A Bearish Shift In Sentiment

We see several significant signs the long awaited correction may finally be happening. There are changes in character that were not visible in recent weeks. We interpret character changes as the most important factors in our analysis. Sentiment is beginning to shift. Nothing seismic, just sort of a gentle nudge that tells us participants are finally beginning to smell risk.

Investor's Intelligence tally of bears recently had the highest two-week percentage of bears since last October. As well, last month's reduction in total margin debt — the first monthly decline in 16 months — likely means risk exposures are being more carefully considered than before.

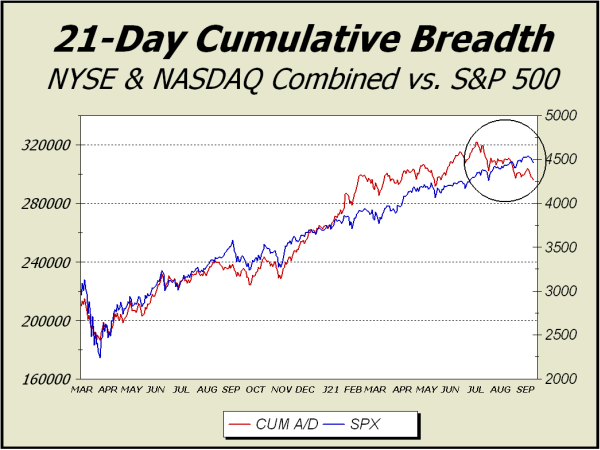

Leverage has been the key for this bull run for far too long. Enormous exposure to risk can turn to abject fear in a moment, as it did in February 2020 when stocks crashed by a third in only 27 trading sessions. In addition, breadth has turned particularly ugly.

We would now label short-term support from Dow 33,271 to Dow 33,741 as "important." Given the change in the market's character, breaks of support levels carry more significance.

Negative divergences are piling up and illustrate a ship riddled with holes. Why isn't it yet seriously sinking? For that answer, we must look at market capitalizations as the S&P 500 is computed by market cap.

Thus, the larger companies become swollen behemoths and a 3% increase in, say, Nvidia Corp. (NVDA) is worth $22.65 billion while in the middle of the list, Lennar (LEN), a similar 3% rise amounts to $1.06 billion.

Near the very bottom of the list, a 3% increase in Ralph Lauren (RL) amounts to only $272 million. Put another way, 20 stocks the size of LEN "falling" by 3% are counterbalanced by NVDA rising a similar amount, and 80 stocks near the size of RL "falling" 3% are neatly counterbalanced by an equivalent rise in NVDA.

The deterioration is hidden from view — but make no mistake, U.S. stocks look quite tired. This has been an extraordinary bull run, in fact, nothing quite like it in all of history. And we'll say it again — when it ends, it will end poorly.

Disclaimer: © 2021 MoneyShow.com, LLC. All Rights Reserved.