A Lack Of Reaction

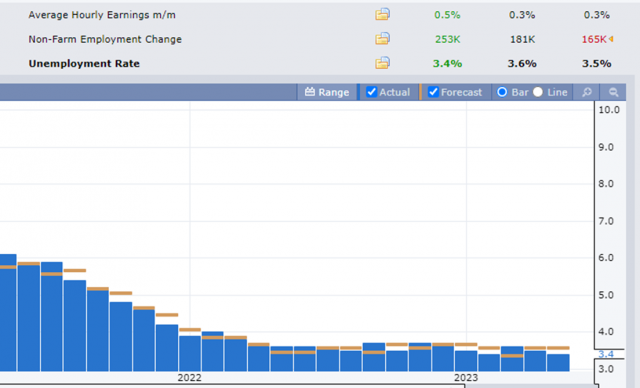

Well, that was kind of anti-climactic. One would assume that between the one-two punch of Apple’s earnings and the monthly jobs report, the market would be absolutely rocking and rolling. Instead, as I’m typing this, the stock futures are up a humdrum three-quarters of a percent or so. It’s particularly surprising since the jobs data came in kind of hot:

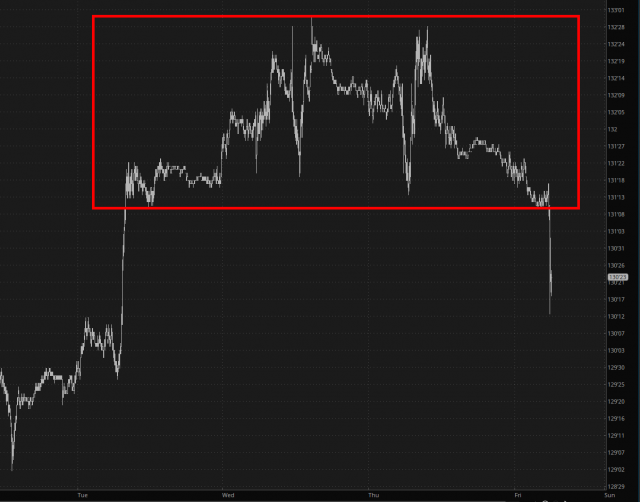

The bonds reacted appropriately, both from a charting perspective and an economic perspective, taking a swift tumble (and pushing rates higher) in the face of this data.

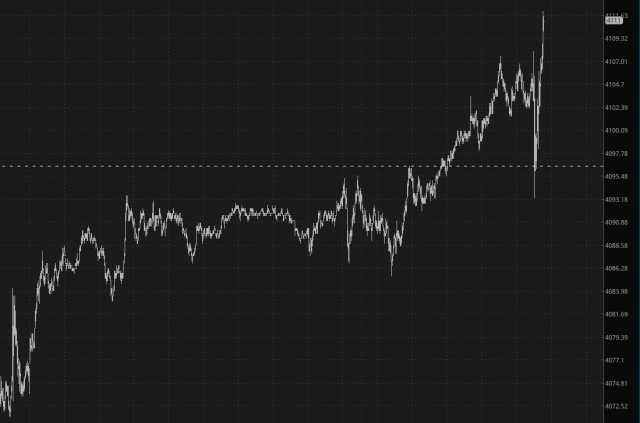

Weirdly, and perhaps thanks to Powell’s “tools” to keep things propped higher, the /ES has been steadily bid every since yesterday morning.

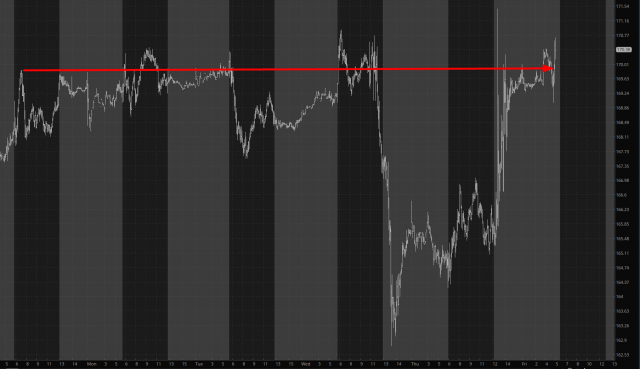

As for Apple (AAPL), their business is weakening, with declining year-on-year sales for two quarters in a row. Their salvation, if one wants to call it that, is the pledge to buy $90 billion of their own stock in the open market (the ultimate form of self-dealing), which has led AAPL to a week which, on the whole, might never as well have taken place.

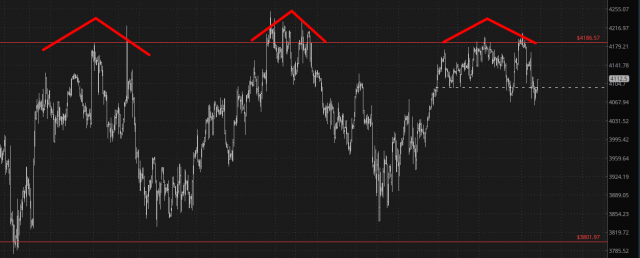

On a longer time-horizon (that is to say, 4 hour bars instead of 1 minute bars), things are clearer. The /ES remains in a sinewave-like cycle, and we remain in the upper portion of a range that has been in place a full nine months. I would have preferred a nice hearty sell-off, naturally, but not every day can be a winner.

More By This Author:

Today's Magic Word Is ...The Key Line For Amazon

Top Of The Ages?