5 Biotech Takeover Targets That Could Get Bought Soon

Don’t let the resurgence in M&A in the biotech sector pass you by. Big pharma companies have set their sights on small and mid-cap stocks and have shelled out offers with big premiums. Bret Jensen shares his top five picks for likely acquisition targets in biotech.

We are starting to see some of the “animal spirits” coming back into the biotech sector after its deepest and longest bear market since the financial crisis. The Treasury Department and the election season have made mega-mergers impossible to get through regulatory agencies, so the biotech and pharma giants are starting to concentrate in the small and mid-cap space by making what some call “bolt on” acquisitions

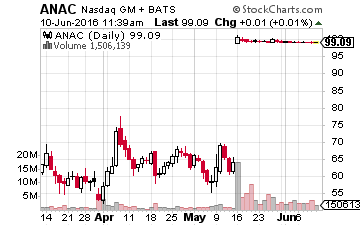

AbbVie (NYSE: ABBV) helped start this new wave when it purchased privately held StemCentrix for almost $6 billion in late April in efforts to expand their pipeline into oncology. In May Pfizer (NYSE: PFE) paid over $5 billion to acquire Anacor Pharmaceuticals (Nasdaq: ANAC).

Pfizer paid a 60% premium for the pleasure. The company has one product on the market. The driver of the acquisition is a compound called Eucrysa, an eczema cream currently before US regulators for approval as well as psoriasis agent AN2898 in Phase II development. Pfizer believes Eucrysa could eventually do $2 billion in peak annual sales.

Outside the mid-caps in the industry, the smaller players are also getting some attention. Xenoport (XNPT), which has an approved product for restless leg syndrome and has compounds in the pipeline targeting psoriasis, multiple sclerosis, and Parkinson’s disease. Privately held Arbor Pharma paid an approximate 60% premium to purchase Xenoport.

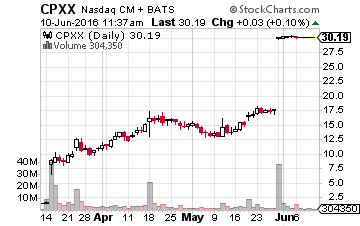

On the last day of May, Jazz Pharmaceuticals (NASDAQ: JAZZ) has agreed to pay $30.25 a share to acquire Cellator Pharmaceuticals (Nasdaq: CPXX) whose stock closed Friday at $17.50 a share. Up until March of this year, the shares spent a good portion of their previous two years available at under $2.50 a share. This company’s main asset is VYXEOS. This is the first product candidate to demonstrate a statistically significant improvement in overall survival in patients with high-risk (secondary) AML and has Orphan Drug Status in both the United States and Europe.

The uptick in purchase activity focused on the small and mid-cap players in the space makes logical sense. Large biotech and pharma players need to replenish their pipelines, they are flush with cash and bargains abound after the deep bear market in this area of the market. In short, the M&A genie seems to be back out of the bottle in this beaten down sector of the market. This action should bode well for future capital appreciation in the small and mid-cap part of the market as M&A helps sentiment move into “risk on” mode once again.

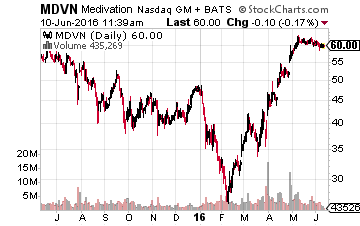

So who in the small and mid-cap space is a logical acquisition target? Oncology concern Medivation (Nasdaq: MDVN) has to be on the short list given it has already rejected Sanofi’s (NYSE: SNY) $9.3 billion takeover offer and that company has now gone “hostile” and is trying to replace Medivation’s board with one that is more open to negotiations. In addition, several drug giants have been mentioned as possible “white knights” in anticipation of a possible bidding war. The stock has roughly doubled over the past three months, so upside seems limited here.

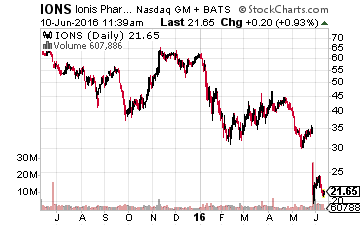

Ionis (Nasdaq: IONS) is another mid-cap that has been speculated on often in 2016 as a possible target. However, in late May safety concerns that emanated from a key late-stage trial puts a good portion of the company’s underlying technology and pipeline candidates in question. Until these questions get resolved, it is hard to see a larger player making a bid for this concern.

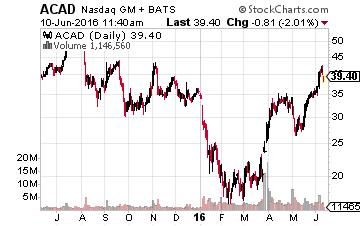

Acadia Pharmaceuticals (Nasdaq: ACAD) is yet another mid-cap concern that has come under intense speculation as a buyout candidate and a who’s who of the biotech and pharma world are rumored to be very interested in a possible acquisition of this mid-cap concern with just over a $4 billion market capitalization. Its first commercialized product “Nuplazid” just hit the market. It is the first approved treatment for the psychosis associated with Parkinson’s, a potential billion-dollar indication. The compound is also in Phase II development for treating the same condition in the Alzheimer’s and Schizophrenia populations.

AstraZeneca (NYSE: AZN), Biogen (Nasdaq: BIIB) and Teva Pharmaceuticals (Nasdaq: TEVA) have all been speculated as likely suitors.

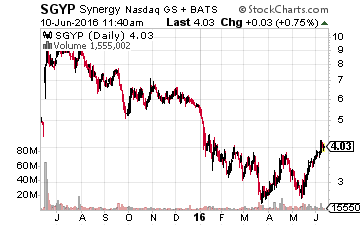

In the small cap space, one has to watch what Allergan (NYSE: AGN) is doing right now. It has already been fairly active in smaller deals since its merger with Pfizer was called in April off thanks to new rules around “tax inversions”. It has also publicly stated it is focusing on “tuck-in” acquisitions to expand its presence in four key focus areas.

One of these areas is the gastrointestinal space. Synergy Pharmaceuticals (Nasdaq: SGYP) makes a logical target for this drug giant. Its primary compound “plecanatide” should be approved for chronic idiopathic constipation in January. The same drug candidate should have a Phase III trial readout for Irritable Bowel Syndrome with constipation later this month. With a market cap of $600 million, Synergy certainly meets the criteria of a “tuck in” acquisition.

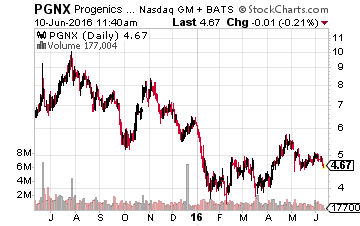

I also like Progenics Pharmaceuticals (Nasdaq: PGNX) as an undervalued play in this space with a $325 million market capitalization. Its distribution deal for its primary compound relistor with pariah Valeant Pharmaceuticals (NYSE: VRX) makes a buyout a bit more complicated. However, Valeant is said to be looking for assets to sell to pay down its large $30 billion debt load. Relistor is currently available only in an injectable form but is doing more than $15 million a quarter in sales and growing nicely. The oral version of relistor should be approved by the FDA next month which should exponentially boost sales.

This approval also will trigger a $50 million milestone payout to Progenics from Valeant. The company also stands to make $200 million in additional sales milestones and already has some $75 million in cash on hand and an interesting pipeline beyond relistor. Add in a 15% to 19% royalty stream on all relistor sales and you have an undervalued stock and a possible logical acquisition target even though it might have to be a two-step process.

Disclosure: Positions: more

Comments

No Thumbs up yet!

No Thumbs up yet!