4 Popular Discount Retailer Stocks Ranked & Analyzed

Discount retailers have built strong businesses in the U.S. With a constant focus on selling products at the lowest prices possible, often in bulk, discount retailers have built a large customer base among bargain-hunting shoppers.

As a result, the four major publicly-traded discount retailers are highly profitable, with strong brands and durable competitive advantages. And, all of them pay dividends to shareholders, and grow their dividends each year.

Each stock mentioned in this article is on our list of 350 consumer staplesstocks that pay dividends to shareholders.

The rankings in this article are done in order of total returns, for the discount retail stocks found in the Sure Analysis Research Database. All four stocks pay dividends to shareholders, and thanks to their strong brands and high cash flow, can afford to raise their dividends at high rates each year.

Discount Retail Dividend Stock No. 4: Walmart Stores (WMT)

- Expected Annual Return: 4%-5%

Walmart’s total expected rate of return is not very high, but the stock does pay a solid 2.5% dividend yield, and the company is likely to raise its dividend each year. Walmart is on the list of Dividend Aristocrats, a select group of 53 stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases.

Walmart is the largest U.S. retailer, with annual sales of $485 billion. It operates over 11,000 stores, located in 28 countries around the world.

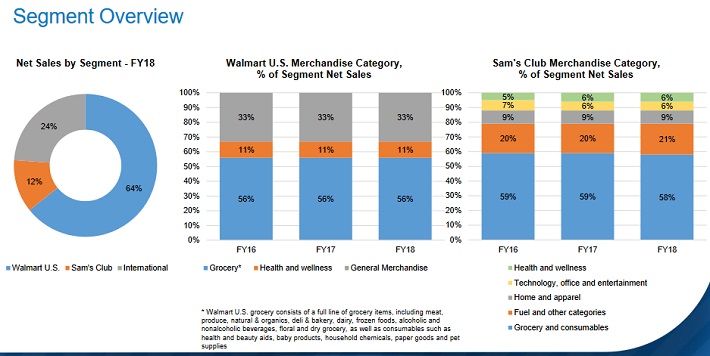

(Click on image to enlarge)

Source: 2018 Financial Factbook, page 7

The U.S. segment includes retail stores in all 50 U.S. states, Washington D.C., and Puerto Rico. It also includes Walmart’s digital business. Walmart International consists of operations in approximately 27 countries outside of the U.S. Lastly, Sam’s Club consists of membership-only warehouse clubs and operates in 48 states in the U.S. and in Puerto Rico.

The past few years have required higher investment from Walmart. The retail downturn in the U.S., coupled with the rising competitive threat of e-commerce giant Amazon (AMZN), have necessitated a significant turnaround. Fortunately, Walmart was more than up to the challenge. Walmart’s earnings-per-share declined 4% in fiscal 2017, as the company accelerated its strategic growth investments, which include improved physical store performance, international growth, and e-commerce.

The good news is, these investments have provided the company with a return to growth. Last quarter, Walmart generated revenue of $122.7 billion, which rose 4.4% from the same quarter a year ago and beat analyst expectations by $2.19 billion. Adjusted earnings-per-share of $1.14 also beat expectations, by $0.01 per share. Comparable sales rose 2.3% in the U.S., while international revenue increased 12%. E-commerce sales rose 33% for the quarter, an acceleration from 23% growth in the previous quarter.

E-commerce and international growth continue to fuel Walmart’s growth. E-commerce sales reached $15 billion last fiscal year, and have continued to grow at a high rate. Walmart has made a number of acquisitions to accelerate its e-commerce growth, including the $3.3 billion purchase of Jet.com. It also has a 10% investment stake in Chinese e-commerce site JD.com.

Emerging markets are a huge growth catalyst for Wal-Mart, not only in China, but also in India.

Source: Flipkart Presentation, page 7

Walmart acquired a 77% investment stake in India-based e-commerce giant Flipkart, for $16 billion. Flipkart’s supply chain business, eKart, serves more than 800 cities in India, and last year recorded net sales of $4.6 billion, up more than 50% from the previous year. Walmart expects to open over 250 new international stores each year in 2018 and 2019.

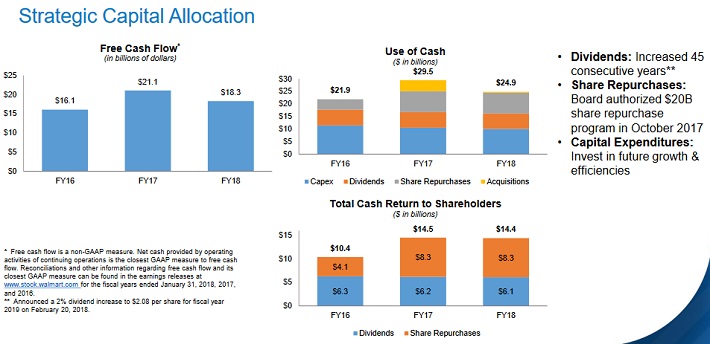

Walmart is a shareholder-friendly company. Thanks to its huge cash flow generation, Walmart returns billions of dollars to shareholders each year, through share buybacks and dividends. Walmart is in the process of a two-year, $20 billion share repurchase authorization. It also has an annual dividend payout of $2.08 per share.

(Click on image to enlarge)

Source: 2018 Financial Factbook, page 10

We believe Walmart is slightly overvalued. Our fair value estimate for the stock is a price of $70 per share, compared with a current share price of $84. Valuation changes could reduce total returns by 3%-4% per year. However, we expect 5% to 6% annual earnings growth for Walmart. Combined with the 2.5% dividend yield, total returns are expected in a range of 4%-5%.

Discount Retail Dividend Stock No. 3: Costco Wholesale (COST)

- Expected Annual Return: 7%-8%

Costco is a wholesale retailer. Its closest competitor in the U.S. is Sam’s Club, another warehouse retailer operated by Walmart. Costco currently operates 750 warehouses, including 520 in the U.S. and Puerto Rico, 98 in Canada, 38 in Mexico, 28 in the U.K., 26 in Japan, 14 in Korea, 13 in Taiwan, nine in Australia, two in Spain, one in Iceland, and one in France.

Costco has proven to be a hugely popular place to shop for U.S. consumers, evident by the company’s impressive growth over the past several years. Today, Costco has 93 million members, with a renewal rate of 90% in the U.S. and Canada.

Source: Investor Presentation, page 8

On 5/31/18 Costco reported strong quarterly financial results. Total sales of $31.62 billion increased 12% from the same quarter a year ago. Earnings-per-share rose 7%. Both figures beat analyst expectations. Costco’s strong sales increase was due to 10.2% total comparable sales growth (7.0% growth excluding gas inflation and foreign exchange). Analysts had expected total comparable sales growth of 8%. Comparable sales increased 11.8% in the international markets, while membership fees increased 14% for the quarter.

E-commerce is a major driver of Costco’s growth. E-commerce revenue increased 35.5% last quarter, and 34.8% over the first three quarters of the current fiscal year. Another growth catalyst for Costco is new store openings. Costco opened two new stores last quarter, one in Mexico, and one in Korea. In the current fiscal quarter, Costco will open 15 new stores, consisting of 13 new stores and 2 relocations.

The combination of mid-single digit comparable sales growth, modest margin expansion, and higher membership fees should be enough for Costco to generate 9%-10% earnings growth each year going forward.

Costco has a dividend yield of just 1.2%, which is below the S&P 500 Index average, but the company raises its dividend at a high rate. For example, on 4/24/18 Costco increased its quarterly dividend by 14%. Since Costco initiated a dividend in 2004 at $0.40 per share, it has grown the dividend at a 13% compound annual rate, to the current level of $2.28 per share.

In terms of valuation, Costco is a high growth stock trading at a growth-stock multiple. Our fair value estimate is a share price of $169 for Costco stock. With a current share price of $198, we believe a declining valuation could reduce total returns by 3% per year.

That said, Costco generates high earnings growth. We expect annual earnings growth of 9%-10% per year over the next five years. In addition, the 1.2% dividend yield brings Costco’s total return potential to 7%-8% per year.

Discount Retail Dividend Stock No. 2: Target (TGT)

- Expected Annual Return: 9%-10%

Like Walmart, Target is a Dividend Aristocrat that has raised its dividend for over 40 consecutive years. Target is a large discount retailer just like Walmart, but it differs in that it operates solely in the U.S. Target has over 1,800 stores.

On 5/23/18 Target released quarterly earnings. Comparable sales grew 3%, ahead of the 2.8% growth expected by analysts. Traffic rose 3.7% for the quarter, which was Target’s best quarterly traffic increase in over a decade. Digital sales increased 28% from the same quarter a year ago. Overall, Target’s adjusted earnings-per-share increased 9.4%. For the full year, Target expects comparable sales to rise at a low single-digit rate in 2018. Earnings-per-share is expected in a range of $5.15 to $5.45, compared with analyst consensus of $5.27.

Aside from digital channel growth, Target’s other growth initiatives—mainly its store renovations and small stores—continue to perform well. Target is redeveloping hundreds of stores. To do this, it is modernizing layouts, and adding new product categories. Target expects it can achieve a 2%-4% lift in sales for each store it renovates. By 2018, the company expects to have completed re-imagining on over 350 of its stores. By 2019, it will have redeveloped over 600 stores, accounting for one-third of its total store count.

(Click on image to enlarge)

Source: Earnings Presentation, page 84

Another major growth catalyst for Target is its small stores. Target’s small stores are being opened under the CityTarget and TargetExpress banners. These are stores with much less square footage, in places that cannot provide the necessary space to build a large store. They provide Target with exposure to densely-populated areas, such as large cities and college campuses. By 2019, Target expects to open over 100 small stores, triple the number of small stores currently in operation.

Target is also building new services to compete with Amazon, such as same-day delivery, with the acquisition of Shipt, and its recently launched Drive Up service. On 5/23/18 Target and Shipt announced the launch of same-day delivery in parts of the Midwest, including Ohio, Illinois, Indiana, Kentucky, Wisconsin, Michigan and Missouri. The program will include over 55,000 items available to customers for same-day delivery from local stores. Target expects same-day delivery will be available to 65% of U.S. households across 180 markets by the end of 2018, and in 2019 same-day delivery will expand to include all major product categories at Target.

We estimate Target stock has a fair value price of $78. With a current share price of $79, shares are fairly valued. That said, Target can still generate positive returns, through earnings growth and dividends. We expect 6% annual earnings growth for Target, and there is potential for acceleration from this level. With a 3.2% dividend yield, total annual returns are expected to exceed 9% per year, assuming no change in the stock valuation.

Discount Retail Dividend Stock No. 1: Dollar General (DG)

- Expected Annual Return: 14%-15%

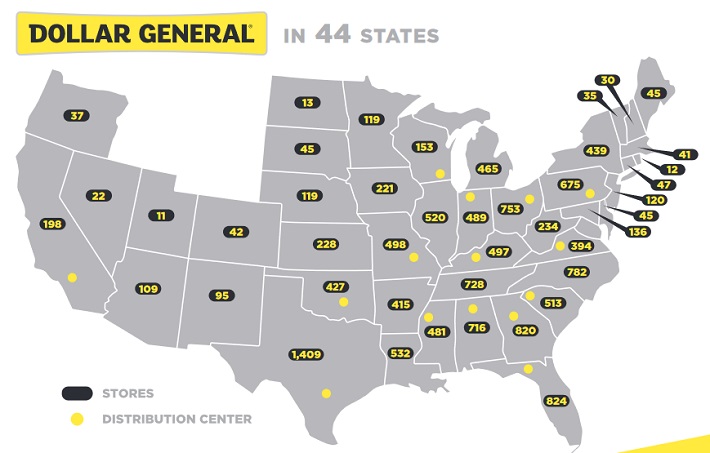

The highest-ranked discount retailer is deep-discounter Dollar General. Dollar General is the leading U.S. dollar store, meaning it sells many products for $1 or less. It sells a wide variety of merchandise, including consumables, seasonal, home products, and apparel. As of 5/4/18, the company operated 14,761 stores in 44 U.S. states.

(Click on image to enlarge)

Source: 2017 Annual Report, page 2

On 5/31/18, the company announced first-quarter 2018 financial results. Quarterly revenue of $6.11 billion missed analyst expectations by $90 million, while earnings-per-share of $1.36 missed by $0.04 per share. Despite the fact that Dollar General’s results missed analyst estimates, the company reported strong year-over-year growth rates. Revenue increased 8.9% for the quarter, due to 2.1% growth in same-store sales. Diluted earnings-per-share rose 33% from the same quarter a year ago, driven by revenue growth, share repurchases, as well as a positive impact from tax reform.

The reason for Dollar General’s disappointing first-quarter financial results, was a surprise drop in store traffic. Dollar General’s results were negatively impacted by unseasonably cold and damp weather across many parts of the U.S., which kept shoppers at home in the first quarter. Fortunately, this was offset by rising average transaction size. Weather trends should normalize, leading to a release of pent-up demand. The company expects over 30% earnings growth in 2018, driven largely by sales growth and a $300 million benefit from tax reform. We expect 10% annual earnings growth for Dollar General through 2023.

Dollar General’s main growth catalysts are opening new stores, and redevelopment of existing stores. Dollar General plans to open approximately 900 new stores, remodel 1,000 stores and relocate 100 stores during the fiscal year. These investments are necessary to keep pace with the highly competitive retail industry, and the emergence of e-commerce competitors like Amazon. Dollar General’s strong brand and focus on low-priced goods are competitive advantages that secure its target customer demographic.

Dollar General’s main competitive advantage is its industry positioning and scale. It has 15 distribution centers in the U.S. With over 14,000 stores, Dollar General benefits from lower distribution costs than its smaller competitors. Dollar General also has a strong brand, and high cash flow, which allows the company to invest in growth. Dollar General’s capital expenditures for fiscal year 2018 are expected to be in the range of $725 million to $800 million.

Based on current forecasts from company management, Dollar General is expected to generate earnings-per-share of $6.05 at the midpoint of 2018 guidance. As a result, Dollar General stock currently trades for a price-to-earnings ratio of 14.9. This seems low for a leading brand in the deep-discount retail space, and also because of Dollar General’s high earnings growth over the past several years. We believe fair value for Dollar General stock is a price-to-earnings ratio of 17.7, which is equal to the 10-year average valuation.

Dollar General has a relatively low dividend yield at 1.3%, but it makes up for this with high dividend growth. For example, on 3/14 the company raised its dividend by 11.5%. And, due to earnings growth and expansion of the price-to-earnings ratio, the stock can generate total returns of nearly 15% per year over the next five years.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more