5 Top Stock Picks For 2018

Top RBC Capital analyst Mark Mahaney has just revealed his top stock picks for 2018. These long cap and small cap internet stocks look set to significantly outperform the market. Indeed large-cap internet stocks are already up 26% (on average) in 2017- with the FANG stocks (FB, AMZN, NFLX, GOOGL) surging 45%. But, as Mahaney says, that’s the past. Let’s look forward.

TipRanks shows that five-star Mahaney is a top analyst to follow. As we can see here, his ranking of #33 out of 4,719 analysts is based on an impressive 68% success rate and 21.4% average return. And if we change the measurement date to two years instead of one, his rating rises as does his success rate (72%) and average return (44.5%).

We took this opportunity to review five of Mahaney’s top stock picks for 2018. So let’s dive in and take a closer look at these premium stocks- all of which have serious growth potential:

Facebook Inc (Nasdaq: FB)

Social media giant Facebook is Mahaney’s no.1 top large-cap long for 2018. The stock’s ‘current low market shares’ (5% of global total advertising and 15% of global online advertising) will ensure that FB ‘maintains premium growth for a long time’. Moreover, its growth-adjusted valuation is very attractive at 25X P/E for 30%+ EPS growth.

“We still see dramatic opportunities for FB to monetize its messaging platforms (FB Messenger and WhatsApp)” says Mahaney. He adds: “[FB-owned] Instagram showed the strongest trends and momentum throughout 2017 across all social media platforms.” The analyst has a bullish $230 price target on the stock.

Overall, FB has a ‘Strong Buy’ analyst consensus rating with 29 recent buy ratings vs just 1 sell rating. This sell rating comes from Pivotal Research’s Brian Wieser who says the stock is trading too high above his $136 price target (24% downside!). However, on average the Street believes FB can climb a further 17% to $210. Note that you can click on the screenshot below for further stock insights.

Netflix (Nasdaq: NFLX)

Streaming site Netflix has demonstrated a very impressive 20+ straight quarters of 35% year-over-year revenue growth. “The NFLX Long Thesis remains fully intact” states Mahaney.

“Content (along with Distribution) is King. And Netflix took a step closer to claiming the throne this year. Why? Well, there are a 100 million reasons! 2017 subscriber additions will likely surpass 2016 additions.”

What about the bear thesis of US reaching saturation? Well US subscriber additions largely beat expectations this year, as did international subscriber additions. Plus Mahaney notes very positive survey responses revealing positive satisfaction levels and low churn despite price increases.

The outlook for NFLX from the Street appears cautiously optimistic. Its Moderate Buy analyst consensus rating translates into 22 buy ratings, 9 hold ratings and 1 sell rating. Meanwhile, the $222 average analyst price target suggests 17% upside potential from the current share price.

Amazon (Nasdaq: AMZN)

Is Amazon the stock of 2017? Its $13.7 billion purchase of Whole Foods certainly created shockwaves across the market. “Moreover, a new phrase found its way into the business vernacular,” writes Mahaney. “Getting Amazon’d. Industries such as Consumer, Retail, Business Services, and even Pharmaceuticals have awoken to Amazon’s broad reach… We continue to believe Amazon may have the strongest long-term growth outlook among the Internet Staples as it faces the largest Total Addressable Markets.”

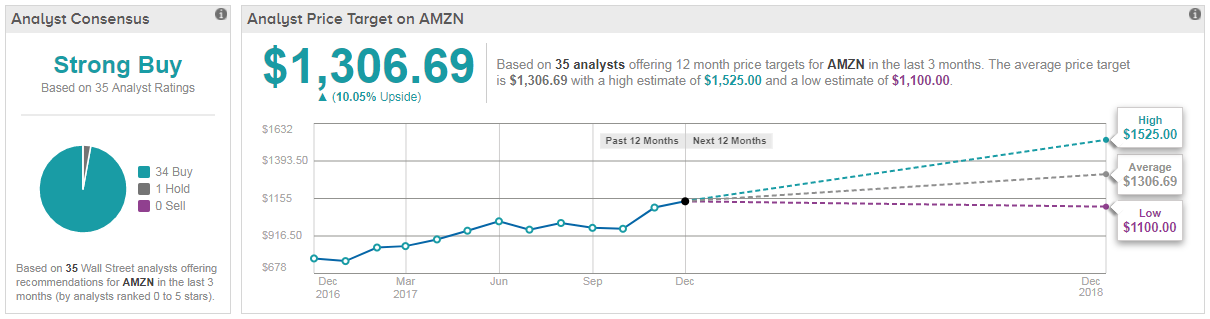

Unsurprisingly, AMZN also has one of the best Street ratings with 34 buy ratings and just 1 hold rating in the last three months. With an average analyst price target of $1,307, analysts are predicting a further 10% rise from the current share price.

Yelp Inc (NYSE: YELP)

Crowd-review platform Yelp scores big as a top 2018 small-cap long for Mahaney. Yelp already boasts over 135 million reviews of businesses worldwide. And it is now growing its salesforce by 20% to ensure that ad revenue continues to stay buoyant.

According to Mahaney: “Improves salesforce execution and new revenue streams (RAQ, Reservations) suggest that current Ad Revenue growth rates are sustainable. And easing comps into ’18 will help. When all is said and done, the Local Advertising TAM remains very sizeable ($150B) and should support a multi-billion-dollar revenue platform. And YELP continues to have strategic value.”

His $55 price target suggests big upside potential of almost 27%. However, analysts are divided on the future for YELP. The stock has received a mixed bag of ratings with 10 buy ratings, 11 hold ratings and even 1 sell rating in the last three months. For example, Piper Jaffray’s Samuel Kemp is nervous that YELP lowered organic fourth quarter guidance by 2%. If we look at the $46.60 average analyst price target, the stock has 7% upside potential from the current share price.

TrueCar (Nasdaq: TRUE )

Last but not least we have TrueCar, Inc. For those who haven’t heard of TRUE before, this is a nifty automotive pricing and information website for new and used car buyers and dealers. The stock tanked in Q3 on the back of weak results and lowered full-year guidance. But Mahaney attributes this ‘to a 1x issue which can be resolved’ namely, the poor performance of their USAA partner. USAA introduced a significant website redesign which adversely affected traffic. The two companies are now working together to address these issues.

Ultimately Mahaney is sticking to his bull picture on this stock. Not only is TRUE very cheap right now, it also ‘addresses a critical consumer need, is attacking a large market opportunity, and presents a differentiated value proposition to both dealerships and consumers.’ With this in mind, Mahaney places an $18 price target on TRUE (59% upside potential).

TRUE currently has a Moderate Buy analyst consensus rating with 3 buy ratings vs 2 hold ratings. These analysts believe, on average, that TRUE can recover by 50% to hit $17.

Disclaimer: TipRanks is an independent cloud based service that measures and ranks digitally published financial advice. TipRanks' natural language processing (NLP) algorithms aggregate and ...

more