A Perspective On The Upcoming Calithera Cystic Fibrosis Read-Out

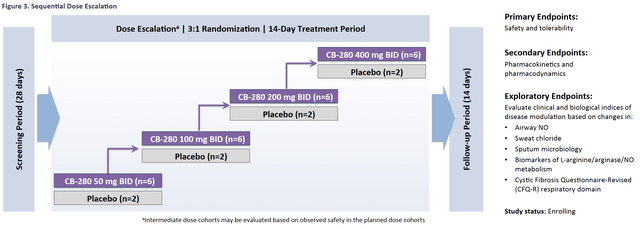

Calithera (CALA) is guiding the market to expect a key data read-out in Q3 of this year from its ongoing CB-280 (arginase inhibitor) study in Cystic Fibrosis. The study intends to enroll 32 patients in a 3:1 randomized dose escalation design to placebo. The study marks the first time Calithera has looked outside oncology indications for its expanding therapeutic candidate portfolio. We think there is significant reason to believe that this readout will carry more weight than is currently assigned by the market. A summary of the study design was provided for by Calithera’s trial-in-progress presentation at the North American Cystic Fibrosis Conference (NACFC) last year. We believe it’s likely the upcoming data will read-out fully in the first week of October of this year.

In totality, Cystic Fibrosis affects approximately 30,000 individuals in the US (70,000 globally) according to the Cystic Fibrosis Foundation (CFF). Of these, only 5% have a CTFR (Cystic fibrosis transmembrane conductance regulator) gating mutation such as G551D, which is addressable by Vertex Pharmaceuticals’ (VRTX) Kalydeco (Ivacaftor). The more common F508del-CTFR mutation is present in around 90% of CF patients, with just under 50% of patients being homozygous (carry two copies of the gene).

For those who are homozygous for this mutation, the only current options for physicians are Vertex's Orkambi (Ivacaftor/Lumacaftor), or the more tolerated Symdeko (Ivacaftor/Tezacaftor). Both treatments are mechanistically similar - a combination of Ivacaftor and a CTFR corrector.

VRTX has recently launched Trikafta (Elexacaftor/Tezacaftor/Ivacaftor) for patients who are heterozygous. This means that these patients carry one copy of F508del-CTFR along with one of the 177 specified mutations. Presently, all approved CTFR modulator therapies are owned and commercialized by VRTX.

Unfortunately, these commercialized assets only provide a modest and highly variable clinical benefit for homozygous CF patients. The effect size for Orkambi in these patients is muted compared to Kalydeco for those harboring G551D mutations, yet the unmet need was significant enough for the U.S. Food and Drug Administration (FDA) to approve Orkambi in this setting.

The clinical effect size for Orkambi is much closer to what one may expect from just an antibiotic therapy. In vitro studies on the mechanism of action of Orkambi and Symdeko found that the corrected F508del-CTFR is destabilized in the presence of the two compounds. This may be the reason why these therapies are still an incomplete solution for homozygous CF patients.

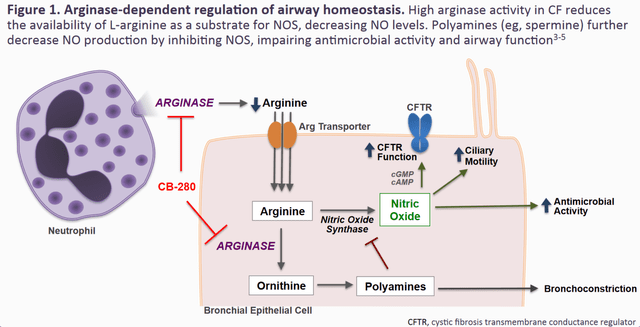

There have been numerous studies which have examined complementary approaches to improving the modest activity of existing CTFR modulator therapy. Notably, elevations of intracellular arginine can increase Nitric Oxide (NO) signaling and enhance CTFR channel function in mice.

The hypothesis followed those interventions which increase arginine in cells, which should therefore lead to an improvement in human patients. As such, studies have examined supplementation of arginine to the lungs in patients as a simple means to boost NO signaling.

The study showed an improvement of FEV1 (The volume that has been exhaled at the end of the first second of forced expiration) from an increase in exhaled NO. However, this effect was only transient as the arginine was quickly metabolized by arginase.

An earlier study showed that arginase activity is greatly increased in CF patient lungs, and inversely correlated with both FEV1. Therefore, it may be more advantageous to directly increase Nitric Oxide activity by blocking arginase and thereby increasing the pool of arginine available to the NO pathway, which would also block the fibrotic substrates Ornithine and its downstream product spermine.

A research study tested this hypothesis (the pathway can be found in the NACFC presentation) by examining CALA’s other arginase inhibitor CB-1158 which is currently partnered with Incyte Corp. (INCY) in cancer indications only.

In the study, CB-1158 was tested in combination with VRTX’s Orkambi in homozygous F508del-CTFR mutant patient derived cell cultures. This demonstrated an additive effect of arginase inhibition on CTFR function, something which should translate in clinical trials.

Interestingly, arginase expression is significantly elevated in mice with P. aeruginosa infection. Over 60% of all adult humans with CF harbor these infections according to the CFF. These notoriously difficult-to-treat bacteria hide under a biofilm which allows them to survive antibiotic exposure as well as resist the innate immune response including phagocytosis (see reference).

Research groups are trying to break down the biofilm present in CF patients using inhaled Nitric Oxide, with the goal of re-sensitization to antibiotic therapy. A 7 day treatment study at very low doses (10 ppm) showed a benefit for these patients in reducing the aggregate load of P. aeruginosa. However, this benefit was diminished when treatment stopped. It seems to us that this points to a potential benefit from sustained increases in NO in CF airways.

In the CALA study, all enrolled patients are screened for P. aeruginosa infection and must be on cycle with background antibiotics during exposure to CB-280. This will allow the company to test the hypothesis that sustained elevations of NO can have a beneficial impact on reducing bacterial load in sputum samples (an exploratory endpoint in the study). As mentioned above, CF patients with these infections also have significantly increased arginase activity, making it a good population to explore inhibition of this enzyme.

Questions will also be answered in the upcoming data release about CB-280’s PK/PD in CF patients, as sustained activity and increased exhaled NO are 2 crucial endpoints to show a therapeutic benefit. Sweat chloride is the last exploratory endpoint in the study for investors to keep an eye on. Sweat chloride is an established FDA approvable endpoint, provided efficacy is demonstrated.

If efficacy is demonstrated, CALA and/or a larger pharma partner like VRTX would need to run a larger patient N. The patient population would need to show durability along with FEV1, which could be accomplished in as little as 4 weeks, and as many as 24 weeks based on the recent FDA approval of Trikafta.

Given the number of CF patients who are presently underserved by CTFR modulators and antibiotic therapy, the market potential for CB-280 as an add-on/tack-on treatment is substantial; the overall market for CF is expected to grow (Evaluate Pharma, 2021, WW forecast, 2026) from approximately 8 billion to 11 billion in the next 5 years.

If the company can serve the 60% of patients who have these P. aeruginosa infections, the upside would be rather significant. Notwithstanding CALA’s Telaglenastat being evaluated now in front-line Non-Small Cell Lung Cancer (NSCLC), a co-dev partnership with VRTX could see CALA realize an even greater market cap appreciation.

We believe given the market dominance of VRTX in the CF space as well as the complementary mechanisms of action, there would be significant potential for the two companies to enter a co-development arrangement should the upcoming data be a success - the study was partially funded under a grant from the CFF.

Therefore, we would expect that the results of this study would be at the NACFC 2021, which is hosted by the CFF. The conference is scheduled to take place between September 30 and October 2, which is in line with CALA’s current guidance of 2nd half 2021.

Financials:

Balance Sheet

| Total Cash (mrq) | 102.85M |

| Total Cash Per Share (mrq) | 1.39 |

| Total Debt (mrq) | 3.75M |

| Total Debt/Equity (mrq) | 3.98 |

| Current Ratio (mrq) | 7.72 |

| Book Value Per Share (mrq) | 1.27 |

Cash Flow Statement

| Operating Cash Flow (TTM) | -79.3M |

| Levered Free Cash Flow (TTM) | -47.05M |

With a developmental biotech, profit margins and revenues are irrelevant because these companies are literally developing drug and treatments that aren't yet approved - therefore, investing in these names carry significant long term risks.

CALA has around $100M in cash and it burns about $80M a year, so the cash runway here extends to about Q3, 2022. With 2 significant data catalysts upcoming and if successful, the company should be in a strong leverage position. However, if both data points fail, the company may see itself in a very bad financial position.

The downside risk here if investing at the current stock price levels is that the data read-out is basically a dud. If that case scenario comes in, then we would expect the CALA stock price to see a haircut of around 25%, which would equate to a pps of around $1.50 a share or so. We think the reason why the stock would not decline further is because CALA still has its upcoming data read-out from its KEAPSAKE trial, which is guided to read-out sometime in Q4, 2021.

However, the upside potential could see the stock price reach into the double-digits. Positive data here would show platform validity due to the well-designed nature of the trial. We think if this scenario comes to fruition, CALA and VRTX would enter into a co-development deal, providing substantial up-front cash to CALA.

Disclosure: We are long CALA

Disclaimer: This article/video is intended for informational and entertainment use only, and should not be construed as professional investment ...

more

Certainly the most detailed analysis in a long while, and a useful product if it works. Lacking an M.D. a detailed evaluation on my part is lacking validity. But for those able to handle the risk, certainly a good investment.

Interesting, thanks.