5 Stocks To Watch After The Market Closes Today

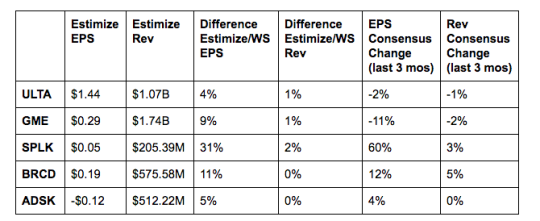

Ulta Salon, Cosmetics & Fragrance (ULTA): Ulta is firing on all cylinders. Year to date the stock is up 48% and 68% in the past 12 months. Improved merchandise mix and persistently strong traffic trends can be credited with the recent string of earnings growth. For 8 consecutive quarters Ulta has delivered over 20% gains on both the top and bottom line. Beauty products, like discounters, run counter to typical trends in the retail sector. While many companies blame weak consumer spending for their woes, Ulta could say the opposite. Analysts have been head over heels for this name with many of them recommending a buy rating.

GameStop (GME): Video games are the fastest growing sector in the whole entertainment industry. This trend hasn’t helped Gamestop though. Gamestop’s woes stem from its backwards business model. Consumers, now more than ever, prefer to download games directly from the publisher or purchase them online. Gamestop, on the other hand, generate a majority of its revenue from its stand alone and mall based stores. Clearly this is a problem and investors have been quick to take notice. Shares are down 28% in the past 12 months. Long-term, Gamestop is moving towards expanding its digital, collectibles and technology segment of the business. During the first quarter, the collectibles sales soared 260% to $82.3 million and is expected to reach $1 billion by 2019. Additionally, partnerships with AT&T (T) and Apple (AAPL) are proving to be quite lucrative. Diversifying its product offerings to more than just video games will drive revenue for future quarters.

Splunk (SPLK): Over the past few years, enterprise cloud and data analytics offerings have seen exceptional growth. Splunk has been strengthening its product pipeline to keep pace with this upward momentum. During the first quarter Splunk added more than 450 enterprise customers, expanding relationships with notable companies including Chipotle (CMG). This quarter wins include Zillow (Z) in early May and Groupon in late July. However, slowing license bookings, increased investment in R&D, and high operating costs are expected to take their toll on tomorrow’s results.

Brocade Communications (BRCD): Brocade Communications was consistently beating on the top and bottom line, up until last quarter. During its fiscal third quarter revenue missed the Estimize consensus by nearly $10 million and earnings dropped 33% from a year earlier. Expectations are that we will see another earnings decline on a year over year basis with flat revenue sequentially. Shares are down 3% from a year earlier but have since rebounded in 2016. The acquisition of Ruckus Wireless in April adds a new layer of growth that may push sales higher than consensus forecasts.

Autodesk (ADSK): Financial performance has steadily declined the past two years. The company is now approaching its third quarter of expected profit losses. Revenue has been just as bad with current sales targets 16% lower than a year earlier. Increased investments in cloud based infrastructure and marketing initiatives are to blame for the dwindling cash position. Meanwhile, competition in the space from heavy hitters like Amazon and Microsoft has inhibited revenue growth. Autodesk is seeing decent growth in new subscriptions but because revenue is deferred it won’t likely impact this quarter’s results.

Disclosure: None.

Thanks for sharing