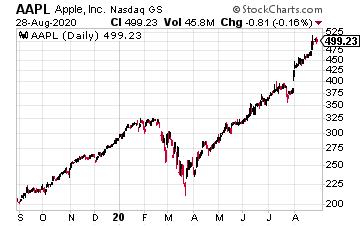

On July 30, Apple, Inc. (AAPL) announced a four-for-one stock split, effective when the market closed on August 24 and with the shares distributed on August 31.

The split means an investor who owned 100 shares of AAPL on August 24 woke up today with 400 shares. At the announcement, the stock traded for $384. On the day before the split record date, AAPL closed at $504. The shares zoomed up 31% in less than a month. The stock split news excited investors!

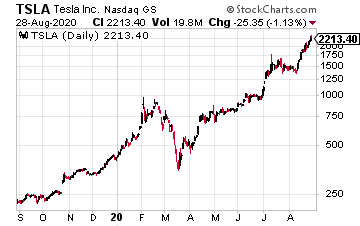

On August 11, Tesla, Inc. (TSLA) announced a five-for-one stock split with a record date on August 21. Split-adjusted TSLA shares also started trading on August 31.

The TSLA share price has been on a tear, up 51% in the 30 days through August 27. An investor with 100 shares of TSLA before the weekend woke up on Monday, August 31, with 500 TSLA shares in her account.

This year, millions of new investors have started trading in the stock markets. Millennials’ favorite stock trading app, Robinhood, has added one million new accounts. Traders on Robinhood do not invest based on fundamental analysis.

They get stock tips and investment ideas from social media and online chat rooms. I am concerned that many new-to-the-market investors are jumping on these stocks with the belief that their positions in Apple or Tesla would be four or five times more valuable after the newly added shares hit their brokerage accounts.

I suspect that many of these new stock traders are not informed about how a stock split works. When a stock splits, the share price also adjusts to keep the value of an investor’s position unchanged. For, example if Apple closed at $500 on Friday, August 28, on Monday, the stock would start trading at $125.

One share worth $500 on Friday turns into four shares worth a total of $500 on Monday. The numbers of contracts and strike prices for put and call options also adjust to reflect the split. There is no way to “game” a stock split for a profit.

Yet, the rapid share price gains since the splits were announced indicates that there are novice investors who may have expected to be four or five times richer on Monday, August 31. I expect there will be widespread disappointment in the Robinhood related chat rooms.

If I am right, stock prices will tell the tale. If Apple and Tesla pull back sharply this week, you can be assured that new, low-information traders did not understand how a stock split works.

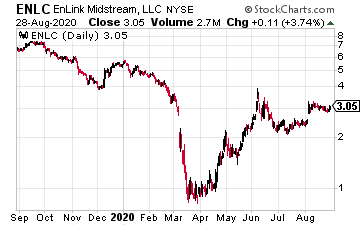

To help ease the pain, here is a stock tip for disappointed Apple and Tesla traders: EnLink Midstream (ENLC) is a $3.00 stock that could climb to $8.00 or $10.00. Don’t worry that the business fundamentals are excellent. Don’t consider the 12% dividend yield with the potential for dividend growth. Just buy some ENLC and share your trade on social media.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more

Excellent article! Thank you!

Agreed

The unintended beneficiaries would seem to be the brokers who gain a percentage commission from the sales of those high priced shares. The unknowing do not realize that they are paying to get "Four $5's in exchange for a $20, and so they may be reluctant to explain in detail.

Of course the fact that a stock IS rising in share price is a reasonable indicator that profits are likely, except for the instances where emotions are running the show.. And it is very clear that such a condition does develop on occasions.

I spent 3 months researching #Tesla before putting half my IRA into it at $360/share. I'm probably a "low information investor." At the time, all the pros gave $TSLA a neutral rating.

I did not intend to imply anything negative about the company itself. And hopefully the split has no negative effect on your investment. It simply changes the selling price of shares without changing the value of the original investment.