4 Top Trucking Stocks To Gain From Improved Freight Demand

Image: Bigstock

As the economy continues to recover, improving freight market conditions indicate a healthy near-term outlook for the Zacks Transportation - Truck industry. Apart from increased freight demand, trucking volumes are expected to continue to benefit from the pandemic-triggered rise in e-commerce demand. Higher truck rates, due to capacity constraints in the face of improved truck volumes, add to the positivity.

Companies like Old Dominion Freight Line (ODFL - Free Report), Landstar System (LSTR - Free Report), ArcBest Corporation (ARCB - Free Report), and USA Truck (USAK - Free Report) are poised to benefit from this optimism in the industry.

About the Industry

The Zacks Transportation - Truck industry consists of truck operators transporting freight to a diverse group of customers, primarily across North America. These companies provide full-truckload or less-than-truckload (“LTL”) services over the short, medium or long haul. Additionally, most of these entities offer logistics and intermodal services (provided by moving freight over the rail), as well as value-added services like container drayage, truckload brokerage, supply chain consulting, and warehousing. A few also offer asset-light services to other third-party logistics companies in the transportation sector. A prominent industry player is J.B. Hunt Transport Services (JBHT - Free Report), which provides a broad range of transportation services to customers throughout the United States, Canada and Mexico.

3 Trends Shaping the Future of the Trucking Industry

Improving Freight Demand: The trucking industry is benefiting from continued improvement in freight demand amid the rebounding U.S. economy. Per the American Trucking Associations’ (ATA) latest report, advanced seasonally adjusted (SA) for-hire truck tonnage index increased 3.7% in May from the year-ago levels. In the first five months of 2021, tonnage inched up 0.4% from the same period in 2020. As economic recovery continues on increased vaccinations and easing coronavirus-led restrictions, trucking volumes are expected to remain buoyant through the end of 2021. Strong e-commerce demand amid the pandemic also supports trucking volume growth.

Truck-Driver Shortage: Persistent driver shortage continues to plague the trucking industry. The demanding nature of the job among other factors is leading to high driver turnovers. According to a CNN report, the average annual driver turnover rate for truckload carriers is about 95%. Despite pay hikes by trucking companies, the driver scarcity problem continues, thus leading to trucking capacity constraints. As freight demand continues to increase, the capacity constraints are expected to become more pronounced.

Rising Truck Rates: Amid increased freight demand and a limited truck supply, trucking rates are rising. According to Cass Freight Index May report, freight rates increased 10.8% year over year in May. With supply constraints likely to persist through the end of 2021 and freight demand expected to increase, trucking rates should remain at an elevated level, thus boosting the top line of trucking companies.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Trucking Industry, housed within the broader Zacks Transportation sector, currently carries a Zacks Industry Rank #31. This rank places it in the top 12% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, implies encouraging near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually gaining confidence in this group’s earnings growth potential. The industry’s earnings estimate has been revised upward by 35.9% over the past year.

Given the bullish near-term prospects of the industry, we will present a few stocks that you may want to consider for your portfolio. But it’s worth taking a look at the industry’s shareholder returns and its current valuation first.

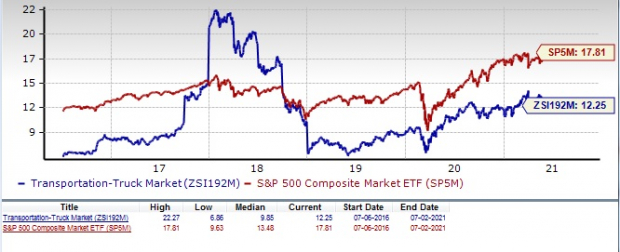

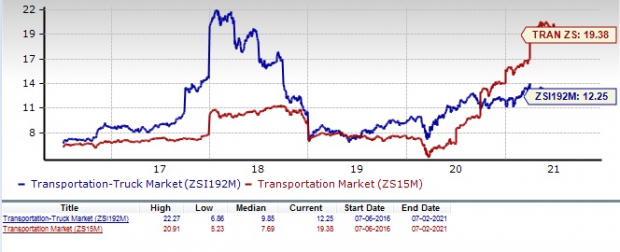

Industry Outperforms Sector But Lags S&P 500

While the Zacks Truck industry has outperformed the broader Transportation sector over the past year, it has underperformed the Zacks S&P 500 composite.

Over this period, the industry has rallied 37.7% compared with the broader sector and the S&P 500 Index’s 35.7% and 38% rise, respectively.

One-Year Price Performance

Industry's Current Valuation

On the basis of trailing 12-month EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation and amortization), which is a commonly used multiple for valuing transportation stocks, the industry is currently trading at 12.25X compared with the S&P 500’s 17.81X. It is also below the sector’s EV/EBITDA of 19.38X.

Over the past five years, the industry has traded as high as 22.27X, as low as 6.86X and at the median of 9.85X as the chart below shows.

Enterprise Value/EBITDA (TTM)

Enterprise Value/EBITDA (TTM)

4 Trucking Stocks to Buy

ArcBest Corporation: Based in Fort Smith, AK, the company provides freight transportation services and solutions.Improving freight demand is boosting the company’s tonnage and shipment levels. The company, carrying a Zacks Rank #1 (Strong Buy), is also benefiting from cost efficiencies owing to the utilization of network optimization technologies. You can see the complete list of today’s Zacks #1 Rank stocks here.

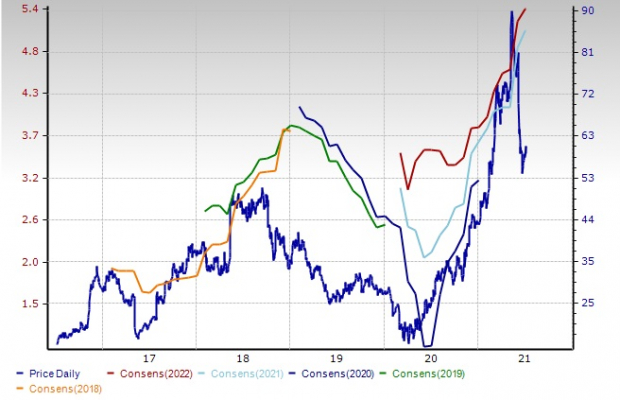

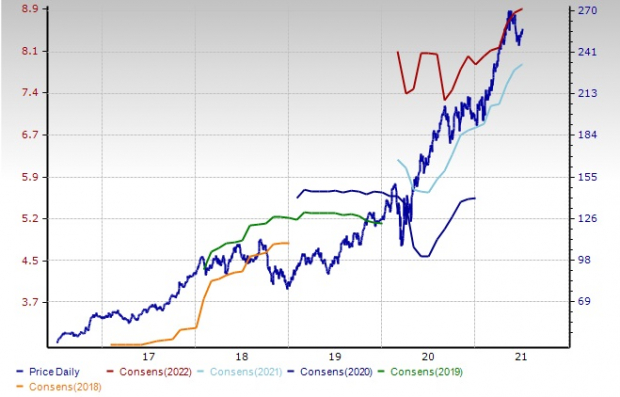

The Zacks Consensus Estimate for ArcBest’s 2021 earnings has been revised upward by 24.6% in the past 60 days. Shares of the company have surged more than 100% in a year’s time.

Price and Consensus: ARCB

USA Truck: This company is engaged in the transportation of general commodity freight in interstate and foreign commerce. It operates in the continental United States and in parts of Canada and Mexico. Apart from improved freight demand, transformation of the Trucking segment through regionalization, optimization, pricing discipline, and focus on safety and cost control, is driving the company’s performance. This stock also sports a Zacks Rank #1.

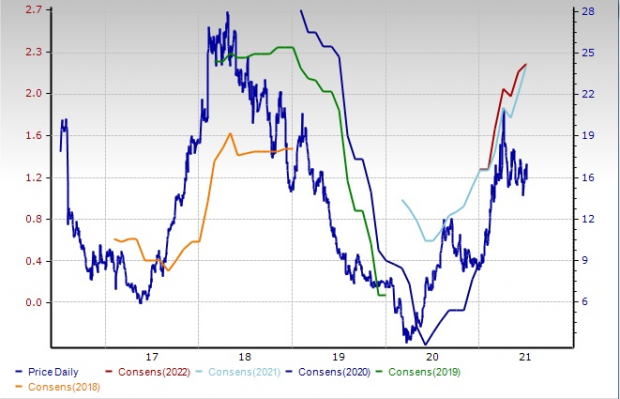

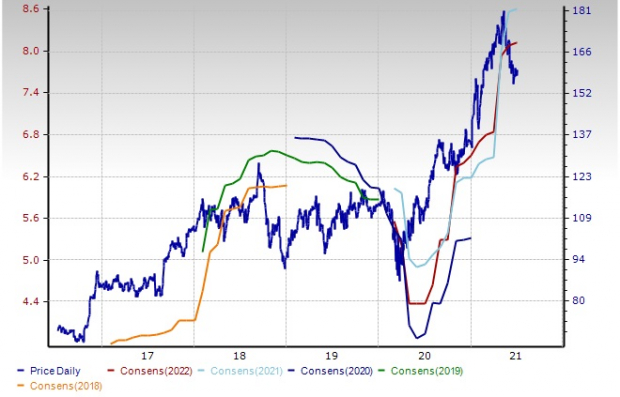

The Zacks Consensus Estimate for USA Truck’s current-year earnings has been revised northward by 27.2% in the past 60 days. Shares of the company have gained 82.3% in a year’s time.

Price and Consensus: USAK

Old Dominion Freight Line: This is a leading LTL company based in Thomasville, NC. Consistent improvement in the company’s operating ratio (operating expenses as a percentage of revenues) is encouraging. After improving to 77.4% in 2020 from the year-ago level of 80.1%, this key metric bettered 530 basis points to 76.1% in first-quarter 2021 on the back of higher revenues. With favorable market conditions, the metric should continue to improve. This stock carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for the company’s 2021 earnings has been revised northward by 2.3% in the past 60 days. Shares of the company have appreciated 46.7% in a year’s time.

Price and Consensus: ODFL

Landstar System: This is an asset-light provider of integrated transportation management solutions, headquartered in Jacksonville, FL. Robust performance of the truck transportation segment owing to strong demand in the van truckload business is driving the company’s top line. With favorable market conditions anticipated to sustain, the company, carrying a Zacks Rank #2, is expected to continue to reap benefits.

The Zacks Consensus Estimate for Landstar’s 2021 earnings has been revised upward by 3.4% in the past 60 days. Shares of the company have increased 39.8% in a year’s time.

Price and Consensus: LSTR

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more