7 Smart Money Stocks To Buy For 2019

As we head into 2019, here are some of the best smart money stocks out there right now. In other words stocks that have a glowing future ahead — especially in the longer-term. That’s because even though the markets are floundering, there are stocks that look compelling at current levels. “It’s not the growth story or the fundamentals,” says JP Morgan’s Joyce Chang about what the market needs. “It’s — right now — confidence that the market is looking for.”

For this article, we turned to TipRanks’ revamped Stock Screener. We scanned the stocks to ensure that they have an overall ‘Strong Buy’ top analyst consensus rating and upside potential of over 20%. And as the headline also implies, these stocks also boast a positive hedge fund sentiment:

![]()

The best part is that you can order the results as you wish, whether by upside potential — a crucial factor in assessing a stock’s growth potential, or market cap, or any other metric that you are screening for.

Now let’s take a closer look at the top 10 stock picks for what remains of 2018!

Morgan Stanley (MS– Research Report)

Financial giant Morgan Stanley has just been upgraded by Oppenheimer’s Chris Kotowski (Track Record & Ratings). This is with a $61 price target (51% upside potential).

But don’t be misled- the upgrade wasn’t the result of stellar earnings results.

Kotowski explains: “We upgraded MS to the middle of earnings season at a price of $45.10. The upgrade in truth had very little to do with the quarterly results, though they were fine at $1.17 vs. our $1.04E and consensus $1.01E and almost everything to do with the fact that the stock was down from $59 in March even though earnings and earnings forecasts were going up.”

Instead, the analyst calls the bigger picture, longer term reasons for owning the stock “compelling.” Most importantly, MS’s mix of business has changed from very capital-intensive ones to less capital-intensive ones. Not only is the TCE ratio way up, but cash is way up, illiquid assets way down, repo way down and funding maturities way extended.

Net-net: This is a very different company from 2006. Plus the stock is yielding 2.7%, and the current dividend payout is just 23% of the 2019 estimate. “Thus, we think there is good upside to the payout. The shares are, in other words, very cheap” wrote the analyst.

This ‘Strong Buy’ stock scores 5 buy ratings vs just 1 hold rating in the last three months. Its $58 average price target suggests upside of 48%. See what other Top Analysts are saying about MS.

Deere & Company (DE– Research Report)

If you think of a tractor, you think of John Deere. And now its manufacturer, the world-leading tractor maker Deere, is poised to soar. If we look at the Street, we can see that all top analysts are bullish on the stock right now.

BMO Capital’s Joel Tiss (Track Record & Ratings) says the stock remains one of his “favorite longer-term ideas.” He has a $195 rating on the stock (32% upside potential).

While predicting the exact timing of the farming machinery replacement cycle is a challenge, the analyst anticipates “years of growth and margin expansion ahead” for Deere.

With shares now trading at $147, the average top analyst price target works out at 32% upside potential. Meanwhile, Baird’s Mig Dobre highlights Deere as a ‘Fresh Pick’ for the firm, and cites a China trade war detente as a near term catalyst for shares.

View DE Price Target & Analyst Ratings Detail

Delta Airlines (DAL– Research Report)

Warren Buffett’s favorite airline stock scores an impressive 11 back-to-back buy ratings from the Street.

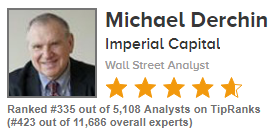

The most recent rating comes from Imperial Capital’s Michael Derchin (Track Record & Ratings). He has just boosted his DAL price target from $76 to $83. This suggests shares can explode by an impressive 48%.

Derchin believes that Delta’s earnings power is likely being underestimated by the Street. Delta is enjoying pricing power in key domestic hubs, strong demand for premium products, and improving business yields.

As a result, Derchin predicts that DAL will increase its Q4 guidance on higher unit revenues and lower fuel prices. Also worthy of note- the Oracle of Omaha currently holds a $3.79 billion position in DAL (following a slight increase in Q3). See what other Top Analysts are saying about DAL.

Royal Caribbean (RCL– Research Report)

Global cruise leader Royal Caribbean is enjoying significant Street support right now. The company owns 25 cruise ships with over 65,000 employees worldwide.

“We reiterate our Buy rating on RCL as Business Performance remains strong, driven by strong consumer travel spending and positive operating momentum,” writes five-star Tigress Financial analyst Ivan Feinseth (Track Record & Ratings). Plus RCL’s launch of its newest ship, the very impressive Celebrity Edge, is being well received and is looking at significant premiums.

Although Feinseth doesn’t publish a price target, he does say: “We believe significant upside exists from current levels and continue to recommend purchase.”

And we can see that the average analyst price target of $149 works out at 42% upside potential. That’s with 6 recent analyst buy ratings (and no hold or sells).

View RCL Price Target & Analyst Ratings Detail

Abiomed (ABMD– Research Report)

Abiomed is a pioneering medical implant device manufacturer. From the world’s first total replacement heart to the world’s smallest heart pump (Impella), this is a healthcare stock that’s breaking boundaries.

The company has just reported ‘very promising’ data at the annual American Heart Association meeting. The data showed that unloading the left ventricle with Impella CP for 30 minutes prior to reperfusion in STEMI patients without cardiogenic shock is safe and feasible.

Stephens analyst Chris Cooley (Track Record & Ratings) sees the potential for a pivotal trial to increase the company’s addressable market by about 250,000 patients annually. He views the pullback as reflecting broader market trends- and therefore a buying opportunity.

Indeed, 7 out of 7 analysts are bullish on ABMD right now. That’s with a $445 average analyst price target indicating 40% upside potential ahead.

View ABMD Price Target & Analyst Ratings Detail

Restaurant Brands International (QSR– Research Report)

Restaurant Brands is one of the largest quick-service restaurants in the world. Alongside the Burger King, QSR also owns Tim Hortons and Popeye’s Louisiana Kitchen brands. Franchisees own and operate nearly 100% of the system.

Investors reap a lucrative 3.29% yield versus the sector average of just 2.03%. This is with a $1.80 annual dividend payment, paid quarterly.

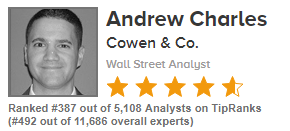

And now is the perfect time to get a piece of the action. Top Cowen & Co analyst Andrew Charles (Track Record & Ratings) has just reiterated his take on QSR as a ‘Best Idea for 2019.’

Charles commented, “Relative to consensus, we model upside to 2019 Tim’s Canada comps (2% vs 1.6%) and RBI global net restaurant growth (+6.1% vs +5.75%). Shares have thrice bottomed at a ~3.5% dividend yield in 2018, and we can envision a 10% dividend raise in 2019 to effectively raise the floor to $57.”

QSR has 100% Street support right now. Seven analysts are bullish on the stock with a $72 average price target (31% upside potential). See what other Top Analysts are saying about QSR.

Equinix (EQIX– Research Report)

This internet-connection specialist is certainly worth checking out. With over 175 datacenters, Equinix is the world’s largest IBX data center & colocation provider.

Most notably, Jefferies analyst Jonathan Petersen (Track Record & Ratings) has just upgraded Equinix to Buy. He also took the opportunity to raise his price target to $479 from $454- indicating 24% upside potential.

The analyst comments “We believe EQIX has built a data center portfolio that should consistently deliver the strongest level of organic growth among the Data Center REITs. With dilution from recent acquisitions behind them, earnings growth should begin to accelerate in 2019.”

Nine out of ten analysts are bullish on EQIX right now. That’s with a $501 average analyst price target for 30% upside potential. See what other Top Analysts are saying about EQIX.

Disclaimer: TipRanks is an independent cloud based service that measures and ranks digitally published financial advice. TipRanks' natural language processing (NLP) algorithms aggregate and ...

more