A Closer Look At The Top IPOs Of 2025: Circle Internet Group, CoreWeave

Image: Bigstock

Key Takeaways

- IPO activity has fluctuated post-pandemic, but it has bounced back recently.

- Renewed IPO interest reflects a meaningful shift in risk appetite.

- CoreWeave and Circle Internet Group reflect two of the top IPOs of 2025, up big since their debuts.

IPO activity post-pandemic has fluctuated significantly, primarily driven by economic uncertainty, rising interest rates, and inflation, all of which have impacted investor sentiment.

But the tide has shifted positively over the past year, with several notable IPOs hitting the market, including CoreWeave (CRWV - Free Report) and Circle Internet Group (CRCL - Free Report). The re-awakening of the IPO market is certainly notable, signaling renewed investor confidence and a meaningful shift in broader risk appetites.

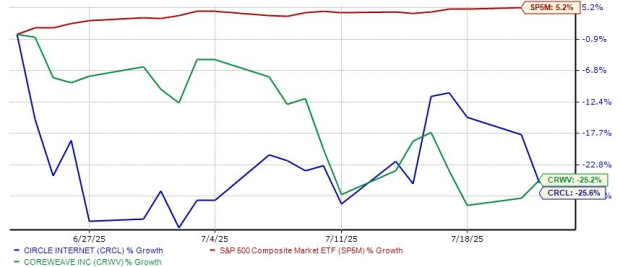

Below is a chart illustrating the performance of each over the past month, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

In short, CoreWeave provides exposure to the AI frenzy, while Circle is a play on the mainstreaming of digital dollars and the evolving stablecoin regulatory landscape. But the poor price action is certainly notable over the past month, perhaps a reflection of investors taking profit after initial red-hot runs.

Let’s take a closer look at each stock..

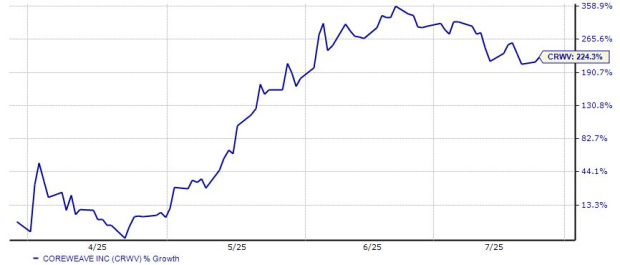

CoreWeave & NVIDIA

Given its backing by AI-favorite NVIDIA (NVDA - Free Report), the IPO reflected one of the most exciting we’ve seen in years. An SEC filing in late May 2025 revealed NVIDIA has a $900 million stake, reflecting one of its largest investors.

NVIDIA supplies CoreWeave with most of its high-performance GPUs that power its underlying AI infrastructure. Investors raised flags concerning the massive amount of sales NVIDIA generated from CoreWeave, but that concern has since evaporated.

The company’s latest set of quarterly results were driven by accelerating demand for its AI offerings, with sales up a staggering 420% year-over-year. Revenue backlog totaled a strong $25.9 billion, with CoreWeave also securing more lucrative deals with enterprises.

Up around 220% since its debut, CoreWeave shares have rewarded shareholders handsomely.

Image Source: Zacks Investment Research

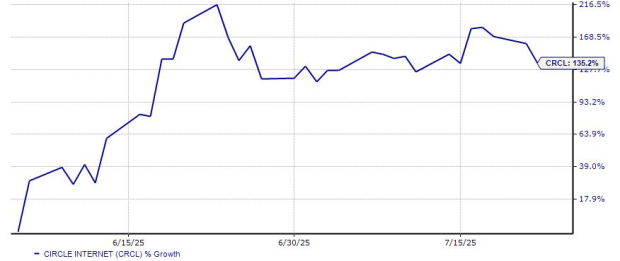

Circle Internet Group Shares Soar

Circle is a global financial technology firm that enables businesses of all sizes to harness the power of digital currencies and public blockchains for payments, commerce, and financial applications worldwide. It’s the issuer of USDC, the world’s second-largest dollar-pegged stablecoin, widely used across exchanges, DeFi platforms, and institutional trading venues.

But for those unfamiliar with all of those fancy words, what does that even mean? CEO Jeremy Allaire explained it simply:

"If you could take what we think of as money, make it digital and available on the internet, then that would dramatically change the way we use money and open up opportunity around the world. That’s the idea behind Circle."

Since their debut on June 5, shares have gone on a massive run. It’s worth noting that Cathie Wood’s ARK had a big win on the stock, purchasing roughly 4.5 million shares on its first day of trading. Up around 135% since its debut, shares have showed notable momentum, holding on to initial gains nicely.

Image Source: Zacks Investment Research

The stock overall reflects a great play on the evolving stablecoin regulatory landscape, which is also just seemingly beginning as we increasingly wade into the digital age.

Bottom Line

Notable IPOs have finally started hitting the tape in 2025, reflecting a meaningful shift in sentiment. Both Circle Internet Group (CRCL - Free Report) and CoreWeave (CRWV - Free Report) have moved up from their initial debuts, though price action over the last month has primarily been sour.

More By This Author:

Like Dividends? These 3 AI Stocks Pay InvestorsCan Nike And Target Sustain Recent Momentum?

NVIDIA's Story Keeps Getting Brighter

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more