5 Good Small Caps

Small Caps have had a hard time recently so I wanted to see if any were having a good day. I used Barchart to sort the S&P 600 Small Cap Index stocks first for the highest technical buy signals then used the Flipchart feature to review the charts.

The list for today includes Epiq Systems (NASDAQ:EPIQ), Symmetry Medical (NYSE:SMA), Vicor (NASDAQ:VICR), Vasco Data Security International (NASDAQ:VDSI) and Marriot Vacations Worldwide (NYSE:VAC):

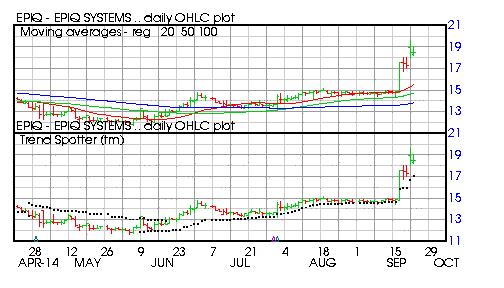

Epiq Systems EPIQ

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 9 new highs and up 25.02% in the last month

- Relative Strength Index 83.83%

- Barchart computes a technical support level at 17.07

- Recently traded at 18.40 with a 50 day moving average of 14.72

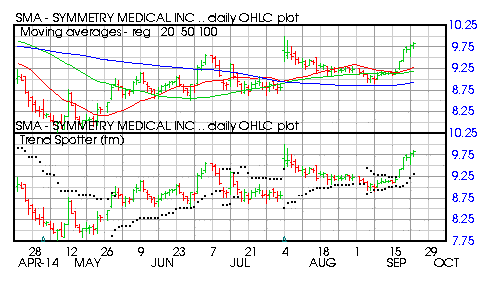

Symmetry Medical SMA

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 8 new highs and up 7.07% in the last month

- Relative Strength Index 74.49%

- Barchart computes a technical support level at 9.41

- Recently traded at 9.80 with a 50 day moving average of 9.19

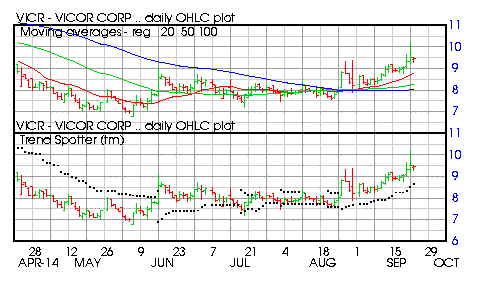

Vicor VICR

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 6 new highs and up 20.93% in the last month

- Relative Strength Index 67.53%

- Barchart computes a technical support level at 8.65

- Recently traded at 9.41 with a 50 day moving average of 8.26

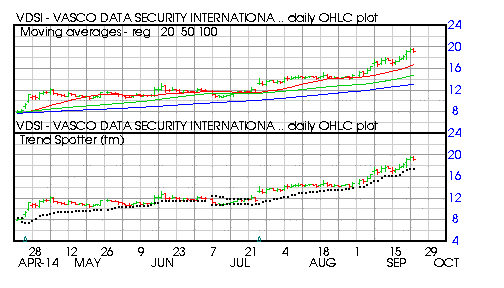

Vasco Data Security International VDSI

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 35.20% in the last month

- Relative Strength Index 76.59%

- Barchart computes a technical support level at 18.67

- Recently traded at 19.06 with a 50 day moving average of 14.81

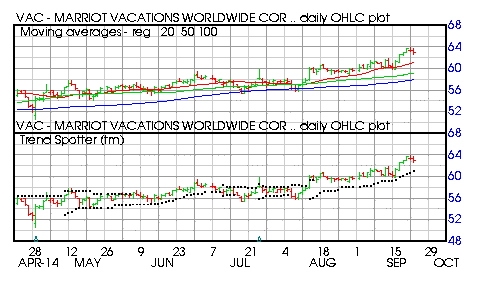

Marriot Vacations Worldwide VAC

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 12 new highs and up 5.77% in the last month

- Relative Strength Index 64.10%

- Barchart computes a technical support level at 62.66

- Recently traded at 62.8 with a 50 day moving average of 59.15

Disclosure: None

Nice Picks. I've had my eye on these.