5 Deciding Factors On An Investment Account For Our LLC

It’s been essentially 24 months since we have monetized portions of our brand and website. On top of that, our blog has been growing and we have started to earn revenue via Google Adsense and media.net advertisements. We have built a small nest egg of cash and what would we, the Dividend Diplomats, do with a nest egg? Invest in dividend paying stocks, of course! We have a solid cash position and determined it to be the right time to research, investigate and decide on the factors for the right investment account for our Limited Liability Company (LLC).

5 investment account factors for the llc

The top deciding factors for the investment account for our LLC will be listed below, with reasons why and an overall grid as it relates to the providers of such an account. This way we can compare and help make a decision, similar to our famous Dividend Diplomat Stock Screener. Let’s check out the factors!

1.) Cost Per Trade – No brainer here, and is similar to one of our (Lanny’s goal) goals for 2016 to keep trading costs low. We would like to trade for under $10 per trade. Why is this important? We aren’t making that much money here, so our capital position isn’t enormous enough that we can swing multiple times. Cost for the trade, therefore, is critical, as if we are at $1,500 – we may be comfortable with making 2 trades at under $10 each, but if it were any higher, we would stick with 1 trade. As you can see from the chart above – there is a tight range of up to $10 per trade, which is fairly common. Therefore, all firms listed above fit the bill.

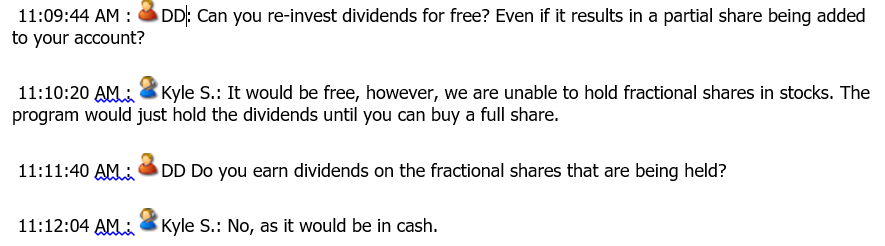

2.) Partial Shares – This is not a pure deal breaker, but I love using the Capital One Investing “automatic” trades, where the trade fee is not only $3.95, BUT they allow the partial share on an investment purchase. That’s one factor. The other piece, to this, is reinvestment, a critical deciding factor to be honest, into partial shares. With such a lower dollar amount for us to invest, we may not have enough capital to own enough shares that produces a dividend for a whole share. For instance, as you can see in the chart, Scottrade does not allow partial shares on dividend reinvestment – what the heck Scottrade? See the conversation below. With that – E-Trade, Fidelity and TDAmeritrade are the runners here.

3.) No monthly maintenance fee – “Duh” right here. No chance in hell we are going to pay a monthly fee to have an account open. My (Lanny) Health Savings Account has a plethora of these, which is fine because I have a huge kick-in from the employer – but if it was my own money, “Later” to that. Our account wouldn’t be large enough at this time to sustain a monthly. Plus, with technology in this day and age, a monthly fee should be a clean cut from most firms. As you can see above – all clean here.

4.) Free DRIP – Here we go dividend investors! Not only do we want to reinvestment our dividends through a “Dividend Reinvestment Plan (DRIP)”, BUT we also want to do this without paying any fees. This is critical, similar to other reasons, we both currently don’t pay anything to DRIP, we believe in the power of DRIP, and want to keep the costs of owning an investment as low as possible. Another pure no-brainer, but the answers we have begun to find out from these factors are quite different and staggering. Scottrade, losing out here, again! No FREE DRIP? No thanks..

5.) Minimum Deposit – This is clutch right now – as some are all over the place, such as – just need enough to buy one share, $500 or even as high as $2,500. So this plays into a very good factor for us to make a decision, as we wanted to get this started earlier, than later. The reason why this is critical, as well, is not just the opening of the account, but also it would prohibit our ability in making a trade. Heck, our cash is sitting on the sidelines right now earning 0.00%, time to make it work, now. Charles Schwab came back with $250K… um… what?? See our conversation below, we also were shockingly surprised he never heard of The Dividend Diplomats.

Other thoughts on the investment account

After our investigation and research of the firms, we are definitely whittling it down. Charles Schwab, however, didn’t even come close to making the cut, as you can see above. This has been a fun process, as Bert and I have been talking about opening the account up for quite some time, but I kept wanting to hold off to build more capital. But, Bert was right and we should have had this opened up, so we could make a move on something when needed. As you can see above, we also asked the question if Citizens & Northern (CZNC) could be purchased, as we are potentially looking at smaller cap bank stocks for the portfolio of ours. The answers were all a “yes”, so that’s solid to know we can do this. Additionally, as you can see, there is also one name off the list, Capital One. Sad to say – they are not offering any investment accounts for LLC’s, and it’s a damn shame. We hope at some point to get this started, as soon as possible.

Lastly, we did not just research firms online, but we also cold called them THIS MORNING, on a Saturday, to see who we could contact and work with. This was a fun process and hilarious hearing Bert cold calling a few reputable firms to put them through the wringer. This was important, as we wanted to see how available customer service was in case we had questions or problems. We also wanted to ask if there were any freebies and bonuses from talking with someone to open an investment account. It doesn’t hurt to ask, something one should ALWAYS do in their life, such as negotiating on a house, a car or cable/internet. Always ask if there are discounts/bonuses, as the answers may be well in your favor. And if not, well, at least you know. Curious on the final verdict of where we are leaning?

Investment account for the LLC Verdict

The firm we had the best interaction with was, needless to say, Fidelity. They were amazing on the phone and were extremely easy to work with, had some nice sign-up perks that the guy could directly work with us through on getting and it appeared to be a very easy process to open. From looking at the chart above – they had a lower cost for a trade at $7.95, offered free dividend reinvestment, as well as reinvestment into partial shares, which is key for us. In addition – there are no account minimums nor monthly maintenance/inactivity fees. The customer service was awesome, ready to talk on a Saturday morning even, and was interested in hearing about who we are and what we do. Something tells me, this could be a great investment account relationship us Dividend Diplomats will have.

Disclaimer: None