5 Large Caps For Momentum Investors - April 19, 2016

Today I used Barchart to sort the S&P 500 Large Cap Index stocks first for the most frequent number of new highs in the last month, then again for technical buy signals of 80% or better. Next I used the Flipchart feature to review the charts for consistency.

Today's watch list includes: Xylem (NYSEARCA: XLY), Zimmer Biomet (NYSE: ZBH), Visa (NYSE: V), Waters (NYSE: WAT), and 3M (NYSE: MMM)

Xylem

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 8.64% in the last month

- Relative Strength Index 80.14%

- Technical support level at 41.81

- Recently traded at 42.88 with a 50 day moving average of 39.10

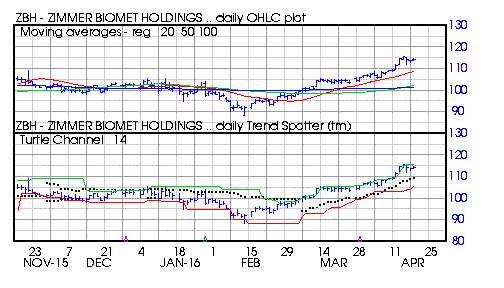

Zimmer Biomet

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 9.18% in the last month

- Relative Strength Index 74.74%

- Technical support level at 112.50

- Recently traded at 114.23 with a 50 day moving average of 102.27

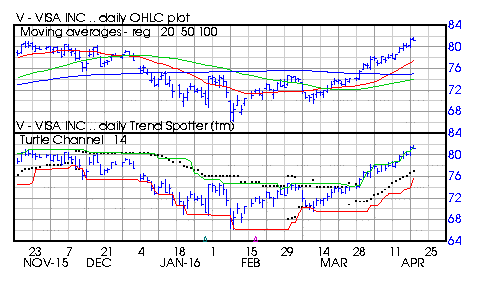

Visa

Barchart technical indicators:

- 80% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 9.88% in the last month

- Relative strength Index 71.44%

- Technical support level at 79.22

- Recently traded at 81.15 with a 50 day moving average of 74.07

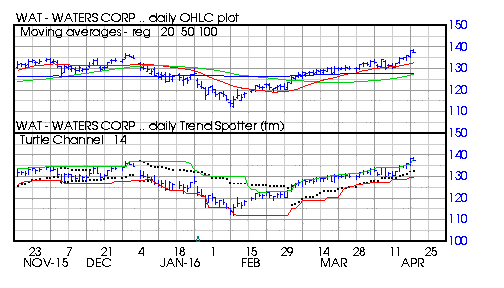

Waters

Barchart technical indicators:

- 80% technical buy signals

- Trend Spotter buy signal

- Above ts 20, 50 and 100 day moving averages

- 14 new highs and up 5.33% in the last month

- Relative Strength Index 64.24%

- Technical support level at 134.00

- Recently traded at 137.19 with 50 day moving average of 127.34

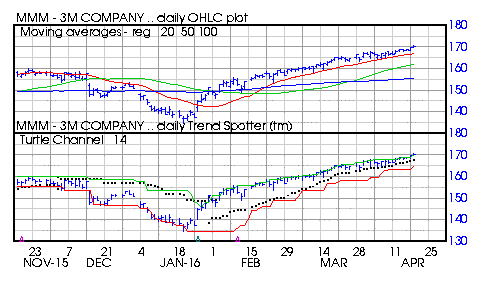

3M

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 2.80% in the last month

- Relative Strength Index 71.35%

- Technical support level at 167.79

- Recently traded at 169.90 with a 50 day moving average of 161.92

Disclosure: None.

Comments

Please wait...

Comment posted successfully

No Thumbs up yet!