A Good Entry Price In MercadoLibre Stock

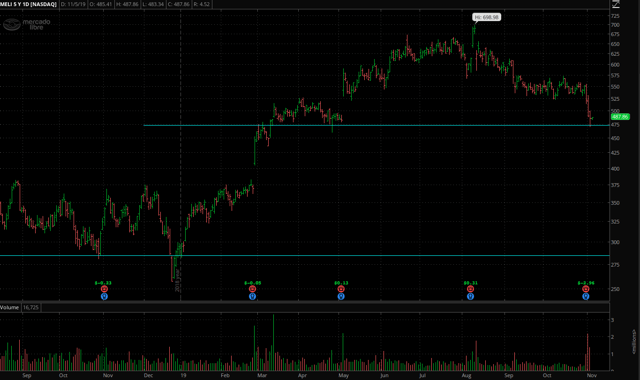

MercadoLibre (MELI) stock has gained an impressive 40% in the past 12 months, but the stock has also pulled back by over 30% from its highs of the past year. We could say that the stock is in a long-term uptrend, but it has pulled back substantially, and it even looks oversold in the short term.

Source: Think or Swim

From a fundamental perspective, the company has just reported explosive growth rates for the third quarter of 2019, even if profit margins are under pressure due to aggressive investments for sustained growth. In terms of valuation, MercadoLibre stock is not too expensive for such a high-quality business.

All things considered, the current entry price in MercadoLibre looks quite attractive for investors looking to build a position in this high-growth business with a long-term horizon.

MercadoLibre Keeps Growing At Full Speed

The company reported $603 million in revenue during the third quarter of 2019, a vigorous increase of 69.7% in US dollars and outperforming expectations by $14.8 million. Revenue in constant currencies increased by 94.5% year over year. The main operational metrics are all pointing in the right direction, both in digital payments and in e-commerce.

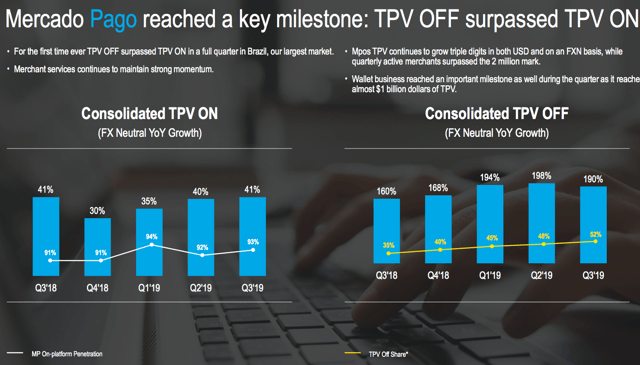

Total payment volume (TPV) through Mercado Pago reached $7.6 billion during the period, a year-over-year increase of 66.2% in USD and 94.5% on an FX neutral basis. Total payment transactions increased 118.5% and off-platform TPV grew 140.4% year-over-year in USD and 189.6% on an FX neutral basis.

(Click on image to enlarge)

Source: MercadoLibre

The mobile wallet reached almost $1 billion in transactions on a consolidated basis. The company's mobile wallet consumer base grew by 34.9% compared to the second quarter, reaching 6.1 million active payers during the quarter.

In online commerce, gross merchandise volume (GMV) reached $3.6 billion, representing a 21.6% and 36.8% increase in USD and on an FX neutral basis, respectively. Unique buyers numbers continue to accelerate, growing 25.7% year-over-year versus 20.8% in the second quarter. Mobile gross merchandise volume grew 32.4% year-over-year on an FX neutral basis, reaching 65.4% of total GMV. Items shipped through Mercado Envios reached 81.2 million, a 47.5% year-over-year increase during the quarter.

MercadoLibre is aggressively investing for growth in key areas such as shipping, logistics, and marketing. These initiatives are hurting margins, and the company reported losses at the operating level during the quarter.

This is understandably creating some concerns among investors in the short term, but heavy investments are also consolidating the company's strengths and generating the conditions for sustained growth in the years ahead.

Reasonable Valuation

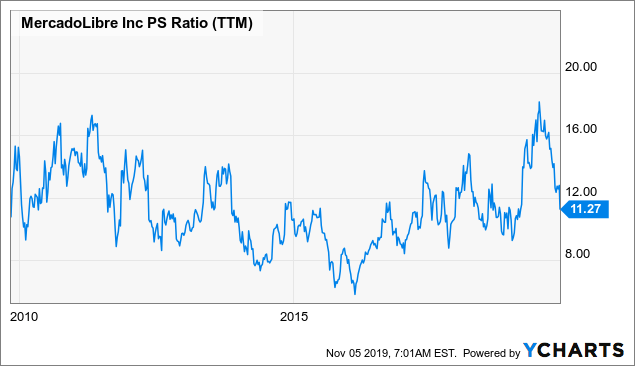

A couple of months ago MercadoLibre stock was making historical highs, and the price to sales ratio was also at record levels above 18. After the recent pullback, the price to sales ratio is down to 11.2. This is not a bargain low valuation by any means, but it's also not excessive for a business that is growing at 69.7% in USD and 90.5% on an FX neutral basis as of the most recent quarter.

Current valuation levels are roughly in line with historical standards for MercadoLibre and looking quite reasonable in comparison to other high growth stocks in the market.

(Click on image to enlarge)

Data by YCharts

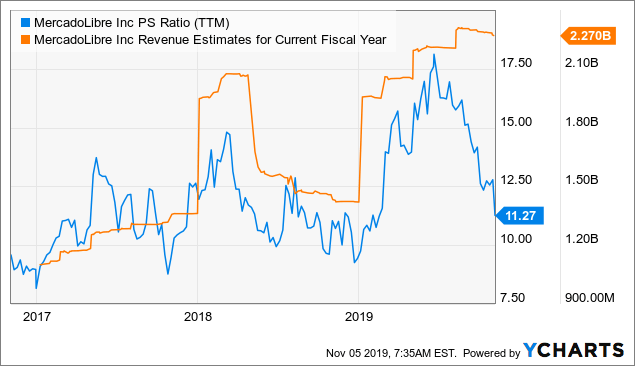

The chart below shows the price to sales ratio in comparison to revenue estimates for the current fiscal year. When sales expectations are increasing, this generally pushes the price to sales ratio higher, because the market is willing to pay a higher multiple to past revenue when expectations for future revenue are accelerating.

However, there has been a gap between revenue estimates and the price to sales ratio recently. There is no rule saying that this gap needs to be closed any time soon, but it's another data point indicating that valuation levels for MercadoLibre are getting quite reasonable.

(Click on image to enlarge)

Data by YCharts

The table below shows the average revenue estimate for MercadoLibre in the years ahead, the expected growth rates and the implied forward price to sales ratios. Two main data points are clear, growth expectations are not unrealistic at all based on the company's track record, and valuation levels could be quite attractive if the company meets those expectations.

(Click on image to enlarge)

Source: Seeking Alpha Essential

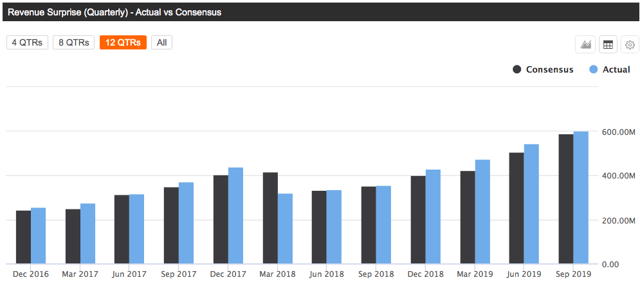

Speaking about meeting - and even exceeding - expectations, MercadoLibre has delivered revenue numbers above Wall Street forecasts in 15 of the past 16 quarters. This degree of consistency is quite unusual for a company operating in a high growth industry and exposed to significant currency volatility risk.

(Click on image to enlarge)

Source: Seeking Alpha Essential

MercadoLibre is not a "cheap" stock, it never has been and it probably never will as long as it keeps growing rapidly. But valuation needs to be analyzed in the context of the company's fundamental quality, MercadoLibre is a high-quality business growing at full speed, and the company deserves to trade at an above-average valuation.

In these kinds of companies, valuations can fluctuate widely over time, since the stock price is volatile and financial performance is dynamic. That said, when considering the company's past history and future growth prospects, the current valuation level is quite reasonable.

Risk And Opportunity In MercadoLibre

MercadoLibre is exposed to significant macroeconomic risk due to economic uncertainty and currency volatility in Latin America. Argentina is the company's home country and the second-largest market behind Brazil in terms of revenue. The country is going through a political transition with massive economic volatility and capital controls.

But it's important to note that a large share of expenses is nominated in the local currency - Argentinean Peso - so the currency devaluation in Argentina could actually have a positive impact on the company's margins.

MercadoLibre has been operating under all kinds of difficult economic and political conditions for several years, and this has not stopped the company from producing outstanding growth over the long term. However, the stock can be under pressure when macro volatility increases.

Some investors are particularly concerned about the competitive risk from bigger players such as Amazon (AMZN) and Alibaba (BABA). Amazon has increased its presence in cloud infrastructure in Latin America, and Alibaba is a growing destination for consumers and businesses importing products from China.

However, MercadoLibre is mainly focused on online commerce inside each country, while Amazon and Alibaba are used mostly for international trade in Latin America. Besides, the company has the first-mover advantage in the region, and it benefits from the network effect, both in online commerce and in payments.

Buyers and sellers attract each other to the leading e-commerce platforms in search of opportunities. Similarly, both consumers and merchants gravitate towards the most widely accepted payment platforms. This generates a virtuous cycle of sustained growth and increased competitive strength for a market leader such as MercadoLibre.

The company is aggressively investing for growth, and this is hurting margins in the short term. Personally, I think that management is doing the right thing by prioritizing long-term growth above short-term earnings, but this can create some uncertainty around the stock price.

Looking at the big picture, MercadoLibre is a unique growth company that keeps firing on all cylinders and planting the seeds for sustained growth in the years ahead. At current prices, the stock is not unreasonably valued at all.

MercadoLibre is a position in my own portfolio. The stock was purchased at $319 per share in January of 2019 and we now have a gain of over 53% from that level in spite of the recent pullback.

The main strategy is holding on to part of the position over the long term and aggressively buying more if it gets more undervalued, while also taking partial profits if the stock gets excessively expensive. For those who don't own MercadoLibre stock, the current entry price is quite attractive to start building a position.

Disclosure: I am/we are long MELI, BABA, AMZN.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business ...

more