4 Stocks To Buy Next Week Ahead Of Their Quarterly Earnings Call

Last week, the earnings season kicked in for many companies from the financial services and airline industries. Some heavy names are scheduled to release their previous quarter performance next week, including Procter & Gamble (PG), Netflix (NFLX), Morgan Stanley (MS), and UnitedHealth (UNH).

The week ahead is filled with American corporations reporting their quarterly earnings. Out of all companies, these four stand out of the crowd as their earnings may provide a hint for entire sector performance.

Procter & Gamble

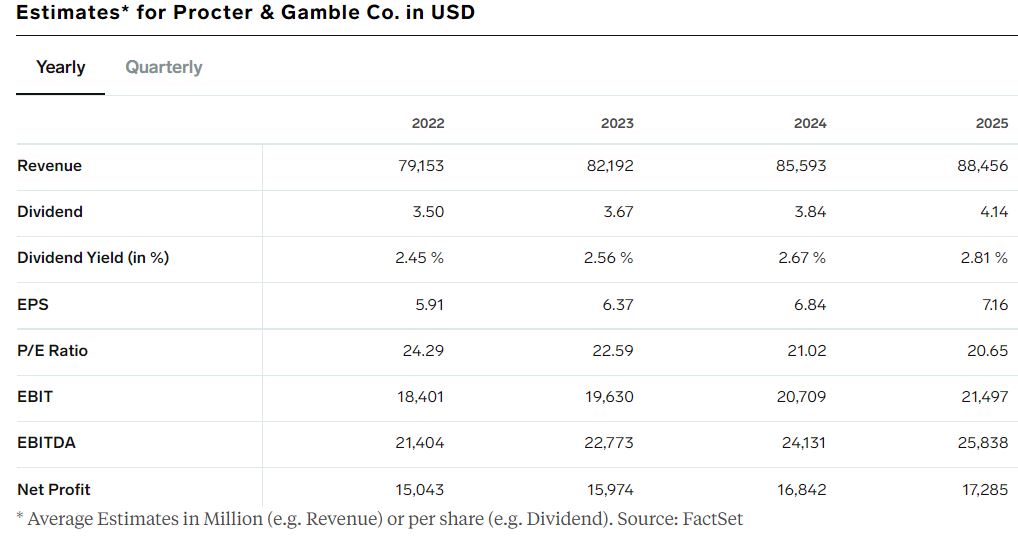

Procter & Gamble is a representative company from the consumer staples sector and it reports its previous quarter earnings on Jan. 19. Investors expect EPS of $1.65, and the annual revenue estimate for the fiscal year ending June 2022 is $79.16 billion. The stock price has been up +17.68% in the last twelve months, and the current P/E ratio for 2022 sits at 24.29.

Netflix

Netflix operates in the communication services sector and reports its quarterly earnings on Jan. 20, post-market hours. The company’s brand has worldwide recognition, and it was one of the preferred investments during the COVID-19 pandemic.

Now that pandemic fears have started to fade away, as indicated by central banks tightening their monetary policies, Netflix’s stock price underperformed. Investors expect EPS of $0.82 on the quarter, and, most recently, the stock price responded positively to the company’s announcement of price increases in the United States and Canada.

Morgan Stanley

Morgan Stanley is one of the largest companies in the financial services sector, and on Jan. 19, it is scheduled to release its previous quarter’s earnings. After JPMorgan missed on revenues last week, investors will pay special attention to Morgan Stanley’s results to see if this is the norm for the sector or not.

The market expects EPS of $1.96 on the quarter, and the annual revenue estimate for the fiscal period ending December 2021 is $59.61 billion.

UnitedHealth

UnitedHealth is active in the healthcare sector, and its stock price is “on fire” – it barely corrected at the start of the COVID-19 pandemic and now trades near all-time highs. Since 2009, this has been a 10-bagger stock that keeps on delivering. Investors expect EPS of $4.31 on the quarter, and 47 out of 56 analysts covering the stock price have issued buy ratings.

Disclaimer: None of the content in this article should be viewed as investment advice or a recommendation to buy or sell. Past performance/statistics may not necessarily reflect future ...

more