A Stealth Equity Market Correction

With the month of July now closed for the market, the S&P 500 Index is up 17.99% in the first seven months of the year. This strong performance is on top of the market's 18.40% return in 2020. Last year's return was a surprise to some given the February to March 2020 decline of 33.92% as a result of the pandemic shutdown. It is understandable then that some investors might expect the market needs to digest these strong returns through either a market pullback or with the market trading sideways over a period of time. This would be a normal occurrence for the market.

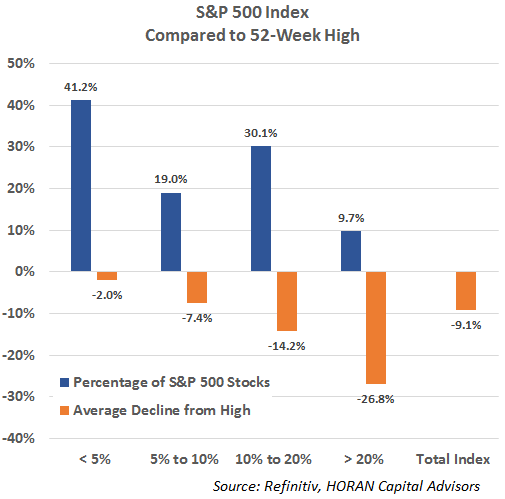

Although the S&P 500 Index is only down .61% from its recent high, under the surface, a large number of stocks have seen significant drawdowns from their own 52-week highs. For the S&P 500 Index nearly 40% of the index's stocks are down greater the 10% and the average decline for stocks from their 52-week highs is 9.1%.

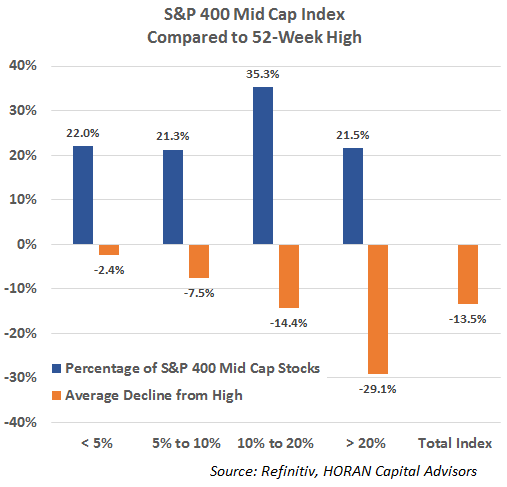

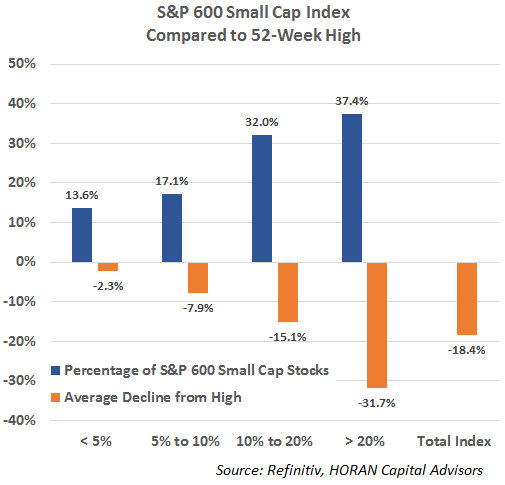

Other indexes have seen an even larger number of stocks with significant declines from their highs. The following two charts show detail for the S&P 400 Mid Cap Index and the S&P 600 Small Cap Index.

The mid cap index is down 2.40% from its high yet the average decline for the stocks in the index is 13.5% and nearly 57% of the stocks are down more than 10%.

The S&P 600 Small Cap Index has seen even broader weakness with almost 70% of the index's stocks down more than 10% from their 52-week highs. The percentage of stocks down more than 20% is 37.4% with the average decline equaling 31.7%. The small cap index is down 5.15% from its high and the average decline of the stocks in the index from their 52-week high is 18.4%.

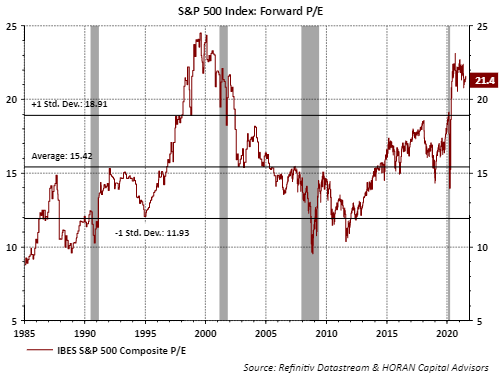

This broader weakness in the index holdings themselves is reflective of a correction occurring under the surface of the indexes. This under the surface corrective action might prevent a more severe correction from occurring near term, keeping in mind corrections are a normal action for equity markets. Equity valuations are elevated, but in a low interest rate environment, it makes sense that stocks can trade at higher forward valuations or P/E's.

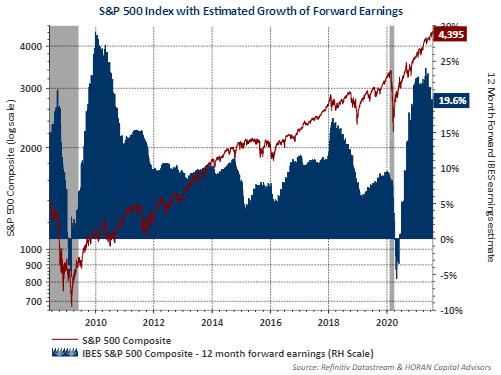

Also supportive of higher valuations is the strength in earnings growth expectations looking forward for the next 12-months. I/B/E/S earnings growth expectations into mid year 2022 remain a high 19.6%. All else being equal, this is positive for stocks.

I will sound like a broken record but stocks do not move higher in a straight line and the market does not like negative surprises. Yet, the underlying corporate fundamentals appear strong and are supportive of the current market, knowing a correction can occur at anytime.

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more