7 Market Predictions For 2024

The last twelve months might have been a roller coaster ride for investors, but in the end, it was a very rewarding year.

The S&P will finish the year up over +20% and the Nasdaq 100 has hit all-time highs, posting a return of over +50%. This spectacular year was accomplished despite all the negativity surrounding higher interest rates, inflation and geopolitical events.

Investors who were scared away by the narrative of fear are going into 2024 scratching their heads.

But for those who stuck with the market despite the doom and gloom, they’re going into 2024 with a smile on their face and money in their pocket.

A Look Back On 2023

After a 20% drop in the S&P in 2022, there was not a lot of hope for the year ahead. However, January started strong, with fuel from a revolution in artificial intelligence (AI).

AI has been around for over a decade, but ChatGPT changed everything. Having debuted in November of 2022, investors were finally realizing what AI could do. And with that, there was a whole new reason to be invested in the tech space.

The Nasdaq shot out of the 2023 gate, up almost +20% in the first five trading weeks of the year. The S&P 500 followed suit, up +10% as the Magnificent Seven led the way.

Investors were feeling good again until higher interest rates hit the banking sector and the market sold off in fear of another banking crisis. The S&P gave away all its gains in March, but when the crisis was contained to just a few banks, stocks rallied into the summer months.

Fear came back into the markets as interest rates continued to go higher and another geopolitical event started in Israel. The S&P saw another 10% drawdown before bottoming on positive inflation data, which marked a top on interest rates.

The fourth quarter finished stronger than a Tom Brady Super Bowl team, as the Fed pivoted helping the S&P rally over +15%.

(Click on image to enlarge)

Image Source: TradingView

Looking Forward to 2024

As we look to the next twelve months, investors should not expect the same topsy-turvy market that we saw in 2023.

The VIX, or the volatility gauge, is trading at lows not seen since before the pandemic. This tells us that investors will be able to sleep better in 2024 than they did last year.

Let’s go over my seven predictions for 2024.

1) Stocks To Post Another Solid Year

The stock market has a lot going for it as we start 2024. This is why we saw such a big move higher at the end of the year.

Inflation was a key word last year and that went hand in hand with interest rates. With recent month-over-month inflation data coming in at 0.0%, we see inflation stabilization to a point where the annual reading will come in at 2-3%.

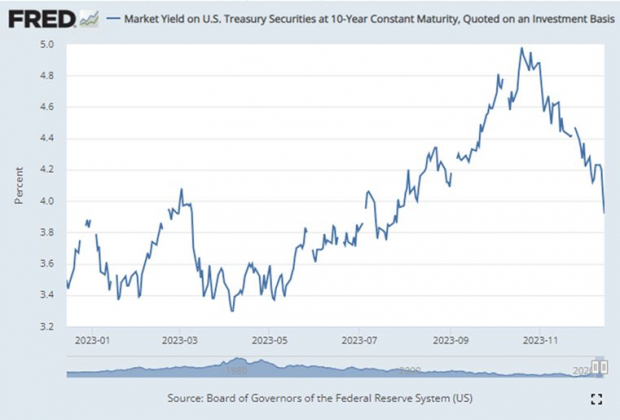

This data has made the Fed happy and in turn, interest rates have fallen sharply. Since topping at 5% in late October, the 10-year treasury note has fallen below 4%.

(Click on image to enlarge)

Image Source: Board of Governors of the Federal Reserve System (US)

With inflation and rates going lower, we are also in one of the strongest jobs markets we will ever see in our lifetimes. We are seeing real wage growth and a resilient consumer, all of which equates to strong profits for corporations.

But what excites me is not falling inflation, interest rates or a strong labor market. What makes me bullish is the almost $6 trillion cash on hand that will eventually be put to work in the stock market.

According to the Investment Company Institute, there was $5.89 trillion in money market fund assets as of December 13th. As rates go lower, these money market accounts become less lucrative in comparison to an S&P 500 index fund that just gained 20%. Investors will shift that money into stocks over time, creating support for the market in 2024.

I see a pullback coming early in 2024, but this support will kick in and the S&P will see returns slightly above the historical average. I have technical targets at 5440, which would be about a 13% gain from current S&P 500 levels.

But let’s not get too bullish here. While all these factors equate to a good year, valuation will start to come into question for some of the big names that led the market last year.

For 2024, investors should expect the big caps to stall and the smaller names to outperform.

2) Magnificent Seven Stalls

Let’s be honest, the Magnificent Seven stocks are all beasts. They are perhaps the most dominant group of stocks that has ever been assembled and they collectively make up almost 30% of the S&P 500 weighting.

If you are not familiar with this group, we are talking about Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), NVIDIA (NVDA), Meta (META), Tesla (TSLA) and Amazon (AMZN).

2023 was the year of the Mag Seven, with gains ranging from about +50% to +240%.

(Click on image to enlarge)

Image Source: TradingView

But can this performance be repeated in 2024?

The momentum of the Mag Seven names is hard to stop, but the valuations of these companies might force some investors to start rotating out of the stocks and into other areas of the market. As forward price-to-earnings ratios increase, the odds are that these stocks start to stall out.

For 2024, I see the Mag Seven stocks collectively underperforming the rest of the market, especially the smaller and mid-sized names.

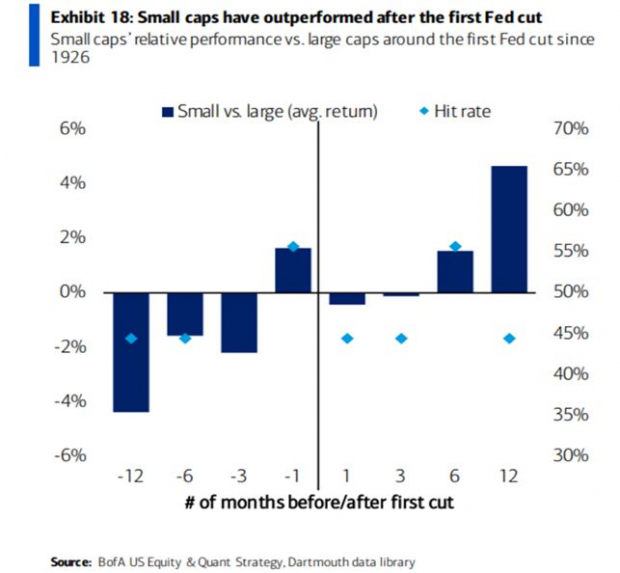

3) Small Caps Outperform

As we head into 2024, the market conditions are changing. Rates go lower, which means the cost of doing business is going down.

For a large company like Apple, interest rates do not move the needle. But for a $1-5 billion company, a combination of higher interest rates and higher inflation can wreak havoc on the bottom line.

Relief was very much needed for smaller companies and when it came, small-cap stocks surged.

From the beginning of 2022 to late October 2023, the Russell 2000 ETF IWM was down over 25%. Since that October low, the IWM has rallied over +20%.

(Click on image to enlarge)

Image Source: BofA US Equity & Quant Strategy, Dartmouth data library

Small-caps tend to outperform their large-cap counterparts as interest rates go lower. And while we have already seen a big move in the space, I expect 2024 to lift the Russell back to all-time highs in 2024, or another 20% in IWM.

4) Big Profits in Artificial Intelligence

The hottest sector in the stock market in 2023 has been AI. This futuristic technology is fascinating to many, and whether we like it or not, it will change our lives.

The AI space will blossom into something like what we saw with cryptocurrency altcoins during the pandemic. Smaller companies you never heard of will prove their use case and the stock will double, triple, or even 10X. As more eyeballs focus in on the space, we will see a euphoria-like move in everything AI-related.

These stocks will be hard to find and many investors will lose money chasing the moves higher. For that reason, an AI ETF might be a better option.

There are a handful of ETFs out there that specialize in the AI space, but the Global X robotics & Artificial Intelligence ETF sees the most volume. With the ticker symbol BOTZ, the ETF is designed to provide exposure to exchange-listed companies in developed markets that are involved in the development of robotics and/or artificial intelligence.

(Click on image to enlarge)

Image Source: TradingView

5) Oil Sees $50

With the economy improving, you would expect oil prices to go higher, right?

Well, not this time. There are just too many barrels sloshing around the world and despite supply cuts from OPEC, prices continues to fall lower.

The main issue is that American production has increased so much that the United States is producing almost 50% more barrels per day than Saudi Arabia.

This dynamic has some speculation that the Saudis could “flush” the market to try to take out American production. Whether that happens or not, there is certainly pressure on price and the crude oil chart looks very weak.

One thing that could save oil is geological events that seem to pop up every month or so. Pending any unforeseen event, I have technical targets at $50 a barrel.

6) Interest Rates Continue Lower

The Fed has officially pivoted, which has brought down the 10-year treasury note 20% off its 2023 highs. The market is now pricing in 150 bps of interest rate cuts by the end of 2024. This would set the Fed’s target rate at 3.75-4.00% versus the current 5.25-5.50%.

The pivot was a surprise to the market. For that reason, we likely see continued pressure lower on rates as bonds rally.

I see the 10-year note falling to 3.50% in 2024 and trading in a range between 3.5%-4%.

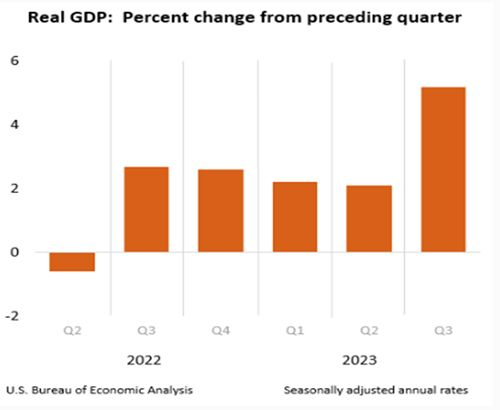

7) No Recession in 2024

The calls for a recession in 2023 were overwhelming, but it never worked out for the bears. And unlike 2022, a recession was not even close, with GDP for the third quarter coming in at 5.2%, the highest reading since Q4 of 2021.

(Click on image to enlarge)

Image Source: U.S. Bureau of U.S. Economic Analysis

There are still calls for a recession in 2024, but because of the many economic tailwinds discussed in this article, we will likely see continued economic growth in 2024.

Here are 7 reasons why there will likely be no recession:

1) Falling inflation, Lower Interest Rates

2) A Dovish Fed

3) Strong Labor Market

4) Strong Earnings

5) Low Energy Prices: $2/gallon gas?

6) AI Productivity Boom

7) Election Year

Since the Fed has made its pivot, we are starting to see the 2024 view turn positive. Recently, the Atlanta Fed raised its Q4 GDP to 2.6% from 1.2%.

Putting It All Together

Investors who missed the gains in 2023 need to start being more optimistic as we head into 2024. While the recent move higher in stocks is ripe for a pullback, any dip in the market should be viewed as a buying opportunity into the end of next year.

But whether the impressive rally continues or goes through a healthy pullback, profits will continue to flow, making it important to separate the companies with solid business from those that are just hype.

That’s why we’ve just released our new Special Report, 2024 Profit Predictions: 4 Big Market Opportunities and the Trades To Play Them. It delves into the burgeoning sectors of AI, Biotech and beyond, and reveals 4 picks set to soar in the new year.

This year, our team of experts closed gains such as +107.7%, +129.7% and +131.9% and we anticipate our 2024 predictions have potential to do even better.¹ The earlier you get in on these new picks, the greater profits you stand to make.

Today you can access the 2024 Profit Predictions Special Report for just $1. When you do, you’ll also get 30-day access to all of Zacks private portfolios for the same dollar.

More By This Author:

Top 5 Consumer-Centric Stocks Amid Rising Consumer ConfidenceKLA Laps the Stock Market: Here's Why

3 Beaten-Down ETFs To Buy For A Turnaround In 2024

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more