5 Stocks To Watch This Week 7/11 - YUM, DAL, JPM, WFC, C

Wednesday, July 13

Thursday, July 14

Friday, July 15

Yum! Brands (YUM)

Consumer Discretionary - Hotels, Restaurants & Leisure | Reports July 13, after the close.

The Estimize consensus is looking for earnings of 76 cents per share on $3.10 billion in revenue, 1 cent higher than Wall Street on the bottom line and right in line on the top. Compared to a year earlier, earnings are expected to grow by 9% with revenue remaining unchanged. Revisions activity since Yum’s last report show that EPS estimates are rising into the report, while sales have trended downward.

What to Watch: While the fast food industry has rebounded in recent years, Yum’s results have been mixed. Earnings have seen double digit gains in the last 3 quarters while revenue has been near zero or negative over the same time period. The stock has largely tracked these ups and downs, decreasing 5% in the past 12 months.

Yum Brands is responsible for operating notable chains such as KFC, Pizza Hut and Taco Bell. In recent quarters there have been robust domestic results which have offset sluggish growth internationally. The first quarter featured a system sales increase of 5% with same store sales up 2% over the same period. Yum China stood out compared to its other divisions, boasting an 11% rise in system wide sales and 6% in same store sales.

Comps are expected to remain high this quarter on the back of strength in the Taco Bell, KFC, and Pizza Hut brands. Taco Bell has been hugely successful with its breakfast offerings while menu innovation and increased efficiency in KFC and Pizza Hut should also drive comps. Emerging markets might have a difficult time sustaining its upward momentum due to currency headwinds. Meanwhile, China continues to face headwinds in the form of a stagnant economy, fall out from food safety scandals and increasing competition.

Delta Airlines (DAL)

Industrials - Airlines | Reports July 14, before market open.

The Estimize consensus is calling for earnings per share of $1.62 on $10.55 billion in revenue, 7 cents higher than Wall Street on the bottom line and $17 million on the top. Compared to a year earlier this represents a 32% increase in earnings with sales expected to decline by 1%. Per share estimates have dropped 15% in the past 3 months and should continue to be cut over the next few days. Fortunately, the stock reacts well to earnings, rising 5% in the month following a report.

What to Watch: The airlines are one of the worst performing sectors this year with stocks down over 20% across the industry. Shares of Delta are down 25.3% since the start of the year, largely driven by macroeconomic volatility, rising oil prices, recent terror attacks and generally lower demand. This has been the primary contributor to flat YoY revenues.

Recent events have been contributed to the decline in the airline industry this year. Terrorist acts around the world, especially those at airports, have scared some from traveling. Furthermore, the Brexit vote last month is expected to have lingering effects on the airline industry which could see a negative impact from unfavorable currency exchange rates.

Delta has already reported that key metrics have decline in the past 3 months. PRASM (passenger revenue per available seat mile), one of the most important metric for airlines, declined by 5% over the quarter. Delta and its peers have been struggling to hold onto current price levels as excess seating capacity increases and demand for pricey last minute business tickets decline. Delta recently cut its projected operating margin to 17% for Q2, down from previous forecasts in the range of 21 to 23%.

JPMorgan Chase (JPM)

Financials - Diversified Financial Services | Reports July 14, before the open.

The Estimize consensus is looking for earnings per share of $1.44 on revenue of $23.83 billion, 1 cent higher than Wall Street on the bottom line and $50 million on the top. Compared to year earlier this represents a 7% decline in earnings and 3% in sales. Shares of JPMorgan are down 5% year to date and typically don’t react to quarterly results.

What to Watch: JPMorgan, the largest of the retail banks in terms of assets under management, kicks things off for banks when its reports Q2 earnings Thursday before the market opens. Across the board, the banking sector will be impacted by the Brexit vote, low interest rates and currency headwinds. Fortunately, the rebound in the oil market and gas prices will alleviate pressure on energy loan losses going forward.

Regardless, JPM has exceeded earnings expectations in 4 of the last 5 quarters and is typically viewed as one of the better performing financial institutions. Last quarter, the company reported increases in consumer banking and asset management sectors. Net interest income increased as well, despite rates staying close to zero during the period. However, significant declines were seen in commercial and investment banking sectors. Overall net income and revenue were down on a yearly basis with a high likelihood of continuing through the remainder of fiscal 2016.

Second quarter results are shaping up to feature some similar factors from past results. An early surge in trading activity this quarter appears as if it will be offset by Brexit and other macro concerns. Moreover, investment banking is likely to remain weak, dampened by a persistent decline in M&A activity and weakened IPO market. Fortunately the mortgage business should see a big boom from lower mortgage rates. Energy loans and expense management should also not be a big thorn in the Chase’s side.

Wells Fargo (WFC)

Financials - Commercial Banks | Reports July 15, before the open.

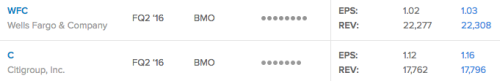

The Estimize consensus is looking for earnings per share of $1.03 on $22.3 billion in revenue, 1 cent higher than Wall Street on the bottom line and $30 million on the top. Compared to a year earlier this reflects earnings that are in-line and a 5% increase in sales. Shares of Wells Fargo are down 5% year to date and typically increase 3% in the 30-day post-earnings period.

What to watch: Currently, Wells Fargo is the only of the 6 big banks that is not expecting declines on the top and bottom line. Despite some shakiness in the banking sector, Wells Fargo’s earnings have been relatively resilient given it has little exposure to risky trading and investment banking businesses. Furthermore, the bank’s operations and investments are largely isolated compared to its large cap peers. Still, the current economic landscape has caused the bank to reduce its profitability targets for the remainder of the year. Wells Fargo recently lowered its full year target return on assets to the range of 1.1% to 1.4%. The bank sees continued stress in its oil and gas portfolio this year with the potential for additional reserve increases or more credit losses.

On the plus side, loan growth is expected to be a key driver this quarter as mortgages sit at all time lows. Wells Fargo has the largest loan portfolio in the financial sector, primarily supported by its mortgage portfolio. An increase in loan and deposit growth from this could offset low rates and in fact boost overall net interest income. The bank’s U.S. focused operations gives them the highest probability of walking out of Brexit and future macro events unscathed.

Citigroup (C)

Financials - Diversified Financial Services | Reports July 14, before the open.

The Estimize consensus calls for EPS of $1.16, four cents higher than Wall Street’s consensus. Revenue expectations are slightly higher than the sell-side, with the Estimize community expecting $17.796 billion, as compared to $17.762 billion. Earnings expectations have trended downward by 8% since last quarter, while revenue estimates are down 3%. This puts YoY growth expectations at -22% for EPS and -7% for sales.

What to Watch: Last quarter was a mixed bag for Citigroup, with the bank beating on the bottom-line, missing on the top-line, and recording YoY declines for both measures. A lot of the weakness in the past couple of years have come as the bank’s traditional engines of trading revenue, fixed income and currencies, have slumped due to high regulatory costs. After years of cost cutting, the Citigroup decided to expand its business in the equity market. Trading revenues should have been strong in Q2 after a rough start to the year.

Like many of the other big banks, the U.K.’s unexpected decision to leave the EU may lead to a decrease in fee income and a further slowing of M&A activity. With Brexit uncertainty looming and causing the Fed to hold off on any further interest rate hikes, stagnant interest revenues will be a problem for Citi as well. The stock is down 24% in the last year, meaning investors will be paying close attention to any guidance given for the second half of the year.

(Photo Credit: Butz.2013)

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.

Thank You, Sir.