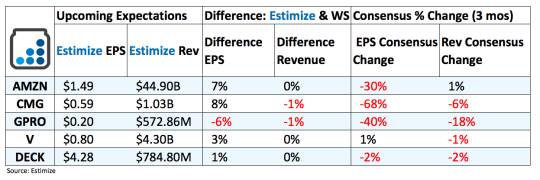

5 Stocks To Watch After The Market Closes Today - Thursday, Feb. 2

Amazon (AMZN): Amazon Web Services produces the highest margins across all of Amazon’s business. The segment remained solid in the third quarter despite a lackluster bottom line number. Business from AWS grew by about 55% to $3.23 billion and also generated record profits, with quarterly operating income income of $861 million. Amazon currently supports some of the biggest platforms like Netflix and Verizon and continues to add more features to further entrench itself as the de facto cloud computing service. That said, Microsoft’s recent rise in the space with Azure places some pressure on Amazon to expand and innovate so as to not lose any market share

Retail sales, on the other hand, generate the lowest margins but a majority of Amazon’s total revenue. In the third quarter revenue from North America accounted for 58% of total sales, representing a 6.8% increase sequentially and about 26% on a year over year basis. The international segment, which accounts for 32% of AWS revenue, grew slightly faster at 7.8% on a quarterly basis. Retail sales also include Prime memberships, content on Instant Video, and Kindle related services, all of which continue to perform well. The biggest concern for Amazon will be whether it can replicate its domestic success overseas. Increasing competition, currency headwinds, and potential Trump fallout remain other near term threats to the retail segment.

Amazon, like Google, also funds moonshot shot investments which investors view as a big pile of burning money, until they aren’t. Some new projects in the pipeline for Amazon include drone delivery, Amazon Go stores, more expansive original content, grocery delivery and much more. Knowing Amazon, many of these early stage projects will become the cornerstone of future growth but in the interim they continue to drag down margins.

Chipotle (CMG): In a report earlier this month, Chipotle state that same store sales progressively improved throughout the fourth quarter. In October comps fell by 20%, dropped again in November but then jumped by 15% in December. December faced the easiest comparisons as it was the first full month following the initial health outbreak.

To offset some of these losses Chipotle continues to use promotional initiatives and new menu offerings with the intent of driving traffic. Some marketing programs used in 2016 include Chiptopia, the introduction of chorizo and an ongoing student discount. Increasing brand marketing and driving technological investments should also help aid in bringing back customers.

But as is always the case, the cost of running new marketing initiatives puts pressure on margin expansion. Meanwhile, the broad pullback occurring in the fast casual space, high wages and food costs should only exacerbate Chipotle’s losses.

GoPro (GPRO): GoPro maintains a steady slide heading into tomorrow’s reports, with investors hopeful that the action camera maker can turn things around. After the third quarter, management guided a weak sales from its two newest products; Hero 5 and Karma Drone. The company back a few months later and claimed sales wouldn’t be as bad, but the damage was done. Shares slipped nearly 17% throughout the fiasco and promises to disappoint again tomorrow afternoon. Given GoPro’s narrowed focus on products that simply don’t sell, investors can come to expect a repeat performance of the third quarter.

Visa (V): Visa’s results come after weak reports from American Express and MasterCard earlier this season. And while that might be a bad sign for the credit card companies, investors believe Visa can buck the trend. Tomorrow’s results should reflect credit growth from the recently added Costco portfolio. Meanwhile the acquisition of Visa Europe should start to exhibit accretive effects on revenue and processed transactions. Because Visa remains the most popular card around the world, it can cushion some of the effects of macro uncertainty and currency headwinds.

Deckers Outdoor (DECK): The unusually (or maybe common at this point) warm winter bodes poorly for Deckers which relies heavily on Ugg boots to support top line performance. In the most recent report UGG sales declined 2.1% to $412.2 million driven by both the weather and a downturn in European sales. Its second largest revenue contributor, Teva, declined 4.2% to $17.1 million which management blamed on lower domestic wholesale sales. Amid this tougher environment, Deckers remains committed to building smaller concept omnichannel outlets, which it believes will drive traffic and enhance the customer experience. But that didn’t stop management from cutting guidance for fiscal 2017. The company now expects net sales to decline in the range of 1.5 to 3 percent and projects earnings in the band of $4.05 and $4.25 per share.

Disclosure: None.

Thanks for sharing