A Safer Way To Play Bank Stocks For Market-Beating Returns

Today, I'm going to tell you about a special kind of financial instrument that you can buy as easily as any ordinary stock. It pays a reliable and steady dividend of 5.3%. And thanks to the stunning collapse of Silicon Valley Bank, it’s handing us an opportunity to collect market-beating returns with what I expect to be very low levels of risk and volatility. Let me explain.

The Special “Hybrid” Instrument All Investors Should Know About

At the top of a company’s capital structure, you have debt. Below that is typically common equity. And sometimes, sandwiched in between, you have a hybrid instrument called preferred stock.

Preferred stock is more of an income-focused investment than a capital return investment like common stock. They typically have a par value—often $25 per share. This means, at origination, the preferred stock is worth $25.

Embedded in that preferred stock is a dividend payment. They can pay on a quarterly or monthly basis. They can be fixed or floating. They can even be convertible into common stock. I like investing in preferred stocks -- that is, when they’re priced appropriately.

Buying a preferred stock at $20 when the par value is $25 can be an interesting strategy. You’re getting income—again, the recurring dividend—but you’re also getting a shot at capital appreciation.

Unlike a bond, preferred stock does not typically mature. It has an indefinite life. However, it often has call provisions. That means the company, at their option, can repurchase the preferred stock at par. This is often a few years after the preferred stock is issued.

Oftentimes, companies opt to repurchase the preferred stock at par. This ends their obligation to pay preferred stock dividends, which benefits the overall free cash flow of the enterprise. That said, you must be highly selective with the preferred stock you buy.

Today, let’s look at the preferred stock of mega bank JPMorgan Chase & Co. (JPM).

Here’s the JPM Preferred Stock I Like Best

CEO Jamie Dimon is the best-known banker in America and has guided JPMorgan over the years to become the largest bank in the US.

It has total assets of $3.7 trillion—a truly astounding number. Bank of America Corp. (BAC) is behind JPM at $3 trillion, followed by Citigroup Inc. (C) and Wells Fargo & Co. (WFC) at $2.3 trillion and $1.8 trillion, respectively. JPMorgan’s common stock currently pays a reasonably attractive 3% dividend and trades for 1.4X book value per share.

This is a high-level way to look at a bank. The theory goes, if you liquidated the bank, you’d get at least the book value in return. This never happens in principle, but it’s one way to think about it. 1.4X isn’t screaming expensive, but it’s not that cheap either.

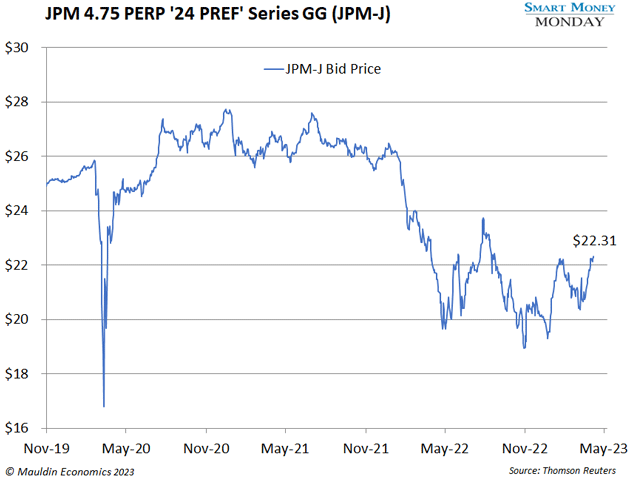

I much prefer JPM’s preferred stocks. There are many to choose from, but the one I like best on the menu is the 4.75% Series GG preferred stock. The ticker is JPM-J. It currently trades for around $22.31.

Every year, JPM-J shareholders receive approximately $1.18 per share in dividends, paid quarterly. That’s a 5.3% yield at recent prices. Between now and the call date (the first call date is Dec. 1, 2024), I suspect it will pay a total of six quarterly payments of $0.30 per share. And then, when the call date arrives in December 2024, it’s entirely possible JPMorgan decides to redeem the preferred stock.

Again, it doesn’t buy it at the market price. It pays par—in this case, $25 per share. Adding it all up, you should get $27 per share in value between now and December 2024. And at the $22.31 share price, that’s a juicy 20% return. On an annualized basis, that’s better than 10% per year. It’s a market-beating result.

So, if you’re looking for a stable income investment with potential capital appreciation upside, this looks like a winner.

How About the Risks?

The risks here are minimal. JPMorgan is the largest bank in the country. If it fails, we’ve got bigger problems to deal with. Below us in the capital structure is $378 billion in common equity market cap. That’s a lot of cushion.

Another risk is around the call date. JPMorgan isn’t required to call, or redeem, the preferred stock. But I think it’s highly likely that it will. If it doesn’t, so be it. We collect our dividends and continue to buy or sell the preferred stock.

The last risk with any fixed income investment is interest rate related. Interest rates and bond prices are inversely correlated. The same correlation applies to preferred stock. If interest rates go up, prices of bonds go down.

This is likely the reason that the JPM-J preferred stock does not trade at par value. Interest rates have risen quite dramatically over the past year. So, again, rising rates mean bonds (and preferred stock) go down.

From here, though, that risk seems minimal. My sense is that interest rates probably stay around where they’re at today. The latest CPI reading showed inflation is starting to cool, as I expected. Cooling inflation means fewer rate hikes. And fewer or zero rate hikes mean flat interest rates. If the opposite happens and interest rates fall -- well, our preferred stock investment will work out quite well.

For a safe income investment, I like the JPM-J preferred stock.

More By This Author:

Be Careful When Buying Beaten-Down Office StocksFCNCA: The Banking Deal Of The Decade

FRC: This Prestigious Bank Is Down 90%—Is Now The Time To Buy?