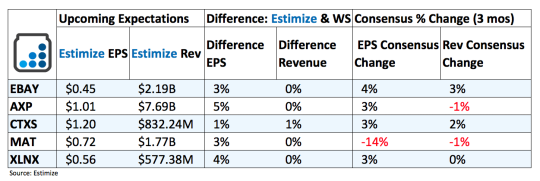

5 Stocks To Watch After The Market Closes Today - 10/19/2016

eBay (EBAY): eBay’s dominance in the late 90’s and early 2000’s has largely disappeared thanks to the emergence of Amazon (AMZN) and other online retailers. This had resulted in a string of dismal earnings and a sell off in the stock. Until recently, its prospects appeared limited. Its recent departure from PayPal put a thorn in the side of investors as the online payment platform continued to succeed. Now after a few stronger than expected quarters under its belt, analysts are optimistic that this upcoming report will be strong. The company has taken several initiatives to improve user engagement and thereby revenue. They include using technological applications to more accurately target customers, shifting towards a fixed pricing model, as opposed to its legacy auction business, and revamping policies to reward those who provide quality services. Additionally, the acquisition of Ticketbis will help expand its Stubhub brand beyond North American markets.

American Express (AXP): Shareholders will get their first look at American Express without Costco in the upcoming quarterly report. This marks the first period that the AMEX won’t receive any kickbacks from the Costco partnership after the wholesaler parted ways in favor of Visa. The combination of soft consumer spending and the lost partnership have analysts cautious heading into this report. The Estimize community is calling for an 18% drop on the bottom line and 6% on the top. This is a significant blemish on its track record which included flat revenue and robust EPS growth.

Citrix Systems (CTXS): Its impressive product portfolio of desktop virtualization, networking and cloud computing technologies have driven robust growth in recent quarters. In fact, the company has consecutively beat on the top and bottom line in each of the past 4 quarters. Analysts are optimistic that tomorrow’s report can continue this winning streak, but it won’t be that simple. Despite consistently beating estimates, growth has seen a marked deceleration over the last 4 quarters, which has also translated to the stock. When compared to some of its competitors, the stock’s 12.5% gains this year look unimpressive. Meanwhile, increasing competition and ongoing pressure from foreign exchange volatility could drag growth down even further.

Mattel (MAT): Shares of Mattel are up nearly 3% in the past 5 days, following fellow toymaker, Hasbro’s, better than expected quarterly earnings. This bodes well for Mattel and its shareholders who were otherwise forecasting another weak report. Mattel has been playing catchup to Hasbro after losing the Disney princess license in late 2015. Its flagship products have also been struggling until a recent turnaround. Core brands such as Fisher-Price, Hot Wheels and Mega Bloks have started to gain traction while it’s Barbie rebranding has been wildly successful.

Xilinx (XLNX): Xilinx has been firing on all cylinders due in large part to improving demand in wireless and wired communication segments and greater adoption in the Automotive, ISM, Test and Aerospace and Defense markets. Additional efforts to tap into rapidly growing cloud sectors, mainly 5G, will boost top line growth. Expectations are exceedingly higher that Xilinx will build on its recent winning streak in the quarter to be reported.

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more

thanks for sharing