7% Yield And Consistent Dividend Growth

Image Source: Unsplash

An attractive yield plus solid dividend growth is a surefire strategy for building investment income and wealth. Energy midstream stocks offer a hard-to-beat combination of yield and dividend increases for investors who want to follow this strategy.

Energy infrastructure/midstream companies are split pretty evenly between those organized as Master Limited Partnerships (MLPs) and C-corporations. Managed by VettaFi, the three Alerian midstream indexes cover the sector:

- Alerian MLP Index (AMZ) includes all MLPs.

- Alerian MLP Infrastructure Index (AMZI) includes only the MLPs focused on midstream (gathering, processing, pipelines, storage, terminals) activities.

- Alerian Midstream Energy Index (AMNA) includes both the corporations and MLPs focused on energy midstream activities.

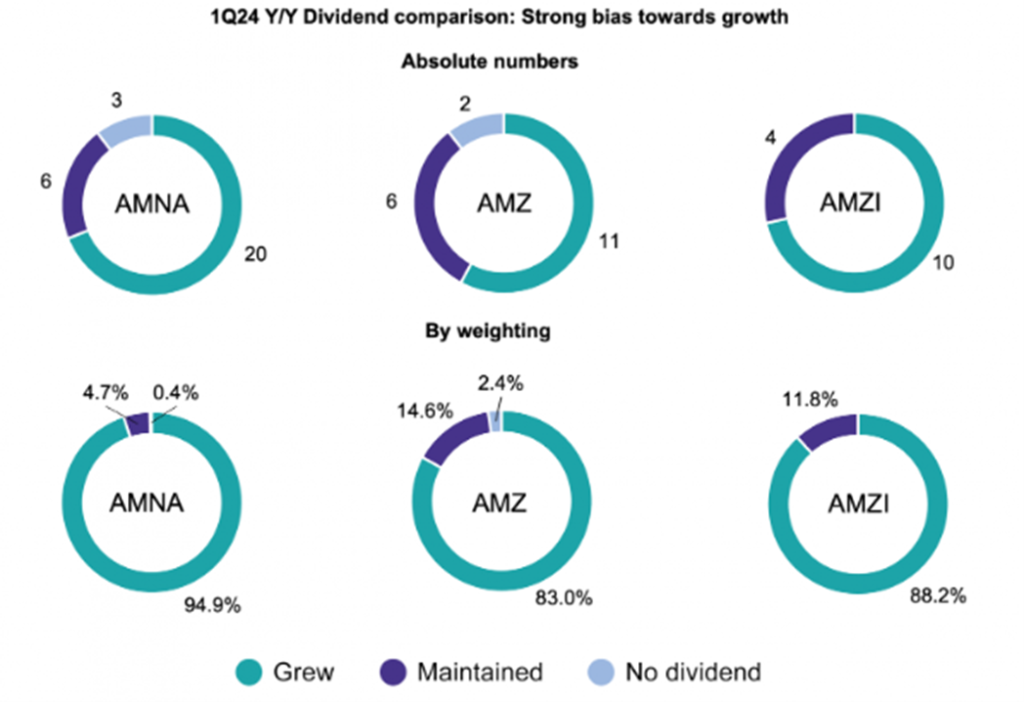

A recent VettaFi article discussed the year-over-year dividend changes for the midstream companies included in the three indexes. The article said: “On a year-over-year basis, nearly 95% of the broad Alerian Midstream Energy Index (AMNA) by weighting has grown their dividends. No AMNA constituent has cut its dividend since July 2021.”

As the indexes are structured, AMNA includes almost all the companies in all three indexes. I especially like that no dividends have been reduced for the last three years. This graphic shows the year-over-year changes in dividends for the first quarter of 2024.

At the same time, these stocks have very attractive yields. AMZI sports an average of 7.4%, AMZ is at 7.1%, and AMNA pays 5.8%.

The higher yields from MLPs are due to an investor and broader market index bias against the MLP business structure. Over recent years, MLP dividends have grown faster than corporate midstream companies’ dividends.

Investors who know better get a win-win by picking MLPs over their corporate cousins.

For my Dividend Hunter service, I recommend MLP investment exposure with the InfraCap MLP ETF (AMZA). Fund shares yield 7.4%, and the dividend grows by high single digits annually.

More By This Author:

How To Trade Covered Calls On Gold – Without Touching OptionsHow AI Will Change U.S. Infrastructure Forever

Big Change Coming To Ex-Div Dates

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more