5 Stocks With Solid Track Records At Attractive Prices

Image: Bigstock

Meme stocks may be on top of investors’ minds at the moment, but there probably isn’t a reason to think that they’ll have a lasting impact. True, trading today isn’t what it used to be in the past with social media providing the platform for retail investor gatherings.

Truth be told, though, this is all a gamble. You could become rich, but there’s an equal chance that you’ll lose whatever you have. The volatility, and therefore risk in these trades is significant because prices aren’t driven by fundamentals.

So should you perhaps earmark a small percentage of your funds to these stocks? Should you ignore them? Or should you think of this as a learning experience?

A learning experience is the way I view it, no matter how much who made from it. Especially if you aren’t young anymore and so, have less to spare. And it’s probably worth keeping in mind that the easy/cheap money the government’s been doling out will soon be gone.

Can this trading style be replicated in the future when that happens? And what kind of role will inflation play for that matter? We don’t have answers to these questions of course, but it seems likely that we won’t see a ton of these things going forward.

And so, this is probably the time when we should be focusing on fundamentals. If we are buyers in this market, we don’t want to overpay for stocks. Which could easily happen given where valuations are sitting right now.

One encouraging trend is the constantly improving earnings picture. The second quarter was always expected to be stronger than the first because the lockdown last year makes for easier comparisons. But these expectations have continued to rise, which also points to some real growth. So it shouldn’t be too difficult to find stocks with a good growth runway.

The selections today are based on the idea that companies that have generated solid earnings growth in the past, on which analysts are incrementally positive about the future, and which are expected to see growth in the next couple of years have to be good choices. Especially when the valuations aren’t too rich and the Zacks Rank and Value-Growth-Momentum (VGM) Scores are supportive-

Harvard Bioscience, Inc. (HBIO Quick Quote HBIO - Free Report)

Harvard Bioscience develops, manufactures, and markets tools used in drug discovery research at pharmaceutical and biotechnology companies, universities, and government laboratories.

The shares carry a Zacks Rank #2 (Buy) and VGM Score A.

The company has generated 24.2% EPS growth in the last five years. Analysts currently expect it to generate EPS growth of 75.0% this year and 42.9% in the next. And they’ve raised their estimates for 2021 and 2022 by 21.7% and 14.3%, respectively.

The shares also look reasonably valued at these levels: the current P/E of 21.63X is below the median value of 28.98X over the past year.

Textainer Group Holdings Ltd. (TGH Quick Quote TGH - Free Report)

Textainer Group is the world’s largest lessor of intermodal containers with a total fleet of more than 1.3 million units, representing over 2,000,000 TEU that it leases to 400+ shipping lines and other lessees, including each of the world's top 20 container lines and the U.S. Military. It is also one of the largest purchasers of new containers and the largest sellers of used containers.

The shares carry a Zacks Rank #1 (Strong Buy) and VGM Score B.

Textainer has grown earnings at 24.2% over the past five years and is expected to grow another 196.9% this year and another 6.4% next year. Estimates for the two years have climbed 27.7% and 35.5%, respectively over the last four weeks.

At 7.03X earnings, the shares are also trading below their median value of 7.49 since it began trading.

Alpha and Omega Semiconductor Ltd. (AOSL Quick Quote AOSL - Free Report)

Alpha and Omega Semiconductor is an ODM (although most of the packaging and test is done in-house) that designs, develops, and sells a broad range of power semiconductors globally, including a portfolio of Power MOSFET and Power IC products.

It differentiates itself by integrating device physics, process technology, design, and advanced packaging to optimize product performance and cost. It targets high-volume end-market applications like notebooks, netbooks, flat panel displays, mobile phone battery packs, set-top boxes, portable media players, and power supplies.

The shares carry a Zacks Rank #1 and VGM Score B.

The company’s earnings have grown 28.5% in the last five years with further growth of 209.1% and 5.15% expected in fiscal 2021 and 2022 (ending June). In the past four weeks, analysts raised their estimates for the two years by 15.8% and 21.5%, respectively.

The shares are trading at their one-year low of 11.40X P/E.

ArcBest Corp. (ARCB Quick Quote ARCB - Free Report)

Headquartered in Fort Smith, Arkansas, ArcBest offers transportation of general commodities, motor carrier freight transportation, business-to-business air transportation, and ocean transport, as well as global customizable supply chain solutions and integrated warehousing services. It also offers expedited freight transportation services to commercial and government customers and premium logistics services.

The shares carry a Zacks Rank #2 and VGM Score A.

The last five years have seen its earnings grow 37.5%. Analysts currently expect growth of 51.4% this year and 7.3% in the next, taking their estimates up 19.1% and 12.9%, respectively in the past four weeks.

The shares are trading at a P/E of 15.53X, which is close to the median value of 14.64X over the past year.

LGI Homes, Inc. (LGIH Quick Quote LGIH - Free Report)

Headquartered in The Woodlands, Texas LGI Homes designs and constructs entry-level/affordable homes in Texas, Arizona, Florida and Georgia.

The shares carry a Zacks Rank #2 and VGM Score A.

Earnings growth in the last five years has averaged at 31.8%. The estimated earnings growth for 2021 is 29.7%, stabilizing in the following year at 0.9%. But these estimates could prove conservative given the strong demand environment, and if the trend over the past month is any indication: the 2021 estimate jumped 25.0% during this time with the 2022 estimate jumping 14.2%.

The valuation has started climbing but the current P/E of 12.01X is still pretty close to the median value of 11.26X over the past year.

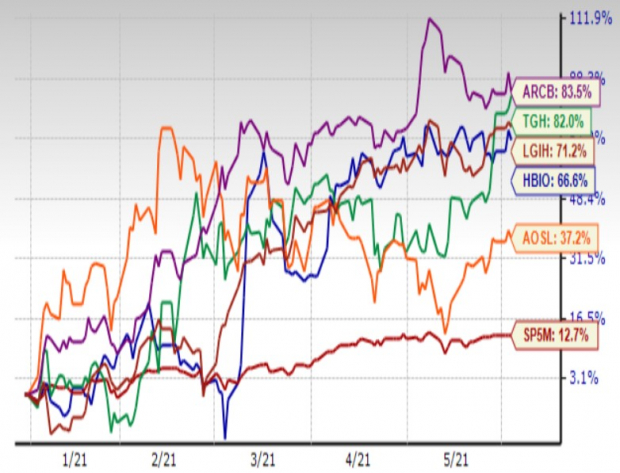

Year-to-Date Price Movement

Image Source: Zacks Investment Research

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more